Guide To Private Label Credit Cards

If you are a retailer or business owner thinking about how to bring some novelty and innovation to your company or store, private label cards might be the thing you are searching for.

No surprise that banks and financial institutions are not the only ones to issue credit cards nowadays. Different businesses and retailers also offer this service. Private label credit cards have some advantages over traditional bank cards. Moreover, they appear to be an excellent solution if you search for a way to innovate your company or store.

This article will answer all the questions that might raise your concerns about whether using such kinds of credit cards in your business is worth it. We will take a closer look at how they work and what their benefits for the business are. The risks of PLCC card implementation will also be provided for you to outweigh all the pros and cons.

What Is A Private Label Credit Card?

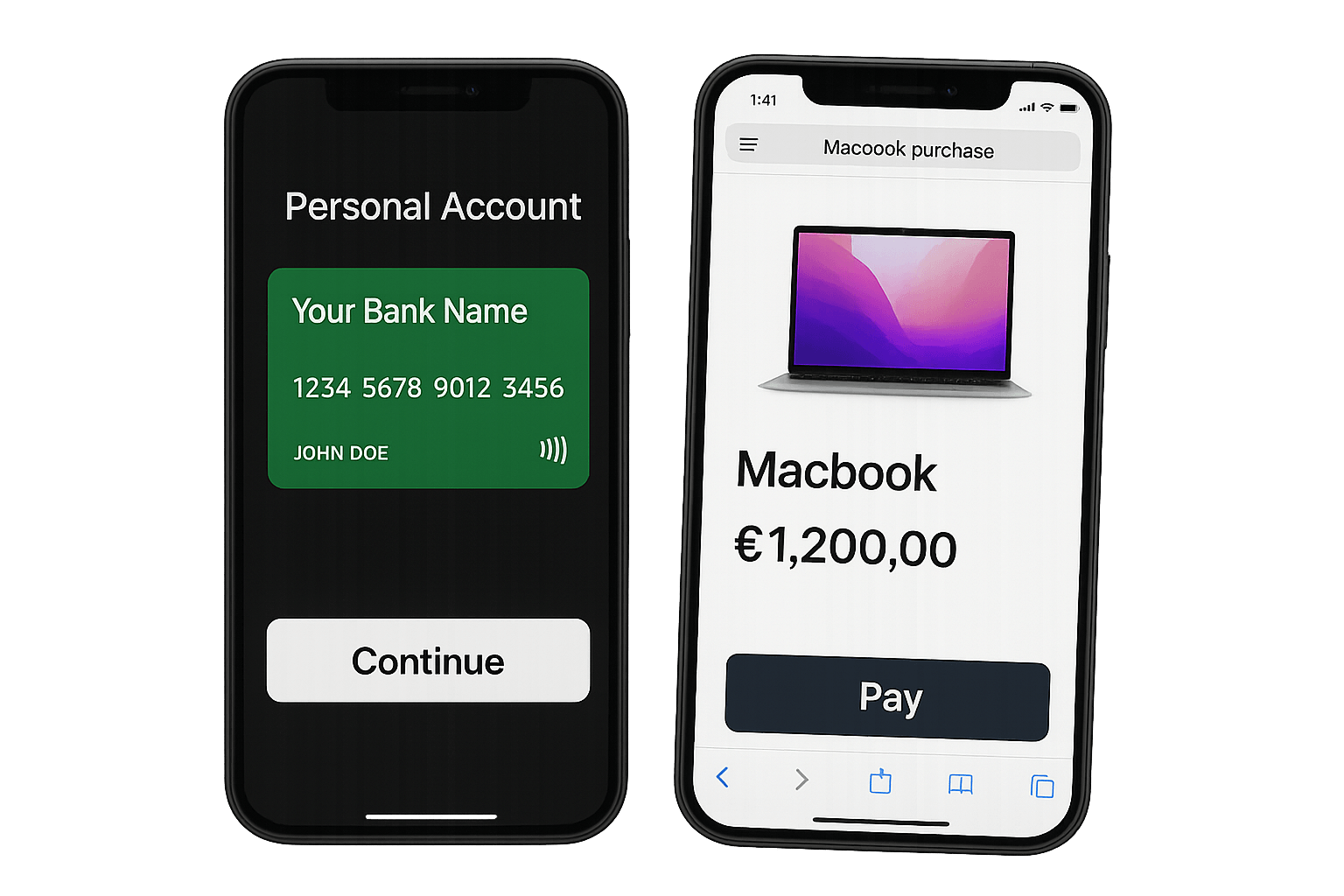

A private label credit card is the one issued by a third party for a specific merchant or business. You might have come across many PLCCs (credit cards named private label) without suspecting that they are such. However, when you see that particular store or a chain of stores have their exclusive credit cards, most probably those are private label ones.

Those are exclusive financing options accepted only in that particular store or the network it belongs to. If you are curious why businesses and card issuers opt for such credit cards, the answer is simple. Stores' turnover has increased, while card issuers receive a certain percentage from transactions as commission.

This kind of credit card is prevalent in the US, and its market position improves yearly. According to the statistics provided by eMarketer, over $200 billion in transactions are made with private label cards. We can also spot a clearincrease in such transactions practically each year.

Let's discuss your project and see how we can launch your digital banking product together

Request demoPrivate Label VS Other Credit Card Types

All available credit cards can be divided into three main types. Some are general use, while others (namely private label credit cards) are exclusive. Each type has its strengths and weaknesses. Thus, let's take a closer look at each category to see their main differences.General Purpose

These are the most common, and banks and other financial institutions issue them. With their help, you can pay at any retailer that accepts credit cards. Thus, they are highly accessible and easy to receive, so customers are offered payment flexibility and a reasonable credit limit. However, they often do not offer any bonuses or loyalty programs.Co-Branded

Co-branded credit cards are often a result of the retail partnerships and the cooperation between banks and certain brands. They are still easy to receive (as soon as you have a possibility to open and account in a bank that has a partnership with a certain brand). Unlike general purpose cards, they offer certain perks. However, those are only applicable to transactions made in the partner brand. Luckily, annual fees are not that high for co-branded cards.Exclusive (Private Label)

A private label credit card is an excellent example of an exclusive credit card (also known as store-branded). It can be received only in stores of a certain brand and can be used there. Those are often called "closed-loop" cards and have a wide range of perks and benefits. They are offered through private-label credit card programs, which are frequently quite lucrative. However, many customers might find it difficult to maintain financial discipline and forget responsible usage.How Does Private Label Credit Card Processing Work?

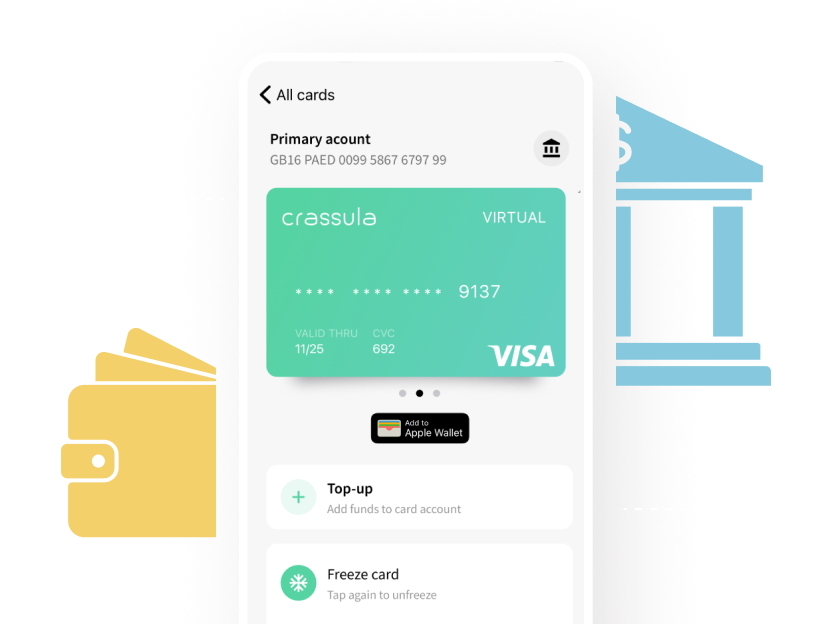

Now that you know what a private label credit card is and how it differs from the traditional one, let’s speak about the way it works. Technically, such cards follow the same pattern as any bank card: a customer uses it to pay for goods or services at a store. Then, a financial institution processes the transaction to ensure payment is completed.

As for the backend, a business signs an agreement with one of the private label credit card issuers. They, in turn, have agreements with banks or financial institutions that support the transaction processing part. Therefore, such cards are as secure as any other bank card. If you decide to implement this solution in your business, be ready that private label companies will charge interests for provided services.

Benefits Of Private Label Credit Cards

Private label business credit cards are highly popular with companies and customers due to all the benefits they offer to both sides. Those are not only perks for business, but customers can also feel the positive impact of using such exclusive cards, especially if they are loyal customers of certain brands.Benefits For Businesses

Let's focus on how a private label card can positively impact the business. Both small and big retailers find benefits that convince them to implement exclusive cards in their stores. They do this despite the additional cost that needs to be paid to private label credit card issuers.Building Brand Loyalty

When customers know they can receive certain benefits for making purchases in one store instead of another, they will certainly choose the place that will give them some pleasant bonuses. This is especially true in situations when the quality of services and prices are very similar. That is when such exclusive cards play their part! Given their exclusivity, private label credit cards for small businesses are a perfect option to build customer loyalty and boost revenue.Increased Sales

As soon as a company has loyalty from customers, it receives another excellent thing for their business. We mean increased sales. A private label card will always incentivize customers to choose one store over the others. This leads to a bigger number of purchases. As a result, your turnover increases as well. Therefore, if you wonder how to start selling some goods more actively, private label cards might be an excellent option for your business.Brand Recognition

It should be ready for additional expenses to feel an actual impact of this benefit, but spent money pays off in the long run. Many private label credit cards offer customized designs. You can consolidate your brand awareness and increase customer retention. Looking at the fancy card will be enough to bring customer loyalty to an entirely new level.Benefits For Consumers

Fortunately for customers, the benefits of private label business finance and credit systems are not only for retailers and companies. Such payment methods are also excellent for those who make purchases. If you always shop at a store close to your house with a PLCC card, you would certainly consider getting one of those!Exclusive Offers And Promotions

Such cards are often about lucrative bonuses and promotions, which can give you essential benefits in the long run. You can accumulate points, take advantage of exclusive offers, and receive a discount on certain products or services. That is certainly not the full list of perks customers can get if they use private-label cards. Some chains and stores can get highly creative when it comes to loyalty rewards.Easier Approval Process

When customers pay for goods or services with exclusive credit cards, they might expect faster transactions. Moreover, the transaction approval process is much easier and more efficient. Another piece of good news is that the payment is less likely to be blocked or declined if it is made with a private label credit card.Establishing Credit History

Another positive side of such cards is that they help customers build their credit history. Therefore, if they have credit history concerns, they do not need to select between general-use and exclusive cards. Private-label credit cards have the same credit score impact as any card issued by a bank or financial institution.Pitfalls To Be Ready For

Unfortunately, as with any other payment method, the payment via label credit card has its risks that should be considered. Understanding those challenges might help you to use such payment services wisely to avoid the pitfalls listed below:- Limited acceptance: such cards are good for the usage at networks that accept them, but they are completely useless at stores that are not a part of the chain. Therefore, some customers might be reluctant to receive them.

- Credit risks: if many cardholders struggle with payments and have a bad credit history, the business that provides them with credit cards is also under a certain risk.

- Complex operations: launching a private label credit card is not a simple process, as it involves multiple steps and huge resources.

- High interest rates: be ready for companies that provide such exclusive cards and maintain them to charge high interest.

- Reputational risks: if there is an issue with a private label card, it might impact the reputation of your business.