14 Best Banking-As-A-Service Providers In The Market In 2024

Banking-as-a-service platforms’ capabilities encompass a full suite of products and services provided by the partner network, including sublicensing, IBANs, SEPA, SWIFT, and other types of payment methods.

Banking-as-a-service is skyrocketing, allowing non-financial companies to propose the necessary banking services, expanding the global market. According to the official statistics, the BaaS market will grow to $14.72 Billion in 2029. Unsurprisingly, banking-as-a service providers suggest more and more impressive opportunities for their non-bank clients, boosting customers' loyalty and guaranteeing there is no need for an official license. Let's delve into the banking-as-a-service ocean, understand its features, and explore the finest BaaS providers.

What Is Banking-As-A-Service (BaaS) And How Does It Work?

BaaS, or banking-as-a-service, is an exclusive business solution that gives the green light to non-financial institutions to supply banking services for their clients. Which is all to say, existing licensed banks and fintech organizations may integrate their banking resources and products into digital platforms of non-financial companies, regardless of their activity direction.

BaaS services are a pathway for various organizations without a license to make a bold move and operate as financial institutions as well. Therefore, a non-financial business pays a fee to access banking-as-a-service to spawn cooperation with the chosen partner. Subsequently, banks or other financial institutions open their APIs to the TPP (third-party provider), guaranteeing access to the information and systems necessary to establish new banking products or provide white-label solutions.

Let's discuss your project and see how we can launch your digital banking product together

Request demoWho Are BaaS Providers And What Do They Do?

BaaS providers are banking organizations that offer access to banking services via application programming interfaces (APIs) to non-financial companies. These providers allow companies to integrate banking services into their apps and platforms without creating and maintaining their own technical infrastructure. Most providers that supply BaaS are responsible for a few functions. We give a glimpse of their primary tasks below:- IBAN generation (real or virtual). BaaS vendors set up cross-border online transactions with their IBAN potential. With SWIFT integration, companies provide a solid infrastructure to build real or virtual IBAN accounts. Furthermore, suppliers of BaaS provide multi-currency management tools to guarantee operation in the international market.

- SWIFT payments. Banking-as-a-service providers use cutting-edge payment processing to ensure effective and quick SWIFT payments for various clients' demands.

- SEPA. Since the finest BaaS companies support SEPA, they simplify global payments. Clients of non-financial businesses may count on euro transactions accomplished in a split second.

- KYC (Know Your Customer). As a potential company with financial services, you must operate according to KYC regulations to prevent such things as corruption, fraud activities, and money laundering. Banking-as-a-service suppliers offer up-to-date KYC solutions, which involve identity checks (face, ID card, and other documents verification).

- FX services. The best BaaS platforms are FX providers. Thus, they offer foreign currency exchanges for clients and complete international transactions in different currencies. On average, you may access financial operations in over 50 currencies.

- Branded cards for clients. Non-financial companies may issue personalized cards for payments by using BaaS. Additionally, the cards can be adapted according to particular needs and use cases. These can be both physical or virtual cards for depositing, financial management, payment services, etc.

Who Needs BaaS Providers?

Banking-as-a-service companies are profitable for businesses that need access to banking services and products but cannot create complete infrastructure using available software. For example, these are online retailers, marketplaces, and e-commerce platforms without access to payments or banking products.

Additionally, the clients of BaaS vendors can be various companies in real estate, healthcare, and transportation areas that aim to embed banking services into their proposals. Of course, educational companies may also benefit from BaaS providers.

Top 14 Banking-As-A-Service Providers That Dominate The Market In 2024

We have crafted a list of top banking-as-a-service providers with beneficial proposals for clients. Continue reading to learn their main hallmarks, pluses, and minuses.Unlimit

Unlimit stands out in the Banking-as-a-Service sector by empowering new markets, and global businesses to embed a full range of payment services into their platforms. With Unlimit’s API-driven configurable platform, companies from London to Singapore and from San Francisco to Sao Paulocan - essentially, every corner of the world to offer global payment options, from multi-currency transactions to branded payment cards, ensuring streamlined and scalable operations. This makes Unlimit an essential BaaS vendor for businesses aiming to expand their global financial services reach without multi-layered intricacies of obtaining a banking license.

Intergiro

Integrito is a Swedish-based financial provider that was founded in 2017. It suggests APIs that supply the infrastructure for payment service vendors, neobanks, crypto exchanges, and crowdfunding websites.

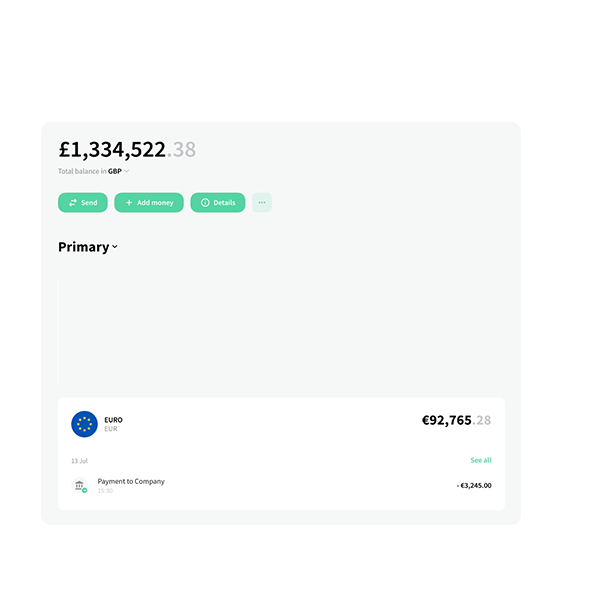

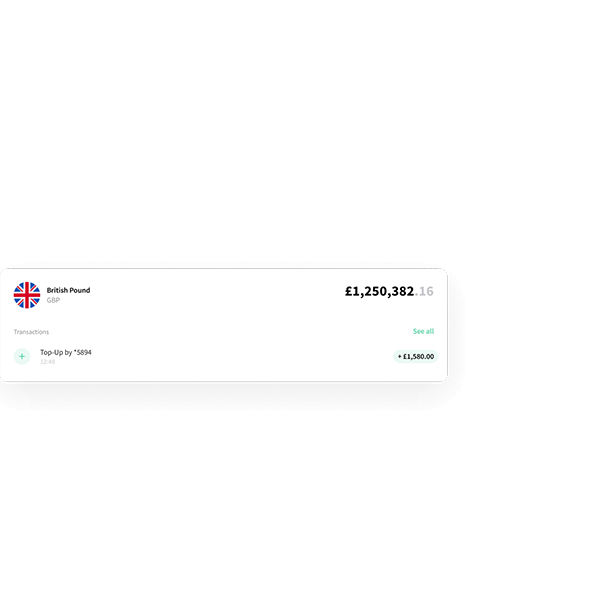

As a versatile BaaS supplier, Intergiro empowers businesses to furnish and manage financial services through API or seamlessly integrate supplemental services into their existing products. The company gives its clients full control over their financial operations. Intergiro provides virtual card issuing and an opportunity to embed multi-currency IBAN accounts. Besides, with its help, you can set up traditional card programs. It also allows the integration of in-app payment methods into available financial services or products.

Bankable

If you seek a UK-based banking-as-a-service provider, Bankable will be a good choice. The company was started in 2010 by experienced entrepreneur Eric Mouilleron. This provider collaborates with a wide range of business directions. Whether you're a fintech entrepreneur, a financial institution, or a corporation, this provider is equipped to supply modern payment solutions tailored to your specific needs.

Bankable has an effective, fast, and secure API banking and a white-label platform, guaranteeing targeted solutions for clients. The cloud-based platform has PCI-DSS certification and is hosted in Tier-4 data centers. As for the services, the company offers digital banking (including payment cards, IBAN accounts, SEPA, and SWIFT), a virtual ledger manager, data analytics, e-wallets, and a branded card program.

ClearBank

ClearBank is also one of the UK-based BaaS providers founded in 2017, focused on creating the finest global payment infrastructure. The supplier offers cutting-edge banking solutions for integration. In particular, ClearBank cooperates with eCommerce businesses, digital banking, and fintech startups. The company offers a flawless API that integrates with the available services or products to create a fully regulated banking infrastructure. Clear.Bank makes account opening and management easier in real time.Centrolink

The Central Bank of Lithuania furnishes this payment system, which enables a technical base to link the Single Euro Payments Area (SEPA) via the CB's infrastructure. However, keep in mind that these services are available for fintech companies licensed in the European Economic Area.Cambr

Cambr is a financial supplier that connects customers with over 850 banks, simplifying increased returns and cash storage. The provider's solutions enable customers to monetize deposits, scaling the payment process safely. The integration with Cambr servers is swift, taking weeks, not months, and saving you time. In most cases, Cambr provides its BaaS for fintech companies and embedded finance that want to allocate their deposits strategically, maximizing interest.Clear Junction

Clear Junction was founded in 2016 by a team of financial experts who wanted to transform the landscape of international transactions and payments. As a BaaS platform, Clear Junction integrates automated payments into your available platforms, manages risk and compliance, and provides virtual and e-money accounts. Clear Junction has created a set of effective payment solutions based on proprietary technology, guaranteeing a seamless operation from start to end.Railsr

Railsr, formerly Railsbank, is a UK-based BaaS supplier that provides comprehensive solutions, allowing companies to embed software into their products or services. Their APIs involve open banking, digital wallets, card issuance, regulatory compliance, international transfers, and more. Although the proposed services operate best for retail and fintech, the Railsr team has noted that their solutions line any digital industry.Starling Bank

Starling Bank is a UK-based BaaS supplier, specializing in current and business bank accounts. Additionally, the company provides access to countless services and functions, including online deposits, mortgages, and insurance. Besides, Starling Bank guarantees a marketplace connecting with third-party service suppliers. Starling Bank also offers joint and multi-currency accounts, as well as business and personal ones. All these services are available from one powerful and single app. With Starling Bank, you can be confident that all your banking needs are covered.Solarisbank

Solaris Bank will be a great option for customers seeking banking-as-a-service providers located in Germany. It is the biggest platform with BaaS, supplying branded physical or virtual credit and debit cards, digital banking services, KYC, and more, ensuring your business is in a safe hands. Solaris Bank is a game-changer in the digital finance landscape by removing any obstacles for businesses in various areas. BaaS by Solaris Bank enables different companies to seamlessly integrate groundbreaking financial solutions into their functions.Marqeta

Marqeta is a top-rated company that focuses on issuing cards for clients. On top of that, it is also known as a solid BaaS supplier. It was formed in 2009 by Jason Gardner, who wanted to simplify payment processes worldwide. Today, Marqeta's reach extends to over 40 countries, offering APIs for card issuance, digital wallets, and fast payment processing. In most cases, Marqeta cooperates with eCommerce and fintech startups, proposing such services as customizable payment management, instant approval, transaction analytics, and full developer tools and support.Stripe

For those who are looking for US-based banking-as-a-service providers, Stripe will be a good choice. It is a trusted American financial company founded in 2010. It provides various services for businesses and enables the integration of scalable embedded finance solutions into available software. The company collects customer payments, multiparty payments, and business cards (virtual and physical cards with your company branding). Additionally, the supplier guarantees fast bank account opening, KYC, and sending ACH or domestic wire online transfers. Today, Stripe supports over 135 payment methods and currencies.Treezor

Treezor is a European BaaS provider that was founded in 2016. The company provides numerous financial opportunities involving online wallets, payment processing, KYC compliance, and card issuance. Treezor frequently cooperates with neobanks, financial institutions, and mobility services. The company is known for its flexible services, which enable it to establish new offers at high speed. Thus, businesses may quickly join the market, improving their competitiveness since they can instantly respond to market needs, changes, and clients' demands.Galileo

Galileo is a US-based financial vendor with over two decades of experience. The company positions itself as a high-powered API platform, offering debit cards for clients, KYC compliance, flexible credit programs, and more. The platform boasts its flexibility, allowing you to tailor your proposals to specific audiences and needs. Moreover, this BaaS vendor enables businesses to safely and quickly transfer funds via peer-to-peer (P2P), wire, and bank-to-bank transactions, operating in over 16 countries.How To Choose A BaaS Provider?

It can be tedious to pick the best banking-as-a-service provider, since you need to consider numerous aspects like security measures, cost, reputation, etc. We have described each essential facet in the review below.Feature Set

First, you should evaluate the number of available banking services the vendor suggests. This includes compliance solutions (AML, KYC), core banking services (wide range of payments, account management, transfers), customer support opportunities, and supplemental services (for instance, financial analytics and credits). The banking services offered must align with your business goals and needs.Security

The banking-as-a-service platform should operate legally according to financial regulations in the area where your business works. Additionally, you need to be sure that the chosen provider utilizes solid security measures for fraud detection and protects sensitive financial data. The BaaS company must use robust encryption methods, have regular security audits, etc.Pricing And Cost Structure

It is crucial to realize the pricing model of the selected banking-as-a-service providers. The vendors may charge you based on transaction volume, API usage, and subscription fee. So, it would be better to compare costs offered by various providers, considering any supplemental fees or customization prices.Performance And Reliability

Providers of BaaS should also operate according to appropriate licenses, guaranteeing the company's reliability. You should pay attention to certifications if you want to operate in different countries with various regulatory frameworks.

Additionally, you need to explore the provider's ecosystem. We recommend opting for BaaS providers with flawless partnerships with global banks and regulatory institutions. Thus, you may count on comprehensive solutions and excellent support for expanding your banking products and services.

Platform Support

Since you may have some questions or remarks about the work of the chosen provider, you need to ensure there is quick customer support. It would be great if the company offered 24/7 customer support via live chat.Vendor Reputation And Stability

If you plan to grow, you should check the provider's opportunity to scale and be flexible according to your business needs. We advise you to verify the BaaS companies' SLAs (service-level agreements) and uptime guarantees. You have to be confident in uninterrupted services and minimal downtime. Do not forget to check reviews of other businesses about the work with the chosen vendor. It helps to have the whole idea of its possibilities.Migration And Exit Strategy

We also recommend considering migration and exit strategies when picking a BaaS vendor. You must ensure that you will receive ownership of your data and an opportunity to export it in a suitable format after the cooperation ends. In addition, you should review contractual terms regarding the termination of your collaboration. We advise checking that backups are available and can be transferred safely in the case of termination of services or migration.Final Thoughts

Consequently, BaaS suppliers are the right move for businesses that want to provide financial services through available software. We can confidently say that banking-as-a-service startups or seasoned players on the field do not just suggest financial services. They also optimize business processes, facilitate innovation, and unlock new possibilities for businesses to flourish in a competitive landscape.

BaaS suppliers enable businesses to focus on their primary services and business goals while utilizing providers' infrastructure to improve their proposals and user experience. You will have no reason to worry about banking services' security and flexibility and will be able to scale with the chosen vendor.