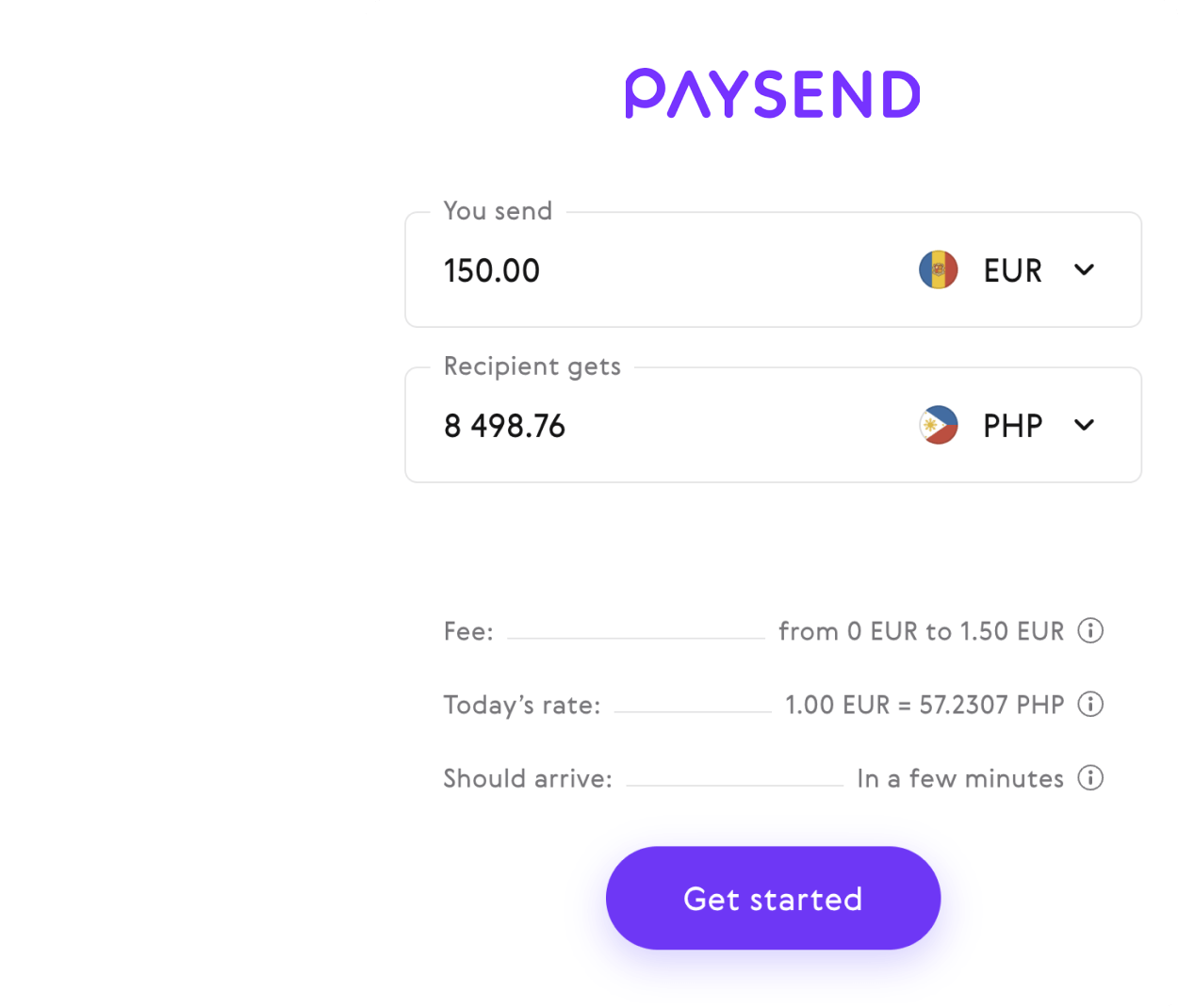

Paysend

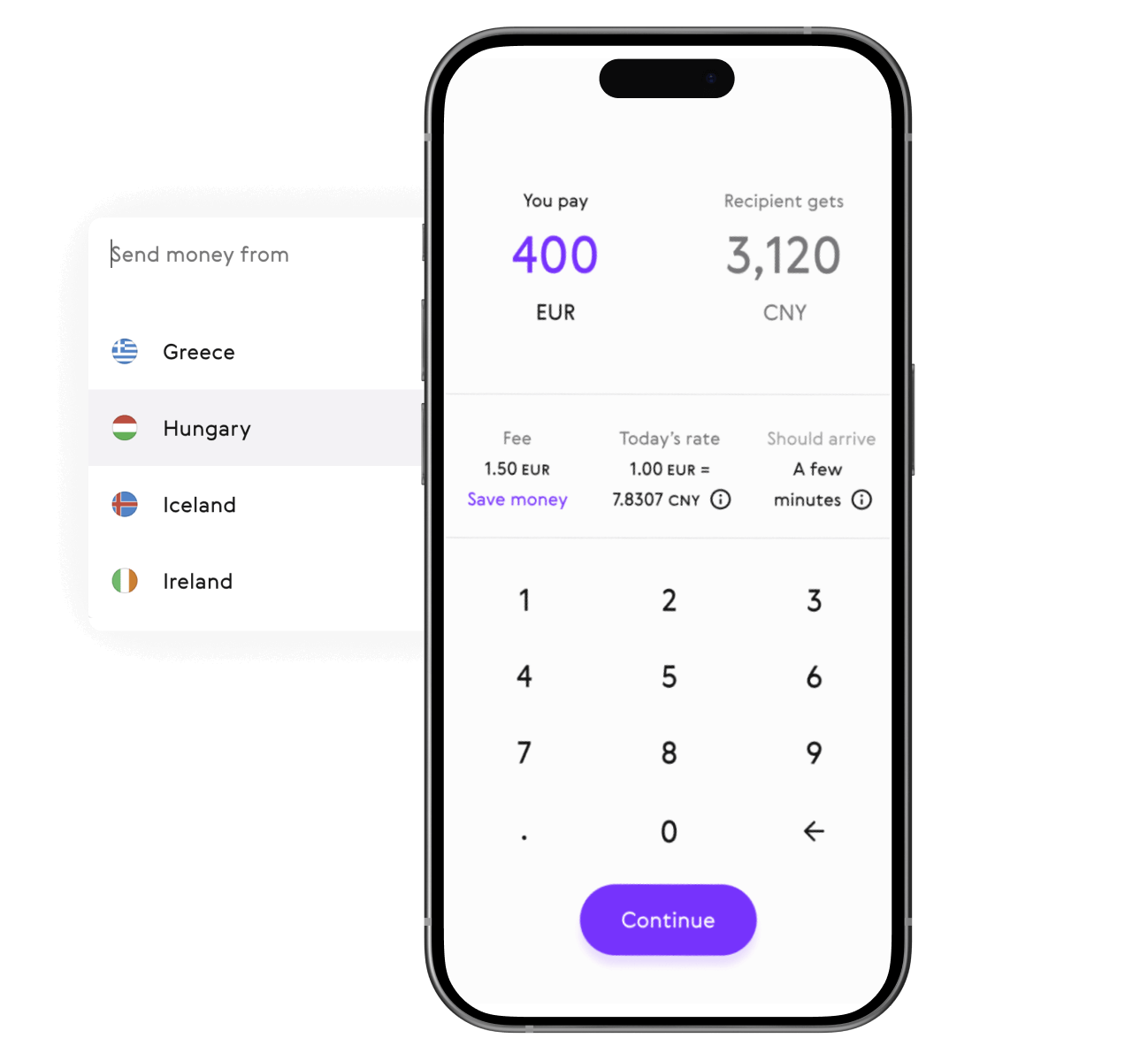

Paysend is a next-generation integrated global payment ecosystem, enabling consumers and businesses to pay and send money online anywhere, anyhow, and in any currency. Supporting and adding multiple international payment channels is crucial for keeping up with demand, pace, and the speed of life.

Paysend & Crassula – SEPA Payment Integration for Enhanced Banking Solutions

Crassula has developed a technical connector enabling Paysend to integrate SEPA credit transfer, SEPA instant, and SEPA direct debit services. This enhancement allows Paysend to offer seamless and efficient European payment capabilities.

Crassula Product Used

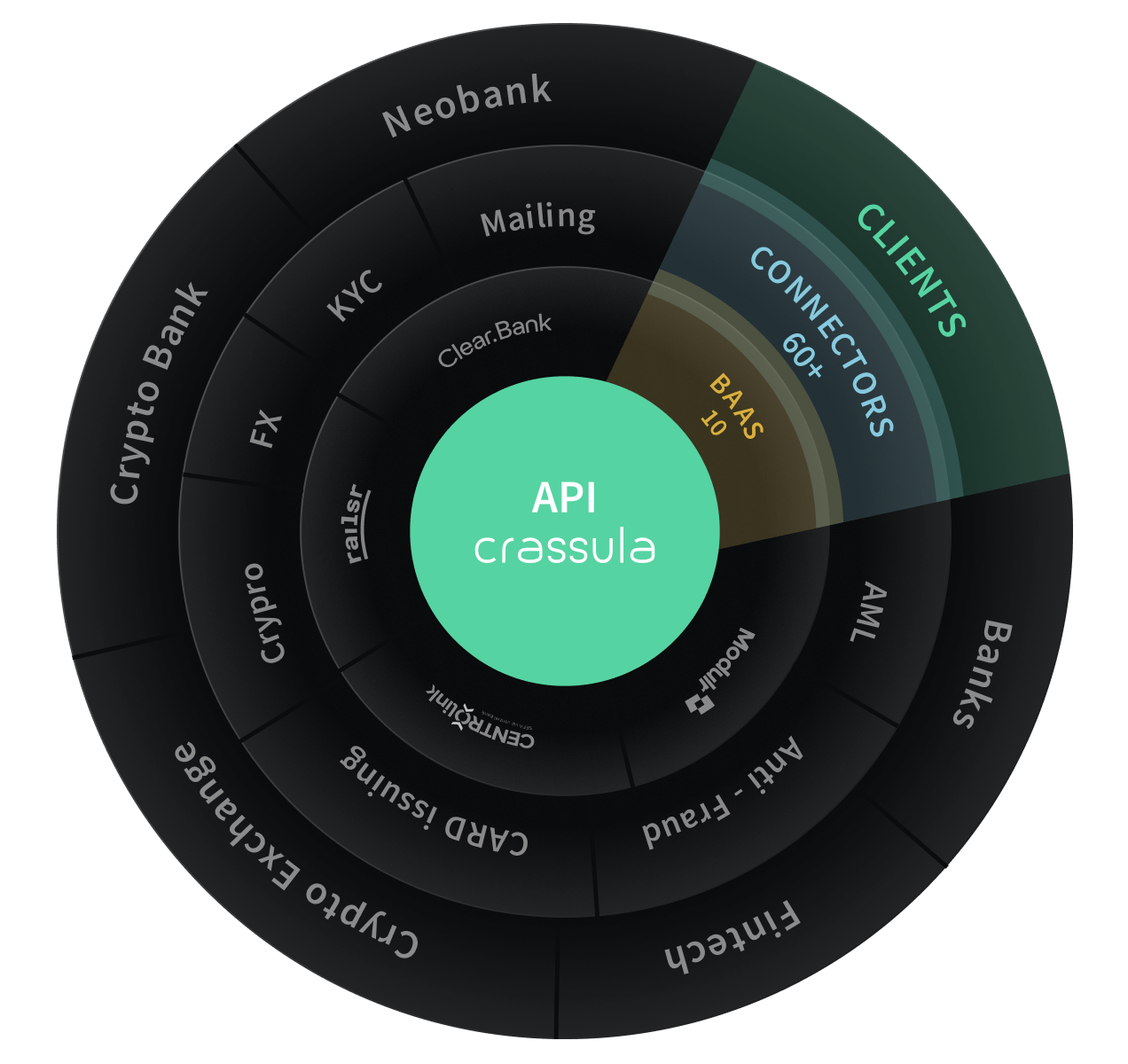

Crassula Hub

Crassula FinTech Hub offers an API to seamlessly connect to financial rails and manage multiple financial services. It eliminates the time-to-market of fintech institutions, giving access to multiple financial service providers with one integration, ensuring high connectivity, cost-efficiency, and scalability.

Features Involved

All Crassula Core-Banking software modules are secured and audited according to PCI-DSS level 1 standard certification.

SEPA Payments

High-grade secured SEPA payments connectorOperational Process

Bank standard-grade operational process workflows and business process managementIBAN Generation

Virtual and real IBANs issued unitary or in rangesLedgers

Internal LedgersBack Office

The ultimate tool for running your businessCrassula’s product allowed us to quickly launch a payment business. A huge advantage is the availability of integrations with many banks and acquirers, which makes it possible to quickly connect new payment methods for customers.

Ronnie Millar

CEO & Paysend Co-founderRelevant case studies

Pay IO enables businesses to easily manage everyday financial operations with their own business accounts

Read Case Study

LuxPay is at the forefront of providing advanced financial services, designed to meet the needs of modern businesses and consumers alike.

Read case study