White-Label Mobile Banking Apps: A Complete Guide

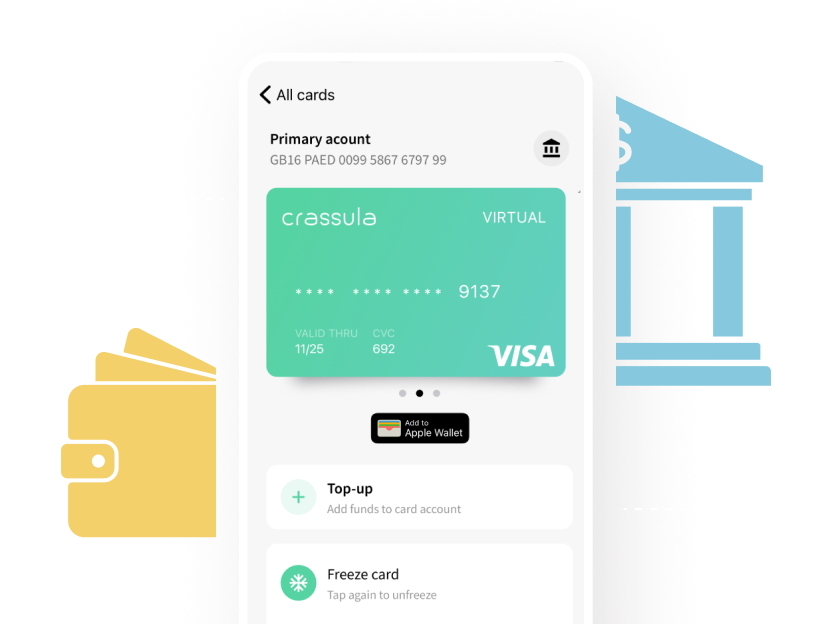

Building mobile banking is now bliss with Crassula white-label SaaS, compatible with iOS and Android platforms.

In the not-so-distant future, many companies will rely on digital services as a significant source of income, potentially leading to a world where every business becomes a financial service provider. What drives this fundamental transformation in business running is a single infrastructure comprised of an established bank’s licensing, regulatory compliance, and technology on the backend. You guessed it! We’re alluding to a proven white-label business solution.

If you aim to keep pace with a fast-moving digital landscape and provide advanced financing solutions to your customers in your own mobile bank, you’ve come to the right place. In this guide, we will cover ready-made white-label solutions and the benefits of using them from a business perspective. Then, the focus will be shifted to fintech applications and software development, where you will learn more about the pathway from the ground up to your own digital bank business. So, keep reading to find out all the ins and outs of affordable and secure white-label digital bank development!

How Popular Are Mobile Banking Apps Today?

In recent years, online banking has gained immense popularity among consumers as a convenient and easy-to-use way of managing their finances.

According to Statista, as of 2025, over 2.5 billion people worldwide use mobile banking apps regularly, and that number is expected to reach 3.6 billion by 2026.

In many regions, online banking is the primary method people use to manage their finances, outpacing traditional web-based platforms and even physical branch visits. Therefore, more and more businesses opt for a white-label banking solution to hop on the trend and build their own proper app. But before we spill the secrets of mobile banking app development, let’s first get to the basics.

Let's discuss your project and see how we can launch your digital banking product together

Request demoWhat Is a White-Label Mobile Banking App?

In a nutshell, white-label banking is a process in which banks provide third parties with access to APIs to build an app that financial institutions can customize with their branding and use to provide their customers with banking services.

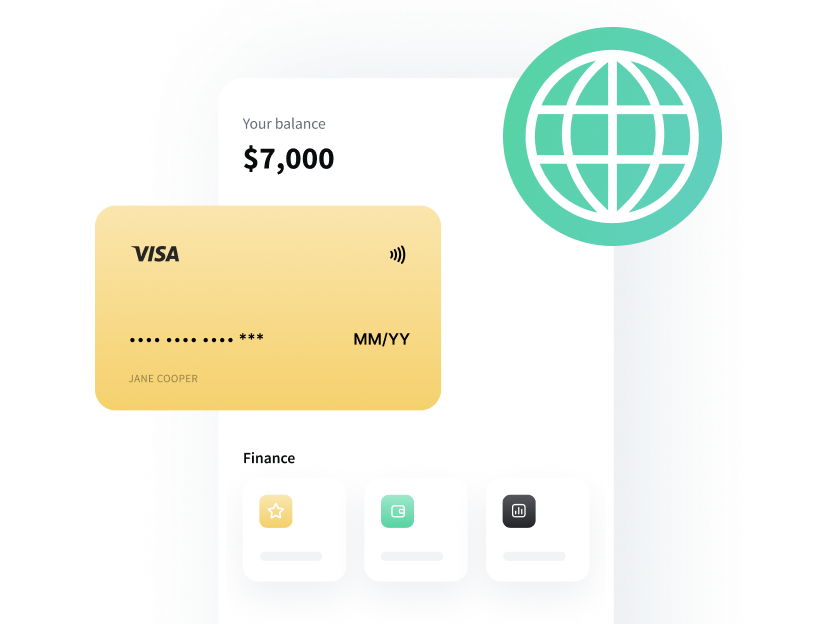

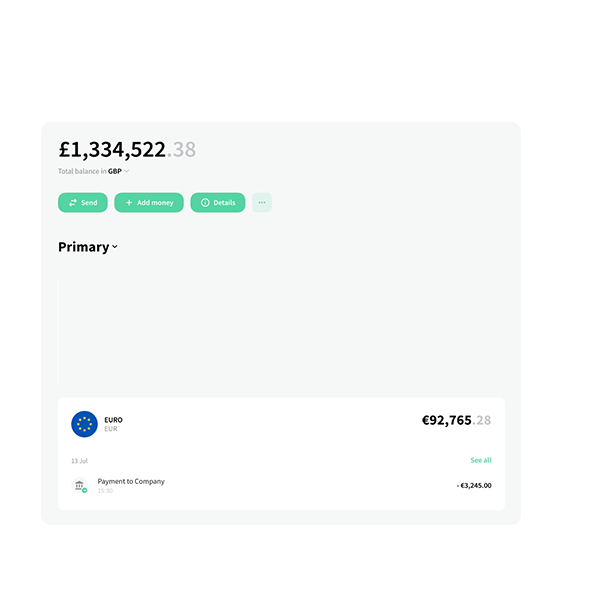

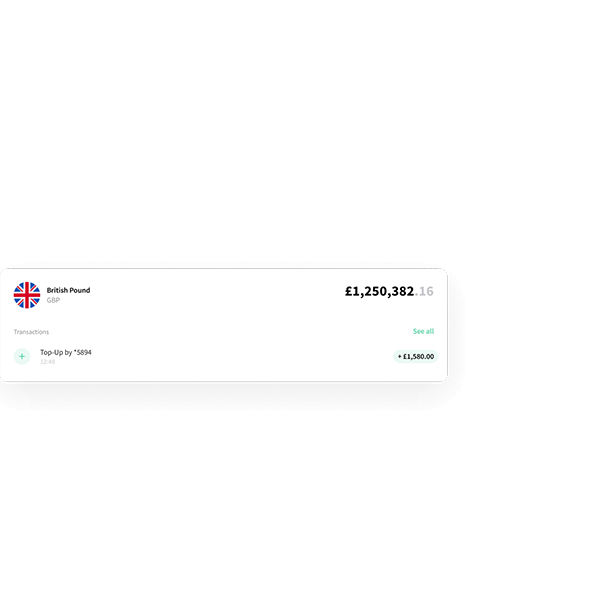

A white-label digital bank app allows remote 24-hour access and finance management via a mobile device, like a smartphone or tablet, from checking the balance and viewing account history to transferring money abroad. Thanks to the indispensable white-label model, your customers can fully leverage a bank app without visiting a brick-and-mortar branch.

White-Label App’s Flexibility

Customize your mobile apps to support your USPs and specific business needs in a function-rich yet simple way. The modular solution helps to enable new functionality fast, while white-label banking features allow modifying your branding to stand out from the crowd.

Would you like to explore new revenue streams and gain a competitive advantage by offering your customers a top-notch financial experience? A white-label mobile banking solution can be a great option for you!

Common Services

Various solution providers offer fintechs a simple integration for all the services, such as deposits, lending, and payment features, under one platform. The following is a complete list of white-label banking services:

- Savings and checking accounts

- Account management solutions

- Account balance and transaction history

- Debit and credit cards

- Simplified bill payments

- Online payment transfer systems

- Loan and credit card applications

- Bank statements with transaction details

- Balance notifications

- Budgeting and expense tracking

- Multi-currency accounts with

IBANs - Private and business banking

- Crypto accounts &

FX SEPA& International transfers- Card issuing solutions

- Mobile onboarding & Verification

How Does a White-Label Digital Bank Work?

A white-label digital bank is a simple solution for fintech companies to get into the market faster and save valuable resources. These companies purchase software from a service provider and then rebrand this solution as their own.

Essentially, certified banking providers offer their source code and infrastructure to deploy a white-label app with key banking features. With API-based solutions, companies can connect to financial and accounting software provided by white-label banking institutions and build their own financial product.

Once the launch is complete, businesses can supercharge the customer-centric app with all the bells and whistles that customers will love. That is to say, a white-label digital bank will enable customers to create and operate their accounts, receive, transfer, and exchange money, get an overview of all transactions, manage all aspects of interaction across all the integrated channels, and ensure the highest level of customer satisfaction.

Benefits of Using a White-Label Solution for Building a Neo-Bank

In this section of our guide, we will define the main pros of building your own financial services and products facilitated by a white-label digital banking platform. Without any doubt, using such solutions offers many advantages. Let’s take a look at all of them in greater detail below.

- Lower Costs: Building a custom app with seasoned designers, developers, and project managers will cost you much more than buying a ready-made app solution and customizing it to your needs. Outsourced development allows you to direct and allocate financial resources more smartly.

- White-Label Banking Saves Time: Efficient use of resources is guaranteed. You can save hundreds of hours and leave in-house development to tech experts, cut the time to launch, and obtain a ready-to-use white-label app in a matter of a few weeks.

- Increased Flexibility: When you create a white-label mobile banking app, you can choose the app architecture on your own, including packaging, branding, marketing, design, currency options, and much more. Regardless of your niche or business industry, it can be tailored to your unique business needs.

- Access to Advanced Solutions: Are you looking into turning your app idea into a full-fledged business? It’s only possible with the latest cutting-edge technology. Ready-to-use white-label licensed software allows you to bring new tools and services before anyone else.

- Better Customer Experience: In the financial service industry, recognizing the importance of customer satisfaction is crucial. The white-label banking model allows you to service your customers with the utmost attention to detail.

- Regulatory Compliance: Cultivating a compliance-competent culture within financial institutions has never been easier. A white-label mobile banking solution takes away the regulatory burden from your shoulders. Essentially, it helps to limit fraud, identify money laundering, and prevent terrorism financing, as well as other malicious schemes through

AML/KYCprocedures. Inevitably, regulatory requirements constantly evolve, so it’s crucial to know how to respond to them flexibly. - Branding Opportunities: Last but not least, you get the chance to focus on what you excel in the most — building a brand and honing your marketing strategy — from the visual elements of your financial product and tone of voice to your business vision and mission. The technical side of development can be left to the tech experts instead.

Private-Label Banking Vs White-Label Banking Apps

White-label and private-label banking products bare some resemblance. For instance, both are created by one company and sold under another company’s brand. However, there are specific differences between the two.

- Ownership: White-label banking is owned by the company that creates it and is sold to other companies to rebrand and sell to their customers. In contrast, private-label mobile banking apps are owned by the company that sells them under its own brand.

- Customization: White-label products are generally manufactured for multiple retailers, whereas private-label mobile banking apps are designed to be fully customized to meet the needs of a specific company.

- Cost: White-label products and solutions are less complex in deployment and, thus, lower in price. Conversely, the manufacturers of private-label products charge more for a higher level of customization and exclusivity.

Advantages of Private-Label Solutions

In comparison, private-label solutions are a go-to choice for businesses aiming to build distinctive custom-made projects not yet presented in the market. These solutions are built from scratch, so you can fully control the end product’s functionalities, unique design, and branding.

Another advantage of private-label mobile banking apps is that financial institutions can outshine their rivals in the same niche by offering a unique value proposition. Therefore, you do not simply create another banking app; you bring novelty to a crowded market and declare yourself as a functional and personalized bank.

Advantages of White-Label Solutions

Usually, white-label banking apps aren’t customized. But that’s what makes them special. Such pre-built solutions don’t require a major financial commitment and can enter the market faster and easier. Therefore, a white-label banking option is ideal if cost and time-to-market are your primary concerns.

Moreover, when you look ahead, a white-label digital bank is less expensive to maintain. Much work cannot be ignored, including fixing bugs, adding new codes or features, improving its overall functionality, providing technical support to resellers and end-users, and keeping track of quality assurances. All this can be taken care of with much lower costs.

How to Start Building a White-Label Digital Bank

Building an app from scratch may not always be the best option. It can be time-consuming, expensive, and risky, which is why fintech startups and other financial institutions resort to white-label banking. If you need help figuring out where to start, here’s an action plan.

Understanding the Requirements

Licensing conditions guide how banks can launch and develop. Therefore, you need to come to grips with the main requirements for building a white-label bank.

Identifying the Target Market

Above all, you need to identify your core customer base and understand the marketplace. For this, find local demographic information, look into who your potential clients are (e.g., behaviors, values, personality, and lifestyle), and, obviously, assess competition. Having done that, you can use this information to create a white-label digital bank that your target market needs.

Assessing the Regulatory Environment

Another vital thing to keep in mind is the legal framework. Fintechs should seek legal advice and implement robust compliance functions, such as a core banking system, Anti-Money Laundering (AML) and Know-Your-Customer (KYC) regulations, and General Data Protection Regulation (GDPR). Failure to comply with regulatory requirements can result in grave consequences — for example, reputational damage and an unsatisfactory user experience. To navigate regulatory challenges successfully, you need to look for these main criteria, as well as technology and support.

Evaluating Technology and Infrastructure Needs

Determine whether your existing infrastructure is satisfactory or should be replaced. Technology plays a crucial role in fintech app development, so make sure you have all the required technology and equipment, including:

- servers;

- physical machines;

- virtual machines;

- cloud;

- storage;

- network;

- print and auxiliary services;

- desktop and other end-user devices;

- security;

- data protection and recovery.

Choosing a White-Label Mobile Provider

Whether that’s a new CRM system, new finance software, or an online retail shop, choosing the right white-label provider that aligns with your existing operations can be difficult.

Factors to Pay Attention To

Amidst a plethora of service providers in the market, what criteria should you consider while selecting a white-label solution provider? The primary considerations to bear in mind are costs, communication management, delivery capabilities, current clients, partnerships, and case studies.

Comparing and Evaluating Different Providers

After compiling a shortlist of potential solutions based on your meticulous research, schedule a demo to evaluate their relevance to your business. Prepare a list of criteria and regulations. It will help you rank different solution providers and find the best fit for your enterprise.

SaaS Versus On-Premises

Choose the type of service, drawing upon your budget, desired regulatory compliance, maintenance, and source code upgrades. SaaS is a service delivered through the cloud and is supervised and administered by third-party vendors. In comparison, an on-premises application is typically installed in-house and maintained by an external service provider.

Negotiating the Terms of the Partnership

Contact the vendor and discuss the deliverables, price, and terms. A dedicated customer service department will be upfront and open about the deadlines and costs of additional users, customizations, integrations, and setup fees.

Customizing the White-Label Digital Bank

The next step in white-label mobile banking app development is customization. At this stage, you can unleash your creativity and create a truly unique application.

Branding and Design

The vendor will provide ready-made templates with all the functions you need. Thus, you will be able to adjust the content, add your branding, create a unique design, and update the white-label mobile app whenever you want to.

Adding New Features and Functionalities

Add enhancements and additional features that align with your customers’ needs. These features can be quickly and easily incorporated into digital banking platforms and include multi-currency accounts, SWIFT and SEPA instant payments, strong customer authentication, KYC/AML onboarding, account verification, and more.

Integrating with Existing Systems

Do you own software or have a well-functioning app? Try integrating your existing systems for a frictionless customer experience and valuable insights.

Post-Launch Support

Ongoing Maintenance and Code Upgrades

If you choose the right white-label banking provider, its expert team will cover all technical source code upgrades, hosting, security monitoring, and a maintenance dashboard. In this manner, the bugs are fixed quickly, and your website always remains functional and protected.

Providing Customer Support

Customer support can also be entrusted to professionals. The white-label mobile banking app provider will quickly respond to incidents and user requests until everyone is satisfied.

Monitoring and Analyzing Usage Data

With powerful analytical software, you can extract analytical value immediately through dashboards and data visualization. Moreover, it enables you to monitor recurring customer issues and facilitates delivering a personalized experience.

What Does the Future Hold for White Label Banking Services?

McKinsey’s experts anticipate that banking will undergo significant restructuring in the coming years. However, we should stay optimistic and acknowledge that the banks that effectively navigate this transformation will expand in size, profitability, and growth, resulting in a potential $20 trillion value-creation opportunity.

To beat the competition in the financial sector, you need to innovate and develop new solutions. The white-label service is your savior in shining armor. It creates a win-win banking system where banks, enterprises, and fintech thrive. It is undoubtedly the future of banking, and Crassula is your gateway to being part of that bright future.

Start Your Digital Business With Crassula

Do you lack the expertise and resources to launch a digital banking app? Revolutionize the banking industry with a unique white-label solution built with Crassula. You will get all the required infrastructure and tools to customize your application, create personalized offers, and augment your revenue streams quickly and within your budget.

Conclusion

Banking app development is an ingenious idea, as the need for novel financial products and services is rising today. To cut to the chase, fintech app development is rewarding but, at the same time, an overwhelming process. If you support innovation, value customer convenience, and are interested in making a profit, you should definitely consider white-label app development.

First and foremost, white-label platforms drive financial inclusion by assisting companies in developing strong fintech ecosystems. Secondly, these solutions lift a burden off your shoulders by ensuring security, innovation, and the use of best-in-class technology so that you can focus on your core competencies. Lastly, outsourced white-label app development is more wallet-friendly than hiring in-house resources.

If you’d like to learn more about how the white-label solution can boost your business, just contact the experienced Crassula team for help!