Back to the guides

How To Start An Online Bank From Scratch In 2024

With the fast development of the Fintech industry, traditional banks these days are perceived by many people as outdated bureaucratic institutions. Hence, more and more online banks appear on the market, continuously setting higher and higher standards within the industry. That is why it may seem to you that starting your own online bank requires plenty of funds and effort. Fortunately, it’s not that problematic.

In this article, you will learn about trends in online banking and find a detailed step-by-step guide on how to start an online bank. Also, below, there is a list of things you will need to consider before starting your online bank.

Let's discuss your project and see how we can launch your digital banking product together

Request demoWhen Do You Need To Create Your Own Banking System

Creating your own Internet banking will unlock numerous benefits for you. Here are the most important ones:- Earn more. Given that in 2023, the global digital market was already estimated at $21.1 billion and is projected to grow, owning an online bank might be profitable.

- Win the customer. If you already have a business and have decided to start an online bank, you will have a significant advantage over your competitors. Customers usually are more attracted to all-in-one solutions.

- Stay tuned. Online banking adoption is 100% necessary for businesses in the 21st century, so you can be sure online bank startups will be in demand.

Major Types Of Digital Banking Services

Even though digital banking usually offers fewer services than traditional banks, online platforms are constantly diminishing the gap. Hence, if you are wondering how to start an online bank in 2024 and become successful, then you have to offer the following services and features to your clients:- Accepting debit and credit cards;

- B accounts (savings, checking accounts):

- Enabling money transfers;

- Providing deposits insurance;

- Peer-to-peer lending;

- Loans for different purposes;

- Constantly improving security measures;

- Aconvenient mobile banking app.

Things To Consider Before Starting An Online Bank

Online banking appears to be a highly regulated sector, which sets a high threshold for all potential entrepreneurs entering this business. Hence, you should know about a few important things before we proceed to the step-by-step guide on how to start online banking.Funding

Even though it might sound like stating the obvious, every entrepreneur who is going to start an online bank must have funds for it. Most likely, this is the biggest barrier preventing most businessmen from entering the sphere. Apart from having the funds, they also need to be from a reliable source of funding so that the regulator issuing licenses can positively evaluate your capital potential. Usually, it’s enough to show a deposit, venture capital, angel investors’ or shareholders’ money before being able to receive a license and start an online bank.Customer Research

Once you have funds or at least know who will be interested in funding your startup, it’s time to understand who your potential customer is. When it comes to such a huge step as online bank creation, you must completely understand who will be interested in your services. So, conduct in-depth customer research to determine their demographic characteristics. Such data will help you to predict the customer’s journey and determine underlying banking software solutions you should offer to be successful.Internal Organization

In addition to having enough funds and a clear understanding of the customer base, you will also need a reliable team with distributed roles. Think carefully to define a clear hierarchy within your company. In case you do not know where to start, try first answer the following questions:- Who will be on my team?

- How many departments do I need?

- How many workers will work within each department?

- Who will become a part of the board?

- Who will be my deputy?

- Who will handle risk management?

Technology Infrastructure

Online banking security is another important issue you must deal with before even thinking of how to build a digital bank. Make sure that your company will be able to get the required state-of-the-art technology stack that will be used to build security layers. Such a stack must be compliant with regulations set by the Payment Card Industry Data Security Standard (PCI DSS). Also, make sure that your team knows how to ensure the highest level of security using the available stack. If it’s not the case, consider hiring an outsource team.Essential Features

We do not know the universal recipe for how to start your own successful online bank, but if you want to be a big fish, you cannot lose to competition to digital and traditional banks. Yes, regular banks have physical branches, but you must offer a substantial branch replacement in terms of services. As for 2024, your online bank has to offer:- Multiple 24/7 customer support channels;

- Personal finance managers;

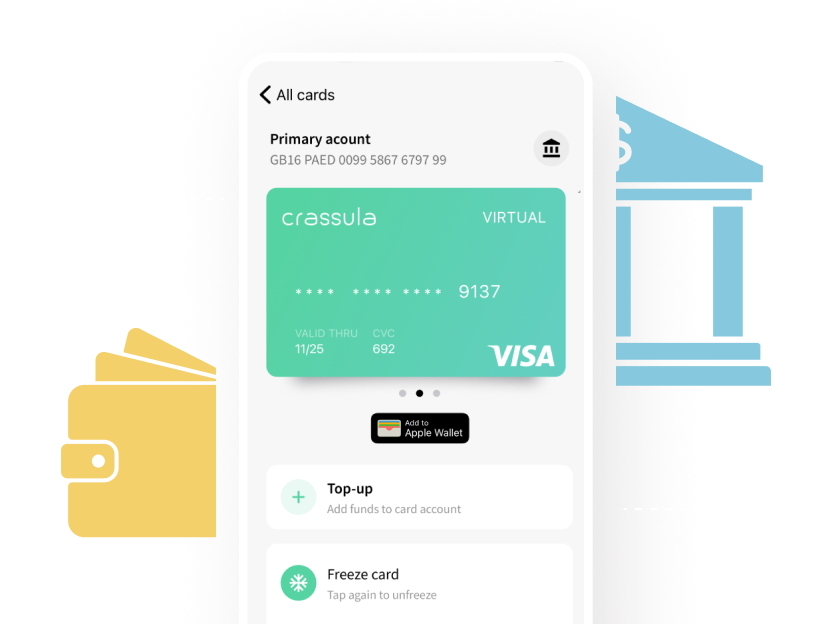

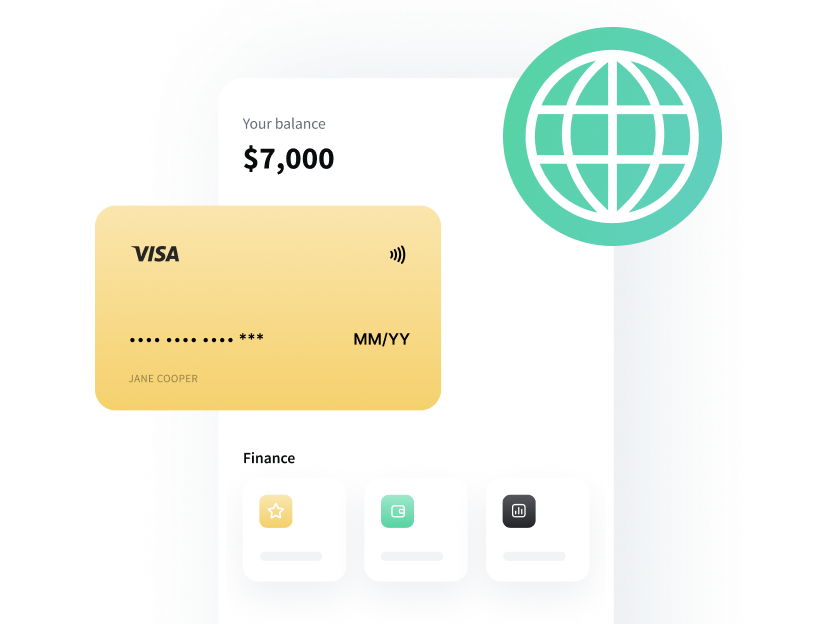

- Virtual debit/credit cards;

- Multifunctional and secure mobile app;

- Discounts perks, and loyalty programs;

- Automatization of recurring payments feature;

- E-wallet integration, etc.

Monetization Strategy

Regardless of why and how you will create online banking, your investors must have a viable strategy to monetize the product. For example, you can charge commissions on cash deposits, ATM withdrawals, or international transactions. Another way is to earn interest from issuing personal, business, and student loans. Finally, you can offer all the above for free but implement premium membership with special perks for users, including enhanced saving rates, travel insurance, etc.How Long Does It Take To Create An Online Bank?

Developing anything from scratch is a pretty time-consuming procedure, especially if you need a license to operate. For example, to start an online bank, you will need at least 14 months, but more realistically nearly 18 months or even more. Here is an approximate distribution of deadlines and processes:- 1-3 months — developing a business model that will show the potential investors what your business will look like.

- 1-2 months — opening an office, registering a legal entity, etc. This step is called the formation of the company.

- 6-8 months — gathering the documents to make sure you fulfill compliance requirements and apply for a license.

- 6 months — the time needed for launching all the IT systems and developing business infrastructure.

How To Start An Online Bank From Scratch

Now that you know about all the essential things for a successful online bank opening, we can finally proceed to the manual on how to start an online bank. Below, you will find a comprehensive guide with 10 consecutive steps you need to move from a simple idea to a successful fintech company.Identify The Target Audience

As we already mentioned earlier, there is no point in even thinking about how to start an online bank if you do not know who your customers will be. Hence, start with conducting marketing research, which must at least answer the question of how old most of your customers are. Hence, if those are students, then your bank must focus on credit loans. In case you are more likely to target middle-aged people, think about adding personal finance management features, etc. Once you understand who your customer and what their needs are, you will know how to address them more effectively.Apply For Licensing

In order to create a legitimate online bank, you need to obtain the license first. Luckily, here you have a few options in terms of licensing: Get a full banking license for banking activities within a certain country (more suitable for traditional banks). Get a non-banking financial institution (NBFI) license. It allows you to offer most services that regular banks do (the most popular for online banks). Get a license under the name of well-established traditional banks (if it is hard to develop your own brand).Build The Digital Bank Platform

Probably the most important step in our “How to start an online bank” guide is developing the website. When it comes to building the platform, do not try to save time or money, as this is your most important asset. The platform must be fast, capable of dealing with thousands of people at once, imply the highest level of security, and feature attractive visual appeal. So, pay enough attention to the development of all components: front-end (the interface), middleware (the orchestrator), and back-end (the processor).Set Up Infrastructure And Services

Once the previous stage is almost done, you also need to make sure that everything works smoothly and that the digital onboarding process for an end user is technically easy. To ensure that, you should have a team that will test the software, its interoperability with third parties, etc. Moreover, you’ll need to have teams that will help with the deployment, monitoring, and maintenance of your bank's infrastructure.Manage System Settings

If your infrastructure works fine and is ready to be launched, you still have to adjust a few important system settings prior to the actual start of an online bank. Among the essential things are the size of the commissions, available currencies, determination of exchange rates, granting permissions, etc. Also, consider adding online lending platforms and do not forget about default contracts.Implement User Management

The next step on your online banking path is the user’s end configuration. Here, you need to adjust 4 stages. First of all, it's the registration process of new users, then configuring the algorithms for KYC procedure, document review, etc. Also, you need to set up the rules for wallets and transactions between accounts, implement anti-money laundering measures, etc. Finally, there should be algorithms for deactivating and deleting users.Enable Payments And Transactions

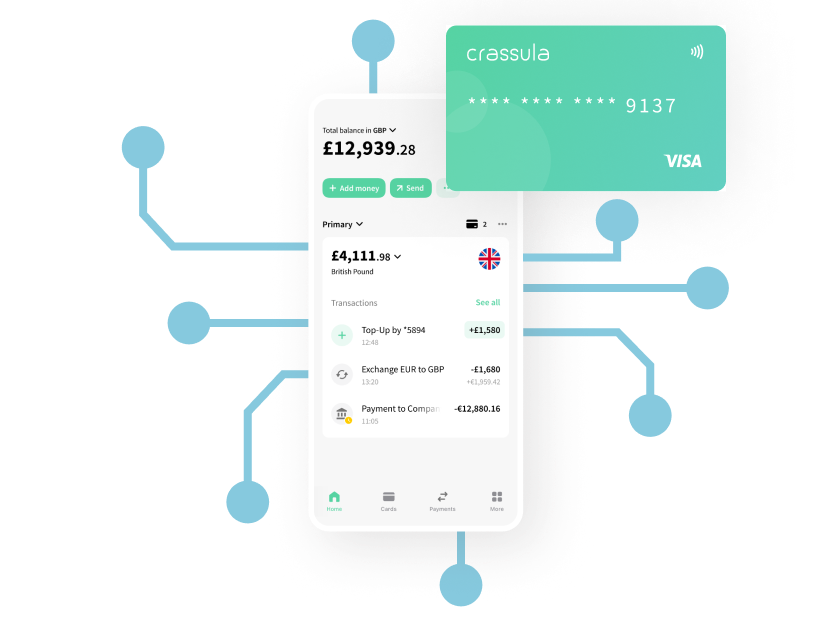

At this stage of building a digital bank, you must settle down the mechanics of online money transfers within your digital bank. A good online bank should include peer-to-peer transactions, recurring payments such as subscriptions, currency exchange integration, invoicing, and online bill payments. Also, users must be able to download a CSV for online payments and sort their spending by category.Integrate Third-Party Providers

Unfortunately, any online bank startup cannot provide all the necessary services on its own. Some features your team will develop, but many functions will be integrated by third-party providers. Here are the most vital for digital banks functionCustomize Charges And Restrictions

The next step in or guide on is customizing restrictions for customers and third-party providers. Develop the algorithm for authorization and restrictions on specific functions or features for a particular user group or particular timeframes. For example, you can set up the rule that new customers cannot get loans. Also, think about establishing a certain flexibility in charges to win the competition with inflexible online banks.Ensure Compliance And Security

Finally, you should implement solid security measures to protect both the finances and sensitive data of your customers. That is wh, think about KYC and AML integrations, multi-factor authentication of customers, etc. Moreover, a legitimate fintech bank should have a proper license in each country it operates, and be PCI DSS compliant.How Much Does It Cost To Build A Digital Bank?

Besides wondering about how to create online banking, you should also be worried about the cost of such a procedure. Obviously it extremely depends on the country where your bank will be registered in. So, if you start it in the European Union, the regular capital requirements usually start from €1 million. Even so, you will not spend all that money for bank opening, you will need it for proof of solvency. As for the US, the price varies between $2 and $5 million.Trends In Online Banking Technology

If you want to start an online bank, that will be up to date for at least another decade, you should consider integrating the following features:- Open banking. Most clients tend to operate their finances using a single platform.

- Artificial intelligence. AI integrations are used to personalize customer experience, which is crucial these days.

- Blockchain integration. Given the dynamic development of cryptocurrencies, you would miss many crypto lovers as your customers.

- Cybersecurity. To make customer security more advanced, you should invest in machine learning, and biometric login (authentification).

Final Thoughts

Starting a successful online bank is definitely a hard task. You will need to have a big team, a few million dollars, and a lot of free time to resolve hundreds of tasks. However, if you have a clear business plan, a skilled team, and know everything about your potential customers, and their needs, such a heavy weight can be lifted. So, read carefully how to start an online bank guide, and start your journey today.FAQ

You should know who your customers are, and what their needs are, develop a platform, get a license, and start the operation. To learn how to create an online bank in more detail, read the article above.

To start a digital bank,, you will need at least $1-$2 million on your account or your investor’s accounts to prove your solvency. However, the exact price strongly depends on the country of bank registration.

According to how to create your own banking system the procedure is manageable for many entrepreneurs. Yet, you will need a few million dollars, wait for 1,5 years, and manage multiple tasks to create a successful digital bank.