Guide On How To Become A Payment Processor

In the era when digital payments have been integrated into our daily routine, creating a credit card processing company may be an extremely lucrative solution. For instance, according to the latest research, worldwide e-commerce sales will reach over 58 trillion by 2028. Still, becoming a global payment processor may be perplexing and requires a flawless knowledge foundation. In this detailed guide, we uncover how to start a payment processing company in 2024, the key terms in this area, the price of this business, and other essential features.

Let's discuss your project and see how we can launch your digital banking product together

Request demoWhy Would You Want To Start A Payment Processing Business?

Grand View research shows that global e-commerce payment transactions will grow by 20.8% by 2030. This means that becoming a payment processor may bring countless customers and revenue consistency. Merchants rely on banking companies to accept payments from customers. Thus, you, as a payment processor, can benefit from the recurring nature of constant transaction charges, value-added services, and monthly commissions.

Of course, you may provide value-added proposals, like white-label payment solutions, cooperation with new financial institutions, assistance with PCI compliance (Payment Card Industry) certification, etc. The e-commerce industry enables you to accept global payments and scale without being tied to a specific country.

Key Terms To Know Before Starting A Payment Processing Company

In preparation for starting a payment processing company, you need to understand a few primary terms. It helps not to get confused in concepts when registering a new business. We have described them in the review below.Payment Processing Company

A business payment processing company is a financial firm facilitating banking transactions between merchants and customers. These companies are crucial for the financial infrastructure and services necessary to process a wide range of e-payments efficiently and securely. Simply put, payment processing organizations are intermediaries between all parties participating in an online transaction, including sellers, customers, banks, and payment networks. Such companies propose various services that allow businesses to accept online payments from clients and manage their payment operations.Payment Service Provider

PSP (payment service provider) is a third-party organization that allows a business to receive digital payments (from e-wallets, debit cards, credit cards, etc.). The payment service provider responds to online transaction verification and assists in transferring online payments from buyers to merchants.Payment Facilitator

Payment facilitators (or PayFacs) are service providers that simplify the acceptance of online payments for small and medium-sized businesses using special infrastructure. They allow transactions from countless vendors to be combined under their accounts, making the payment process faster and easier. Additionally, they optimize the payment processing setup and simplify control of the money flow. Therefore, if merchants need to process online transactions, they may utilize an account from a payment facilitator. Here, we can highlight two types of retail accounts: ISO or independent sales organization and PSP (payment service provider).How Does A Payment Processor Work?

To become a payment processor, you need to realize the primary stages of its operation. We have described all of them in the list below:- The payment process begins. The transaction process starts when a client buys goods or services on the merchant's site or in a physical store. The customer should provide their bank, credit card, or digital wallet details.

- The payment information is transmitted. At this stage, the data is safely transferred from the buyer to the payment processor through the gateway, which responds to payment data encryption and transmission.

- The authorization process starts. Here, the payment processor checks the validity of the buyer's payment information and determines the availability of funds in the account to complete the transaction.

- The transaction is confirmed. Suppose the client has sufficient cash on the account and no additional issues (like suspicious activity or stolen card). In that case, the card network or the financial institutions give an approval notification to the payment processor.

- Seller receives notification. The payment processor should inform the seller whether the online transaction was declined or accepted. In the case of approval, the merchant can deliver services or products to the buyer.

- The money goes to the merchant. After a positive transaction, the payment processor starts the settlement procedure. It involves transferring money from the client's account to the seller's balance.

Payment Processing Business Solutions: Building From Scratch Vs A White-Label

When you explore how to start a payment processing company, you may learn about both options: building from scratch and using a white-label model. The white-label solutions involves cooperation with a third-party vendor that provides a ready-made payment gateway infrastructure. Therefore, you can adapt the available gateway to your company's needs, saving your brand identity.

In contrast, a traditional payment processing company includes the creation of payment processing infrastructure from scratch. You need to go through numerous stages, like acquiring licenses, finding partnerships with banks, and developing custom software for online transactions. We have described the pros and cons of each variant in the detailed lists to make your choice easier.

Pros of white-label solution- Fast start. Using white-label solutions, you can quickly start your payment processing business without spending time on building your infrastructure.

- Cost-Effectiveness. You may count on lower costs compared to building a payment processing business from scratch. You will utilize the pre-developed platform for online transaction services. Straightforward customization. If you use a white-label solution, you may count on a pre-built technical foundation, enabling customization to match the company's brand features.

- Scalability opportunity. White-label solutions are designed to grow with clients' transaction volumes, making them suitable for large-sized businesses as well.

- Dependency. This solution is just like an online payment processing franchise, so you need to rely on a picked white-label provider. All support, updates, and system reliability depend on the chosen provider.

- Complete control. Starting a business from scratch involves full control over the payment processing system, design, and functionality, as well as the set-up of transactions for specific business needs.

- Profit margins. Since you do not need to share revenue with a third-party processor or pay licensing fees, your profit may be substantially high in the long term.

- Unique brand. You may create your brand-new financial company, adding unique functionalities and features that are adapted to your specific business industry.

- Cost and time. Creating a payment processing solution from scratch involves considerable resources (including monetary ones), time, expertise, etc. You should invest in security, software development, frequent maintenance, etc.

- There are more risks. When you decide to start a payment processing company from scratch, you need to be ready for possible technical difficulties, security breaches, and errors that may cause money losses.

How To Start A Payment Processing Company From Scratch

You need to understand how to start an online payment processing company from scratch to avoid issues on your way. Keep in mind that this process includes several steps, which we uncover in the guide below.Do Your Market Research And Planning

Initially, you should thoughtfully analyze the financial landscape in the chosen market and consider potential demand for your businesses. Additionally, you should define the payment processing business model of your fintech project, as well as your development strategies and functional requirements.Create A Business Plan And Register

After conducting thorough market research, you should create a business plan, including a revenue strategy and financial projections. At the next stage, you need to determine the legal structure of your financial project (corporation, LLC, etc.). Then, you must receive the necessary permits and licenses to work as a legal payment processor.Check Compliance And Regulations

During the next stage, you must realize your jurisdiction's regulatory requirements and legal features. Ensure you receive all the necessary permits and licenses. Besides, create solid anti-money laundering (AML) and KYC (Know Your Customer) systems to comply with regulatory requirements and prevent third parties from being involved.Build Financial Partnerships

Of course, before starting a credit card processing company, you need to find solid banks or financial institutions with which to partner. Such companies will facilitate the settlement of money from your online transactions.Develop Technology Infrastructure

Subsequently, you need to create or acquire a special payment processing platform for online transactions that operates according to industry standards for reliability, security, and scalability. Do not overlook customizing tokenization, encryption, and other security measures to protect user data and transactions. Your company also needs to be integrated with payment gateways to allow seamless online transaction processing.Test And Launch

How to become a payment processor and become a leader in the industry? Of course, you must test your system before starting the official work. You need to ensure that your payment processing company operates without delays and interruptions. After final testing, you may launch your company for merchants' online transactions.Scale And Expand

Last but not least, you need to optimize and evaluate your business processes regularly, increasing technology infrastructure and customer services. Besides, don't forget to explore new opportunities for expansion into other markets and geographic regions. Such an approach will help boost your client base and revenue.How To Become A Payment Processor With Label Solution

Now, let’s see how to start a payment processing company using the white-label solution. Such an approach also involves several steps, which we have lined up in the review below.Plan Infrastructure Setup

Initially, you should pick a white-label payment provider according to your business needs, pain points, and target market. After contacting the chosen provider, you may start the partnership process and set up your business operations. The process can include such procedures as setting up sellers' accounts, and transaction software, and finding payment networks and banks for partnerships. You should also get permits for legal operation as a payment processor in your jurisdiction and customize business banking accounts.Establish System Management

Establishing system management for a payment processing organization involves customizing tools for robust security, smooth operation, and business efficiency. We recommend implementing alerting and monitoring tools to track the online transaction process in real time. You may set up alerts, dashboards, and notifications to quickly identify security issues.Implement User Management

This stage involves creating user management approaches to administer clients’ accounts, including regular updates of personal data, contact details, and information. It is crucial that users will be able to customize the necessary security settings, notifications, permissions, and authentication according to their preferences and requirements.Enable Merchant Products Management

Either way, you need to enable merchant product management in the payment processor with a white-label solution. It includes providing interfaces and tools for merchants to administer their pricing, products, inventory, and other related facets.Facilitate POS Management

How to start a payment processing company without customizing effective POS management for merchants? The answer is obvious – no way. You need to adjust this module that enables sellers to add, edit, view, and delete their POS systems and generate new secret codes for robust security. At this stage, you should design intuitive, user-friendly interfaces (or ensure the payment provider has them). Moreover, you have to implement a synchronization feature that allows sellers to sync product data between the payment processing platform and their POS systems.Develop Payment And Transaction Features

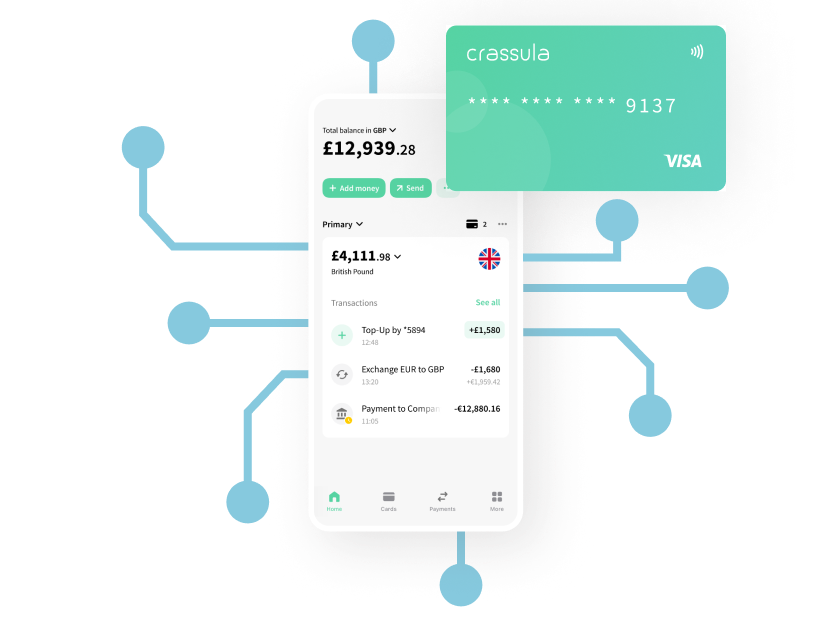

You should provide services such as payment acceptance, funds transfer, currency exchange, recurring payments setting up, and invoicing. Furthermore, you require services such as transaction management, chargebacks, analytics, and reporting. Do not forget to implement support for various payment methods (like PayPal, Apple Pay, Google Pay, cryptocurrency, etc.).Integrate Accounting Tools

Accounting is crucial in managing money flow and ensuring financial transparency in the payment processing industry. The online dashboard should include basic functionality, such as transactions and their history, and a withdrawal function. Accounting tools also include top-upping customer balances, managing cash desks, and system operations like cash collection, cash input, investments, etc.Implement Reporting Functionality

A business payment processing company created using a White-Label solution should allow users to create reports based on completed transactions. It would be great if these reports could be downloaded for analysis. Reports should be securely stored in a database and easily integrated with various monitoring tools.How Much Does It Cost To Start An Online Payment Processing Business?

How much does it cost to start a payment processing company? Unconditionally, each potential business owner wants to know this information. On average, the price starts from $ 150,000. It depends on numerous aspects, which we disclose below.Features and Functionality

Since the payment gateway is crucial in the payment processing business, the cost of opening a business and developing a service will depend on its functions and capabilities. The cost is affected by the ability to support various payment methods (bank cards, online wallets, cryptocurrency).Development Tools and Technologies

Moreover, the choice of development technologies and tools influences the cost of opening and running a payment processing business. In particular, it is worth noting the programming language, database systems for data storage, and the way of payment integration with banks, networks, cloud services, and infrastructure.Development Team

Besides understanding how to start a payment processing company, you need to select a solid development team with experience and the necessary skills. The cost of developing a payment processing business will depend on the price of the chosen company. Obviously, newcomers will charge less for their services than experienced market players. At this stage, you can use outsourcing to save money.Location

The cost of a payment processing business may vary depending on the area you are starting to provide your services. Different countries and regions have various tax structures, which may impact the cost of opening your fintech company. Pre-Developed Solutions vs. Custom Development As noted, the cost of a white-label solution will be lower than building a payment processing company from scratch. Custom development frequently takes longer and requires creating all platform aspects from the ground up.Hosting and Infrastructure

Of course, aspects like hosting and infrastructure influence the opening of an online payment processing business. Logically, hosting providers with PCI-compliant infrastructure and a proven reputation will cost more than newcomers to the field.Regulatory Compliance and Security

If you are wondering how much it will cost to build a payment processor, remember that the price will depend on the security features and regulatory compliance. The cost of building a payment processing company depends, in particular, on the implementation of encryption, compliance with industry standards (for example, GDPR and PCI DSS), KYC, anti-money laundering functions, testing, and ongoing maintenance.Final Thoughts

So, now you know how to start a payment processing company to provide services for merchants. You may enter the market with a solution from scratch after conducting close research, creating a business plan, and integrating technical systems. This approach requires more time and money.

In contrast, you can use a pre-developed platform and adjust it to your business goals and needs. Both white-label solutions and building from scratch allow you to provide payment processing services, scale, and earn more profit.