White Label Digital Wallet

White label wallet is a SaaS product that you can customize, add new functionalities, integrate into your existing product, and maintain in a cost-efficient way.

In the “cashless” era, consumers yearn for the full scope of financial capabilities that digital banking has to offer. Apart from that, many individuals opt for payment solutions that combine adaptability, rapid scalability, enhanced security, and optimized user experience. Digital wallets are one of the proven ways to provide exceptional value in one product.

Businesses that pick it up quickly look for agile and scalable white label software to build a fully-functioning wallet in an efficient and timely manner.

Embracing the digital payment model enables them to accelerate their time to launch and conquer new markets. In this article, we’ll go into the depth of digital wallets and why it is a must for all enterprises.

What is a digital wallet?

A digital wallet (or electronic wallet) is an online payment tool or financial transaction application used to make purchases at stores, online or via a mobile wallet app, and securely store your payment information and passwords.

Likewise, a white label wallet is a SaaS product that you can customize, add new functionalities, integrate into your existing product, and maintain in a cost-efficient way. White-label platforms, like Crassula, indeed help businesses and merchants with that.

Let's discuss your project and see how we can launch your digital banking product together

Request demoTypes of white-label digital wallets

Consumer wallet

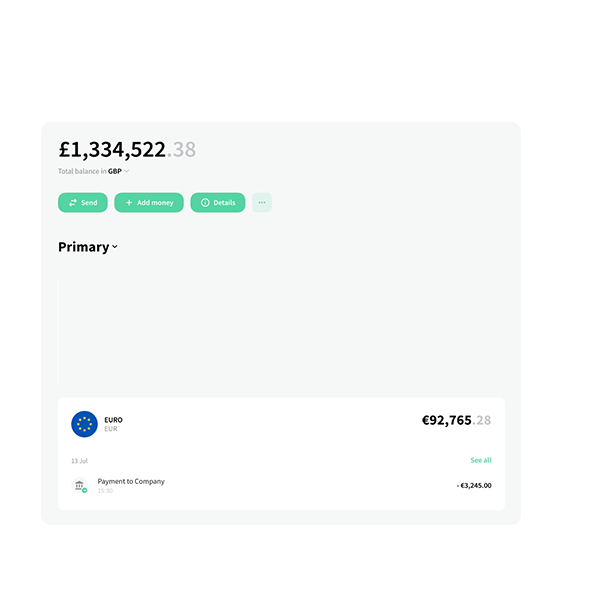

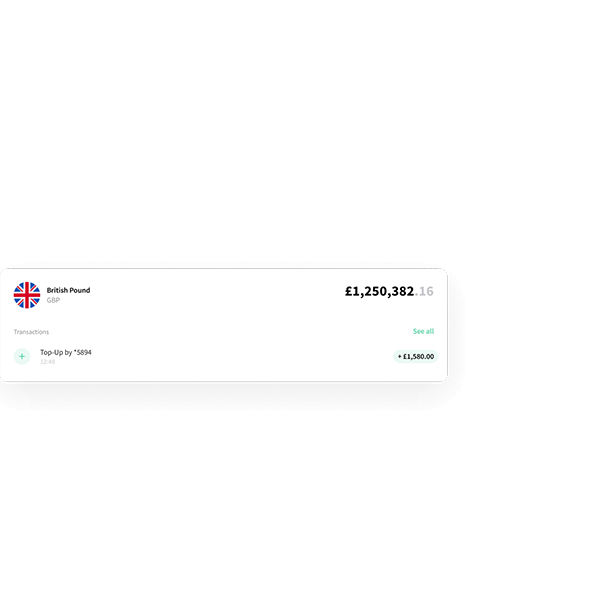

White label digital wallet with which you can create a bank account and manage money requests, P2P transfers to contacts, QR code payments, send and receive, make cross-border transfers with instant currency conversion, credit and debit cards, loyalty, and rewards.

Merchant wallet

A white label store for merchants that want to enable their customers with various payment methods, handle billing, manage sales, and so on.

Cryptocurrency wallet

A white-label cryptocurrency wallet with the opportunity to make payments, deposit and earn from crypto, and much more.

What does the demand for digital wallets look like?

To understand the context of the digital wallet’s take up and use better and how massively it is adopted, we need to look at the numbers. The statistics below exemplify the relevance of digital banking nowadays and what’s propelling its usage:

According to a global study by Juniper Research, more than five billion people will be using a digital wallet by 2026 as “super apps,” driving adoption in developing countries.

As for the Marqeta new report, its respondents revealed that their consumer confidence in mobile payments and digital wallets is so high that they feel more compelled to leave the house with just their mobile device and are completely comfortable without their wallets.

Similarly, the growth of e-commerce businesses has accelerated over the last few years, and the increasing number of users on PayPal serves as an example. The main contributor to it is indeed digital banking, which makes products and services more accessible.

How to pick a trustworthy white-label wallet provider?

When it comes to launching a digital bank, a good start leads to long-term success. A team of skilled experts to offer a custom-branded digital wallet solution is highly recommended.

With the provider’s infrastructure, you will save yourself and your team plenty of time and a development budget. Building such a product from scratch may take up to several years of coding, testing, and development while implementing a ready-made white-label product requires just a couple of weeks. An excellent white-label provider will lay a solid business foundation needed for your scaling ambitions and covering specific business needs.

But here’s a catch. There are numerous fintech mobile app providers out there that deliver unique solutions. So, how do you find the right one?

Here are the main factors you should take into account when choosing a white-label platform for your business:

- Pricing: make sure the provider offers flexible pricing structures that suit your current budget and not leave you in the red.

- Integrations: favor vendors with multiple integration capabilities and partner with leading digital banks.

- Compliance: choose the provider that delivers compliant web, mobile wallets, and back-end solutions with two-factor authentication, QR code scanner, multi-signature support, institutional-grade security, or other relevant security features.

- Reputation: schedule a demo only with the providers with reviews and decent rating, reliability is a must.

White-label digital wallet development with Crassula

At Crassula, we provide fully-functional white label digital wallets equipped with a wide variety of features, thereby enabling you to offer a brand-new experience to your customers. Our job is to handle development, maintenance, and overall support. Yours is to focus on your business.

Request a free demo of our white label digital wallet to connect with our experts and start working on a development strategy for your wallet.

FAQ

The future trends in white-label digital wallet development include:

- More mobile wallets: Expect a rise in white-label mobile wallets due to their growing popularity.

- Enhanced integration: White-label wallets will be better integrated with additional services like loyalty programs and e-commerce platforms.

- New features: Anticipate the introduction of contactless and peer-to-peer payments to white-label wallets.