Banking As A Service: Ultimate Guide

Banking as a service BaaS is an end-to-end process that enables licensed banks to execute financial operations and offer digital banking services to other third parties.

The financial industry is immensely expanding its scope to attain an improved customer experience and boost the revenue even more than it was just yesterday. Indeed, fintech banks are introducing a surging amount of services that sometimes we can lose count of new things emerging on the market.

This guide will help you catch up and stay on-trend with one of the service branches in the financial industry. Here you will find the most relevant information about this banking model and how to apply it in your own business. If you are excited as much as we are, let’s roll into the definition straight away:

What is BaaS?

Banking as a service BaaS is an end-to-end process that enables licensed banks to execute financial operations and offer digital banking services to other third parties.

It grants non-banking enterprises access to the bank’s systems and information through APIs. This way any independent company can create new financial products or offer white label banking services.

Let's discuss your project and see how we can launch your digital banking product together

Request demoHow does banking-as-a-service work?

Non-bank companies leverage their offerings to deliver an enhanced customer experience and boost their revenue in multiple kinds of ways. With a BaaS digital banking platform they can take these achievements to an entirely new level by allowing their customers to access additional financial products.

But there is always a twist. If you want to offer banking services, you are obliged to acquire a banking license of your own. Obtaining a license is a daunting task that requires both a significant amount of capital and a lot of time.

Additionally, if you want to get involved in the financial sector, you must recognise the sheer volume and breadth of regulations taken on your shoulders. Apart from that, your non-banking institution will need to deal with the complex risk calculations, cope with new demands of data management and adjust to the regulatory challenges. If this looks like a huge burden for your company, don’t worry. This is where a banking-as-a-service platform comes in.

What are the benefits?

For financial institutions:

You might be questioning yourself about the intentions of traditional banks and other financial institutions to lend their entire client base to other financial institutions, agents or non-banking businesses. And if you are still convinced that their piece of a big pie seems to be the smallest, you should dig deeper. By granting licenses, infrastructure and technology to FinTechs, the BaaS providers win over a significant revenue stream. Furthermore, lending enterprises, accounting companies equally have a head start.

How does it work? The bank or electronic money institution provides the basic infrastructure services – financial products such as current accounts, ledgers, seamless bank card issuance, SEPA, SWIFT payments to a FinTech client or platform. And the second party has to pay them for accessing the required licensed financial products through enabling core-banking services within the FinTech platform. A traditional bank or financial institution (a baas infrastructure provider) reaps the benefits of banking-as-a-service by offering new innovative embedded payments products that attract new customers in the long run.

For financial institutions:

If you own a non-financial business, what is in it for you? BaaS offerings allow you to put forward extra services such as, debit cards, payment services and international payments. And all of these choices give you a competitive edge over other companies as you can stand out with a longer list of extra features that your competitors might not have.

This might sound pretty vague without examples, so let’s take a look at a few of the most popular brands and how they win the loyalty of their users or customers and earn profits by adopting embedded finance on their individual platforms.

For instance, a ride-sharing app like Uber offers drivers a debit card that helps them manage their driving activity and earnings through the Uber app. They made it possible with BaaS, of course. Or take for example Google Pay that gives its users an elevated experience: a digital wallet with cash back rewards. In order to access such unique offerings a major non-financial company like Google or other BigTech doesn’t need to become a bank or electronic money institution.

After all, accommodating legacy banking services involves a lot of infrastructure costs. Therefore, the company takes advantage of BaaS and distributes banking services without opening its own bank or becoming a relevant financial institution.

On top of that, banking-as-a service helps non-banking businesses analyze their customers’ spending habits and understand them better. So, any enterprise can become more successful and respond to new customer purchasing habits faster.

For financial institutions:

Obviously, the benefit of banking-as-a-service is not just for non-financial companies and banks. Financial services are not just about getting a loan or making a deposit. It involves smart contracts, loyalty programs, and blockchain that change customers’ experience in leaps and bounds.

For example, company X might want to integrate with a financial institution and distribute financial products. The BaaS allows it to do that under a company X’s own brand. This way the customer journey is shortened at the moment of purchase because they buy a product from a familiar brand. Little do they know that, actually, it is a BaaS provider, a FinTech platform and licensed banking or other regulated financial institutions staying behind the curtain. Thus, end customers reap the benefits in the same way just like other parties without doing many frictions on their customer’s journey.

Also, thanks to banking-as-a-service, consumers have more diversified choices and avail multiple value-adding services. A common trick is to give customers points and rewards every time they use a debit card while purchasing something from one of your stores. So, the transaction is not only effortless, convenient but also money-saving. Many brands generate revenue and strengthen their customers’ loyalty by equipping their customers with a wide selection of similar tools.

All in all, end customers have their own gains. The developments offered by BaaS result in a pleasant experience and an abundance of choices for buyers.

How to build your Banking as a Service platform?

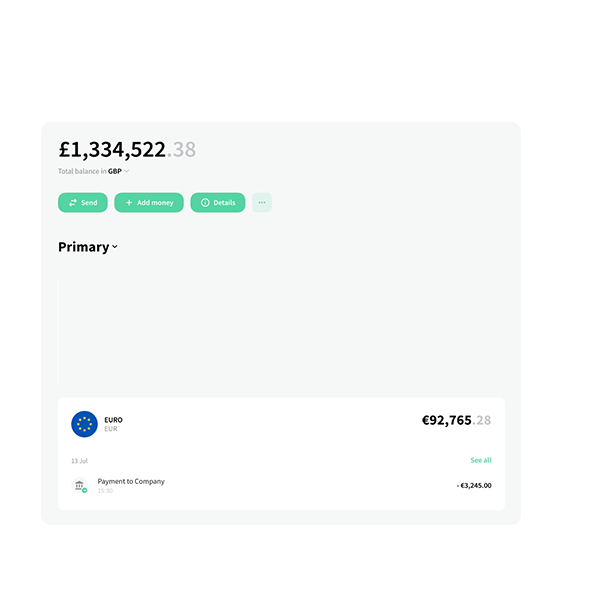

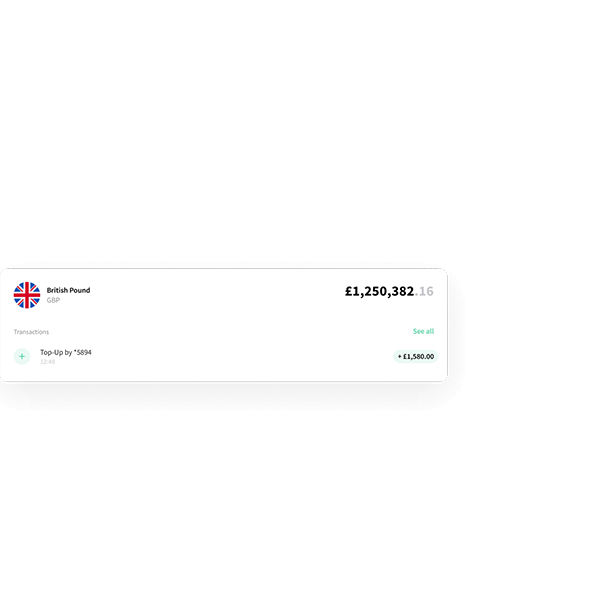

Today there are many ways to unlock opportunities to become Banking as a Service. One of the most effective is White Label Software Solution like Crassula which will allow you to turn an idea into a product just in a few days.

With Crassula Software API Financial Institutions can become BaaS Providers for their clients, get the opportunity to embed customer onboarding, account opening, payments processing or to sublicense your financial services for your clients.

Crassula can lend you a hand in launching your BaaS to provide your customers with functionality for seamless integration of financial products to their marketplaces and digital businesses.

To sum up

With BaaS, pretty much any business can unlock the open banking opportunity and create financial solutions from scratch. You do not need to comply with legacy systems or seek bank software. Finding a platform that delivers all the advancements of BaaS would be just enough.

This model serves each of its players and rewards everyone with plenty of winnings. From a Fintech platform to neobanks, from to non-financial start-ups. Everyone stays ahead of the game. Would you like to leverage it to get higher revenue next month and accomplish tremendous success? If so, Crassula can help you to introduce to more than 10 most popular Banking as a Service providers, which already is integrated into our Banking platform.

FAQ

A BaaS provider is a financial institution that provides banking infrastructure, license and services, such as payment processing, account management, and compliance with banking regulations to third-party companies.

At the same time, BaaS platform is a software platform that serves as a mediator between a BaaS provider and a third-party company. By connecting both, offering a pre-integrated software solution with support, customer service tools, and marketing and analytics capabilities, it enables third-party companies to build their own financial products and services hassle-free.

Depending on the capabilities and offerings of the BaaS provider or platform, a large portfolio of FinTech services can be offered. Here is the list of the most common services that empower fintech businesses to build and run a fully-integrated and compliant neobank:

- Account management and administration

- Digital wallet and mobile payment services

- Worldwide payment processing, initiation and settlement

- KYC/AML verifications with a risk-based approach

- Compliance and regulatory support according to PCI DSS standards

- Fraud detection and prevention

- Frictionless exchange services

- Financial reporting and accounting

The regulatory landscape for BaaS is constantly evolving, but it is similar to the regulation of traditional banking, e-money (electronic money) or payment services.

BaaS providers must comply with anti-money laundering (AML) and Know Your Customer (KYC) regulations, data protection and privacy regulations, as well as capital adequacy requirements. By utilizing the KYC and Transaction and Fraud monitoring Tools provided by Crassula, BaaS providers can manage a regulated environment across FinTech companies.

There are many polar differences. Firstly, BaaS providers mainly focus on enabling non-banking companies to offer financial services to their customers through infrastructure and licenses. Unlike brick-and-mortar banks, they don’t offer banking services directly to consumers.

Secondly, thanks to the BaaS model, providers supply companies aiming for the financial services market with a fully-fledged solution without having to become a bank itself.

Thirdly, BaaS providers are dominant players that challenge traditional banking with their agility and ability to adapt when new changes and trends get thrown their way.

When companies integrate BaaS services into their own product, they reap many benefits. The reduction of the costs associated with regulatory requirements compliance and IT infrastructure deployment that comes with the BaaS system is what makes it so attractive.

A BaaS platform can also charge some additional costs, such as transaction and licensing fees. However, regardless of the size of the financial institution and its complexity, it still remains cheaper than services offered by a traditional bank.

Banking and financial services are very demanding industries when it comes to regulation. This is why very few companies actually choose to build their own payments system.

If you opt for the use of BaaS, there are varying amounts of risk to take into consideration, including:

- Costs: companies that use BaaS should be ready for unexpected or hidden costs, such as fees for exceeding usage limits, additional services, features, or data transfers.

- Security: there can be some constraints in relation with security protocols that can compromise the security of users' financial data.

- Regulatory risks: certain BaaS providers operate in different countries, and this can cause regulatory compliance issues, which can be challenging to navigate.

BaaS makes financial services products more accessible and inclusive by lowering barriers to individuals and businesses who may have been underserved, underbanked, or unbanked.

By empowering any entity to become a financial services provider and create products that are designed around customers’ real needs, BaaS closes the financial inclusion gap and ensures that more people have access to the financial services they need.

The future of BaaS is bright and promising. As more non-financial companies introduce new financial offerings with the help of BaaS, partnerships between banks and other entities are likely to expand and grow stronger.

Additionally, we can expect the BaaS model to be increasingly adopted across a range of industries beyond traditional financial services, such as e-commerce, healthcare, retail. This can drive competition among players as well as foster greater innovation and development of new financial products and services.

When choosing a BaaS provider, it’s essential to evaluate the factors, such as compliance, integration options, pricing, support.

For the success of your neobank, you want to ensure that your provider can address any issues and support you on the way. You might also want to verify that the provider is compliant with all regulatory requirements and standards and compare the pricing, so you can find a solution that fits your budget and meets all the expectations.