Private Label Credit Card Explained

If you are a retailer or business owner thinking about how to bring some novelty and innovation to your company or store, private label cards might be the thing you are searching for.

Banks are not the only ones to offer credit cards. Large companies such as supermarket chains or airlines often issue their own credit cards. And if you are a retailer or business owner thinking about how to bring some novelty and innovation to your company or store, private label cards might be the thing you are searching for.

Still do not know much about it and where to have it issued? It’s ok. This guide got you covered.

What Is a Private Label Credit Card?

A private label credit card is a type of credit card that is branded for a specific retailer or brand.

With this card, you can easily pay for your purchases in the network of the brand that issued it to you. Usually, managing private label cards involves a lot of operational costs and compliance.

Thus, retailers or brands assign a third party to issue the cards and collect the payments from cardholders. It’s like a win-win for distributors and brands, as the first ones get their share from consumers’ transactions, and the latter increase sales at the store.

Let's discuss your project and see how we can launch your digital banking product together

Request demoHow Does a White Label Credit Card Work?

The private label credit card program strikes a partnership with a third-party financial institution that implements payment collection and card issuance. These credit cards are more viable and secure, as the banking institution still operates them.

This helps eliminate any shady practices by the company offering the credit card. So, you are all covered, and, in return, the third-party business gets its percent by charging interest.

Additionally, each issuing establishment has its own card model and its own terms and conditions of using private label credit cards. However, one thing is common for all. Private label credit cards do not have a credit card network logo such as Visa or Mastercard and can generally be accepted only by the issuing brand.

Basically, the main idea of such private-label cards is to allow a company to maintain its brand image through credit cards, which is acceptable within its chain or network store. Brands can design and name the cards the way they see it without necessarily being a financial institution.

Benefits of Private Label Credit Cards

At first glance, it may seem that a white label credit card used at one retailer is not very beneficial. If you think there are no cons, you are mistaken. Let’s take a look at the main benefits of a private label credit card for both individuals and businesses:

Loyalty Points

Loyalty points encourage clients to make an establishment where the shopping is made frequent. Every one of us is an opportunist. If you know there’s a chance to get a bonus, special perks, and privileges by spending money. You are more likely to keep shopping with the private branded card.

Brand Recognition

Many private label credit cards offer customized designs. You can consolidate your brand awareness and increase customer retention. Looking at the fancy card will be enough to bring customer loyalty to an entirely new level.

More profits

A private label card will always incentivize customers to choose one store over the others and shop from there. If your customers have credit cards, they will be more lenient when it comes to spending money, renewing the card, and making purchases.

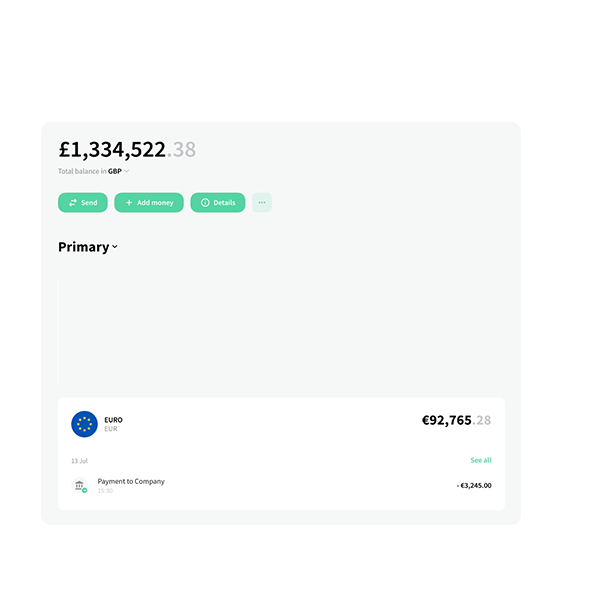

Access innovative capabilities of credit cards with Crassula

A single integration with us means access to a scalable technical infrastructure that we enhance and maintain for you. If you have unique business needs our solution doesn’t cover yet, we would be excited to accept the challenge and solve your case.

FAQ

A branded private-label credit card is an amazing opportunity to reap rewards for your business. This powerful tool offers tangible benefits in the form of increased customer loyalty, enhanced brand exposure, and customer spending.

With these cards, businesses access crucial data that can be used to understand consumer behavior, preferences, and shopping patterns better, allowing for more targeted marketing strategies and personalized offers and rewards. In turn, they differentiate a business in the market and gain a competitive edge.

Creating a private-label credit card involves costs and complexities. Businesses need to invest in systems, infrastructure, and an IT team to handle card management, payment processing, customer support, and compliance with regulations. However, there’s a silver lining for businesses. It’s a private label card provider that enables them to offload this burden and focus on their core competencies.

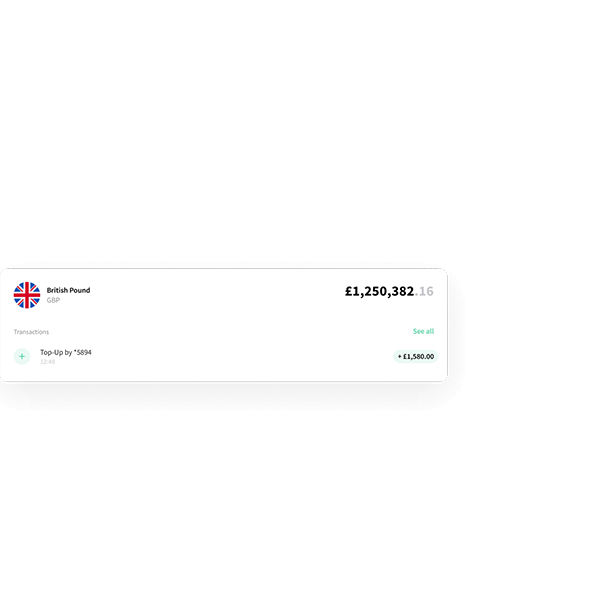

Crassula has built a technical infrastructure that brings payment service providers, alternative payment methods, and third-party business solutions together. You can send us your request and have your card issued in less than two weeks.

Do you want to make the shopping experience more accessible for consumers and drive repeat purchases? Look no further than a store-branded credit card issued by Crassula.