Banking software precisely designed for your business

Our single banking software platform has everything you need and provides facilities under proper management.

Crassula offers the most comprehensive and hassle-free portfolio of software solutions in the market. We know how to address the needs and wants of banks, financial service businesses, and other regulated electronic money institutions of any size and scope. Our platform guarantees cost reduction and elimination of complexities and obstacles associated with building and launching financial products or services. Would you like to innovate and expand yours? Crassula’s team is ready to help you out with its banking offerings.

We are ready to make your business goals come to life

Single Platform for Efficiency

You don’t need to look for other platforms or providers to kick the entire process. Our single banking software platform has everything you need and provides facilities under proper management. We introduce you to all the required service providers or assign new ones for your particular project.

Tighter Compliance

In order to meet all requirements, we deliver configurable best practices for managing manual revaluations, updates, and releases. It is ideally designed for Banks, EMIs, APIs, MSBs, and other financial institutions that want to maintain regulatory procedures in a modern way. Crassula brings the best AML/KYC and onboarding tools inside its banking software product. Financial monitoring tools like ComplyAdvantage or Hantli could give Crassula customers an ideal inside outlook on its customer database and transactions integrity.

Speedy launch

How about this one? We will not keep you waiting longer than ten business days. With Crassula, you can customize a brand new financial product in less than a week and offer a range of opportunities to your customers. Crassula software banking product stays in the cloud giving customers 24/7 access with up to 99.9% uptime.

Enhanced flexibility

Crassula’s platform is built on a modular system that enables excellent flexibility and many variations of how financial solutions can be done. You can adjust a financial product to match any specific business needs and build an exclusive development on the market with us. Crassula’s development team is capable of performing complex integration tasks in addition to new feature development aimed to cover customers’ demands in UX/UI and core functionality improvements.

Minimum budget

We introduce you to the latest banking software technology even if your budget is limited, letting everyone digitize their banking customer experience. Launching with us is so affordable that you can get a White Labeled product for the price of hiring an IT developer.

Versatility

Crassula is the most versatile white-label online banking app on the market. We are working with a dozen institutions, including banks, neo-banks, payment institutions, cryptocurrency exchanges, asset companies, e-money institutions, and anyone else involved in client accounts management.

Let's discuss your project and see how we can launch your digital banking product together

Request demoWhat are the gains?

- You will receive many customer insights and understand their needs and behaviors better thanks to the automation of our solutions.

- You can get rid of your own IT department and development hassle to minimize integrations and have everything implemented at one platform very cost-efficiently .

- As a business owner, you just think about how to grow your business and customer engagement, and we will take care of everything else.

For your business

- You can build a unique customer journey and hook them with end-to-end online banking solutions with our future-forward approaches.

- Crassula helps you keep customers at the core by giving them the most personalized offerings.

Redefine your retail and corporate banking customer experience

We want your finance experience to come off with flying colors. That’s why we give you access to a wealth of the essential features and tools necessary to build the banking solutions of your dreams.

Mobile banking

Bring your customers’ experience to the next level with a full range of loyalty programs, exchanges, transactions, personalized offerings, and much more on their phones. Crassula will assist you in building mobile banking solutions or provide ready-made iOS and Android applications ideally matching your clients’ specific needs.

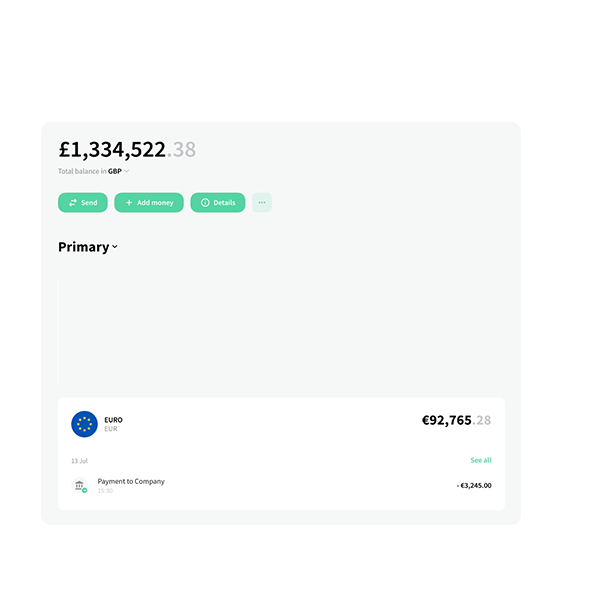

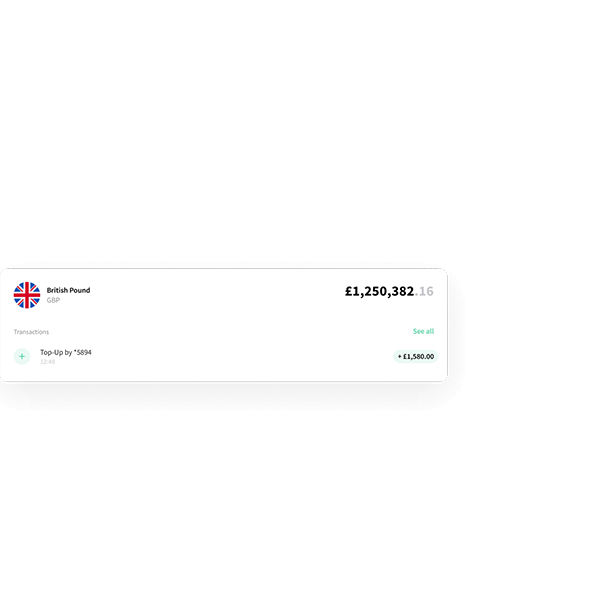

Balance and operations

If your goal is to carry out finance operations, but you know nothing about how to organize your own bank, we are ready to make your life easier. The BaaS model enables you to implement financial operations such as lending and depositing through its interface. Moreover, this is your extra channel of essential data and insights: forecast a banking app’s customer trends and spending behaviors.

KYC and AML compliance

Be confident that increased security and protection against fraud are guaranteed. Protect your business and your customers. Crassula platform is compliant with Know Your Customer (KYC) and Anti-Money Laundering (AML). We can help you mitigate any risks associated with financial crimes.

Support around the clock

Crassula will service you on a daily basis. In case any questions arise, we are there for you to solve them. Your own manager and tech support will handle everything.

Digitize your business with Crassula

It is easier to run a business with automation of all processes and new future forward-driven solutions. You can earn a competitive advantage and high revenue by delivering personalized offerings and robust financial products to your customers.

However, achieving all of that is possible only when you have your own bank or with our providers that can do everything at a low cost and in less than a week. Crassula is your getaway solution to make a vast array of integrations and revolutionize how you do business.

FAQ

Banking software is a comprehensive suite of computer programs and applications designed specifically for banks and financial institutions to manage their operations efficiently. It serves as the backbone of their infrastructure, enabling daily banking transaction processing and maintaining up-to-date financial records.

This back-end software handles various crucial functions such as account management, transaction processing, fund transfers, loan management, and customer relationship management.

- Core Banking Systems

- Online Banking Software

- Mobile Banking Software

- Customer Relationship Management (CRM) Systems for Banks

- Risk Management Systems

- Payment Processing Software

- Fraud Detection Systems

- Loan Origination Software

- ATM Software

- Anti-Money Laundering (AML) Software

The demand for banking software in the market is substantial and it is expected to reach a CAGR of 7.8% between 2021 and 2028. Financial institutions of all sizes, including banks, credit unions, and other financial service providers, are on a hunt for reliable advanced banking technologies, and investing in banking software is their top choice.

Banking software lays the foundation for the automation of financial operations and overall market efficiency.

For example, CRM software assists banks in managing customer interactions, preferences, and marketing efforts to improve customer satisfaction and retention. Similarly, Payment Processing Software allows banks to automate the processing of payment transactions, including credit card payments, online transfers, and Automated Clearing House (ACH) transactions.

Depending on the type of banking software, the features might differ. But the main functionalities that all of them need to have include:

- Account Opening

- Cash Deposits and Withdrawals Processing

- Payment Clearance

- Loan Processing

- Interest Rate Calculation and Management

The financial institutions might choose several implementation and deployment options available. These include:

- On-Premises Deployment: the banking software is installed and hosted on the institution's own servers and infrastructure.

- Cloud-Based Deployment: the banking software is hosted on a cloud infrastructure provided by a third-party service provider, accessed and managed remotely.

- Hybrid Deployment: certain components of on-premises and cloud-based Deployment are combined.

- Software-as-a-Service (SaaS): with this model, the banking software is offered as a subscription-based service hosted and maintained by the software provider.

Developing a banking app is a tedious job involving various complexities. Starting from compatibility issues with some devices, code quality maintenance and ending with security and encryption management, regulatory compliance, and platform choice.

Building a mobile app on banking software usually costs between $30,000 and $130,000. However, it's important to note that the actual cost can vary depending on various factors, such as the complexity of the app, desired features and functionalities, the development platform, and the development team's rates.

It can be difficult sometimes to pick the right banking software providers, as each one offers different modules, functionalities, and commercial packages. When making your mind up, keep an eye on the following:

- Evaluate the provider's experience and expertise in developing banking software. Look for a track record of successful projects.

- Pay attention to software architecture, enabling modular development and easy maintenance.

- Invest in banking software with top-notch support to outclass your competitors.

- Prioritize the capabilities of the technology over the cost.