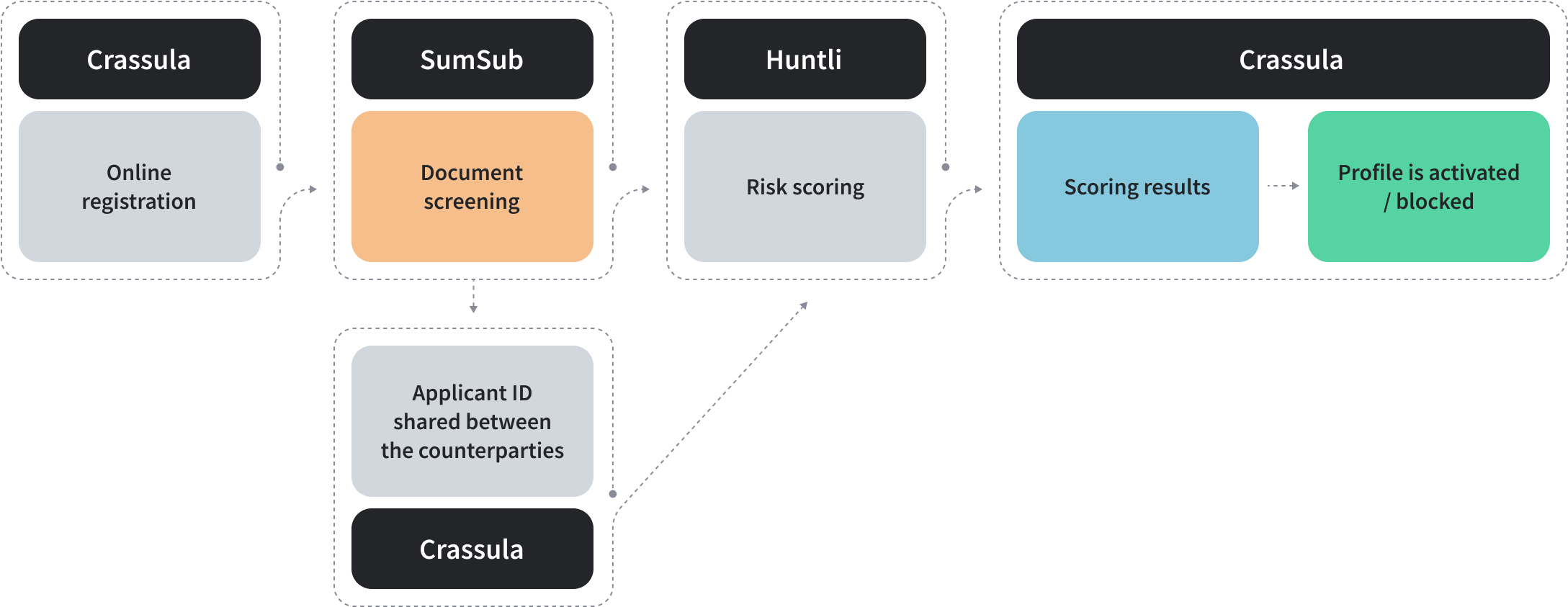

Decision-Making System

Crassula's Decision-Making System offers a comprehensive solution designed to streamline client verification and account opening processes in financial services. This advanced system integrates client scoring, transaction monitoring, and profile screening, providing a robust and efficient approach to client verification. Enhance your customer onboarding with 3-party integration.

The Decision-Making Flow

-

1

Profile Creation and Data Sharing

-

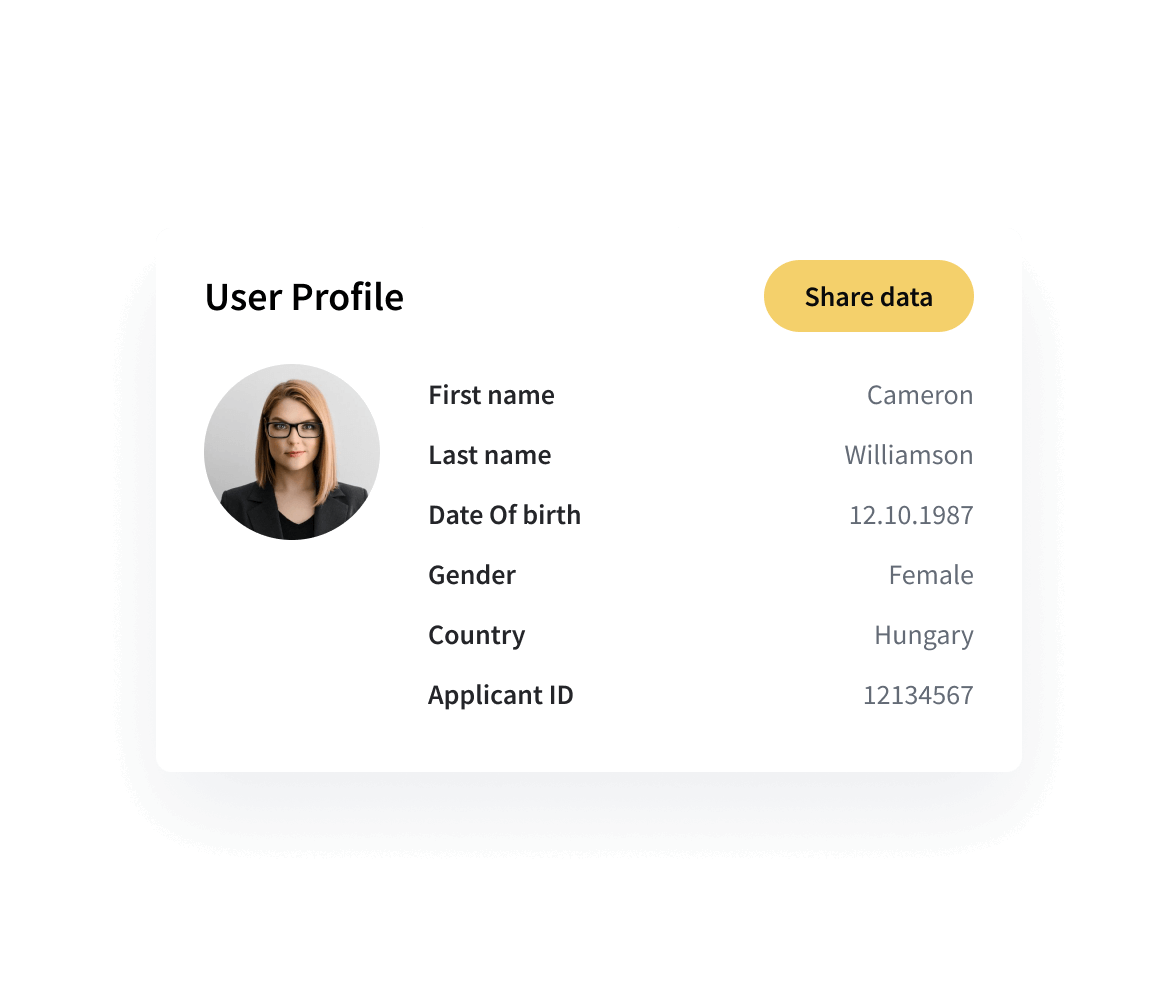

Crassula Client's Profile

Client profiles are created seamlessly through Crassula's Web Interface. All applicant documents and questionnaires are securely shared with SumSub for further processing.

-

SumSub Applicant Profile

SumSub generates a detailed applicant profile within its system and provides a unique Applicant ID, which is then integrated back into Crassula's system.

-

Integrating the Data

Crassula ensures smooth data integration by sharing relevant information with Huntli, facilitating comprehensive processing across platforms. This streamlined approach guarantees efficiency and accuracy in client verification and account management.

-

-

2

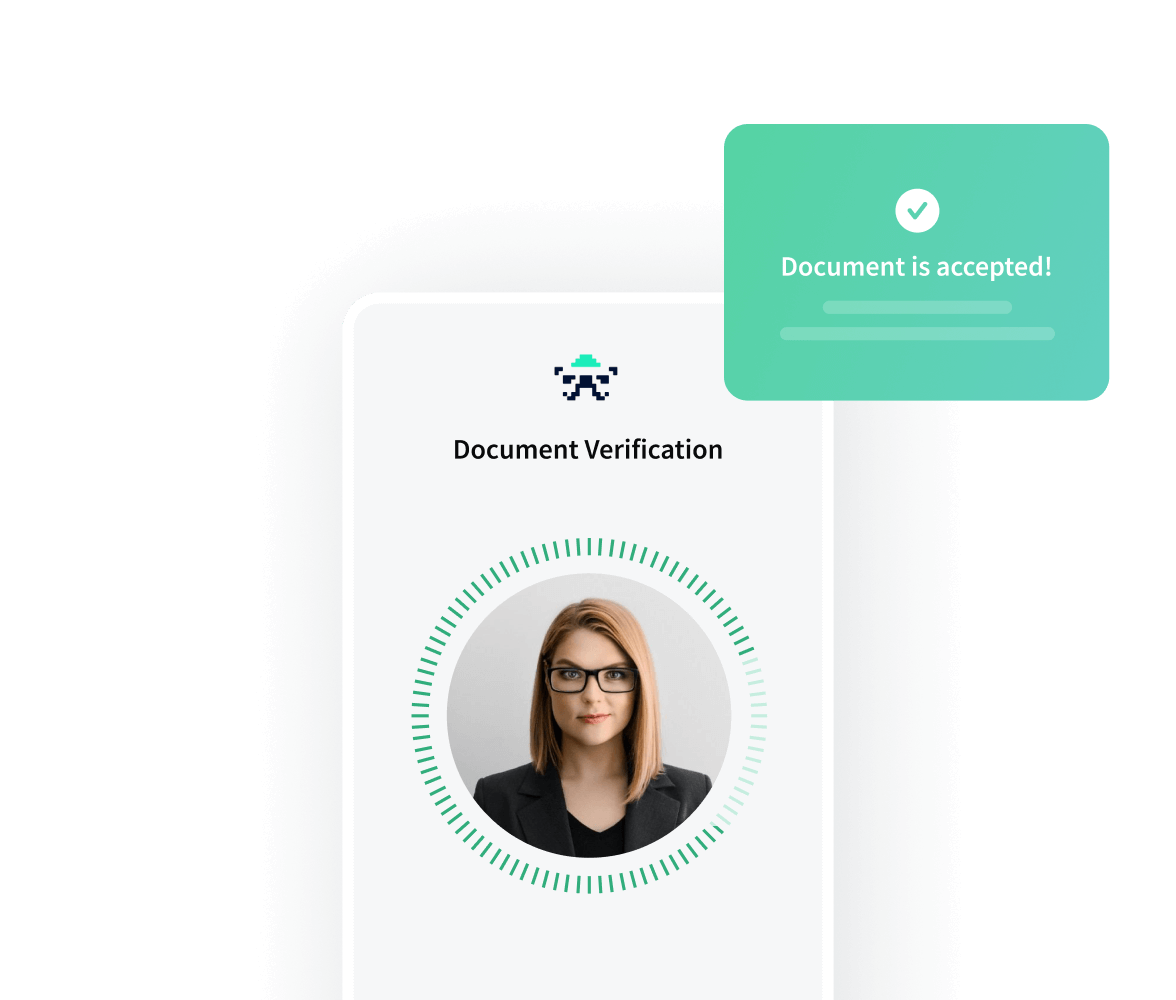

Document Verification by SumSub

-

Verification Process

Upon receiving identification documents from the client, SumSub initiates and completes a thorough verification process.

-

Verification Status

The verification status and related documents are then shared with Huntli for additional analysis, ensuring a multi-layered approach to client verification and security.

-

-

3

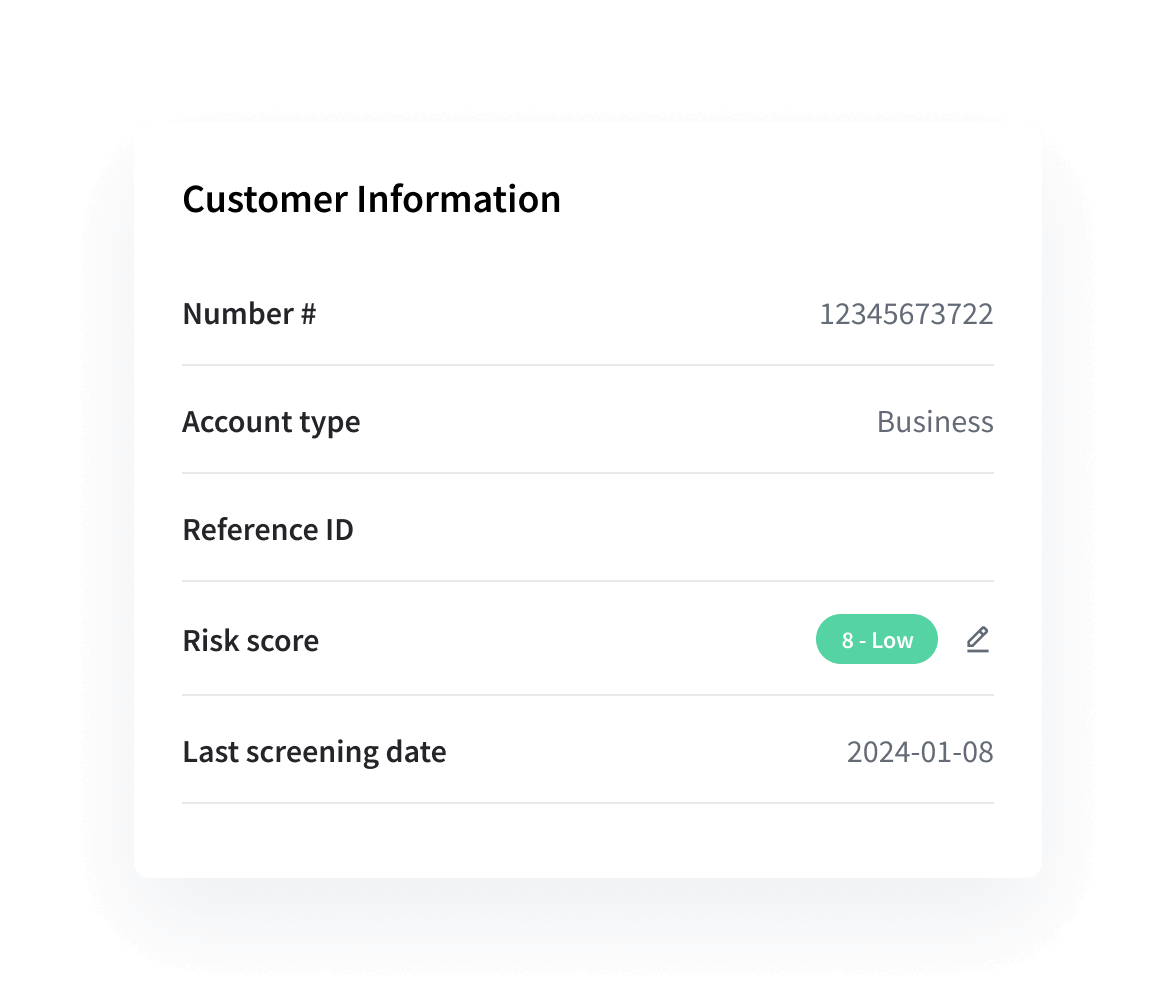

Risk Scoring by Huntli

-

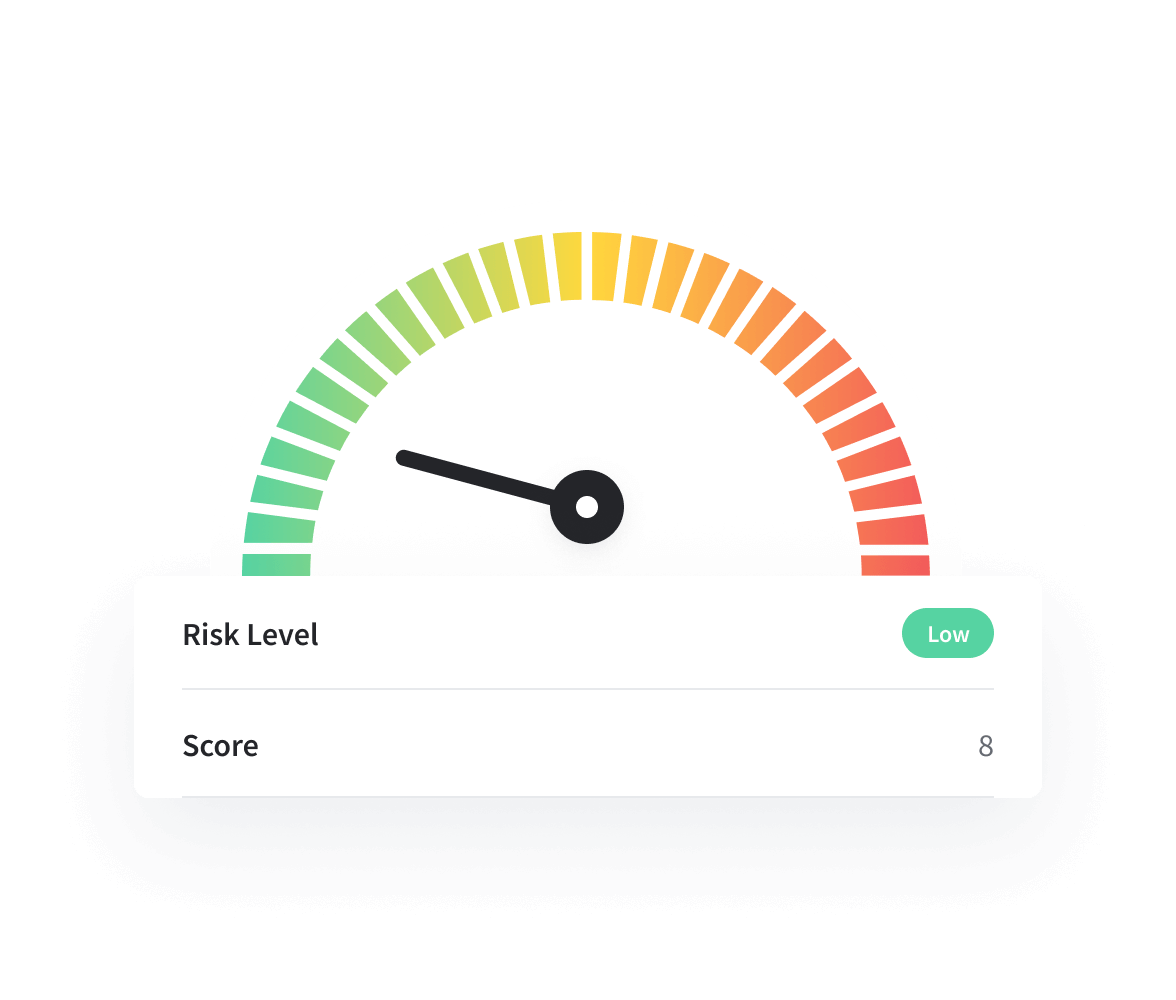

Detailed Scoring

Huntli conducts a comprehensive scoring process, meticulously analyzing the provided documents and questionnaire.

-

Numerical Risk Score

Utilizing rules defined by the White Label on the Huntli platform, this process generates a numerical risk score and determines a risk level decision, such as refuse to board. This ensures informed and precise risk management for your financial operations.

-

-

4

Final Decision by White Label

-

White Label

The White Label receives the detailed scoring results directly in Crassula's admin panel.

-

Final Decision

Based on the comprehensive information and risk assessment provided, the White Label makes the final decision on whether to onboard the client. This process ensures a thorough and informed decision-making framework for client onboarding.

-

Customizable Client Tags and Rule Application

The Crassula Decision-Making System enhances efficiency, security, and reliability in financial transactions by offering customizable client tags and dynamic rule application. Tailor the verification process to meet your specific needs, ensuring a more personalized and secure client onboarding experience.

Custom Client Tagging

The Crassula Decision-Making System allows for the setting of custom client tags on both SumSub's and Huntli's platforms. These tags facilitate more tailored management of client profiles, ensuring that special regulations or specific requirements are efficiently applied, providing a customized and compliant verification process.

Dynamic Processing by SumSub and Huntli

Both SumSub and Huntli are equipped to handle custom tags, enabling them to apply specific rules that differ from the default settings. This dynamic processing ensures that unique requirements and regulations are met efficiently, providing a flexible and tailored approach to client verification and risk assessment.