What Is Branchless Banking And Why Use It?

Global digitalization could not bypass such a large-scale industry as the banking sector. Millions of people around the world use various financial services every day, and they always welcome innovation that will help make this process easier and faster. Digital financial services bring a great solution.

In this review, we will look at what branchless banking is. Moreover, you will learn the strengths and weaknesses of the branchless concept of banking.

Let's discuss your project and see how we can launch your digital banking product together

Request demoWhat Is Branchless Banking?

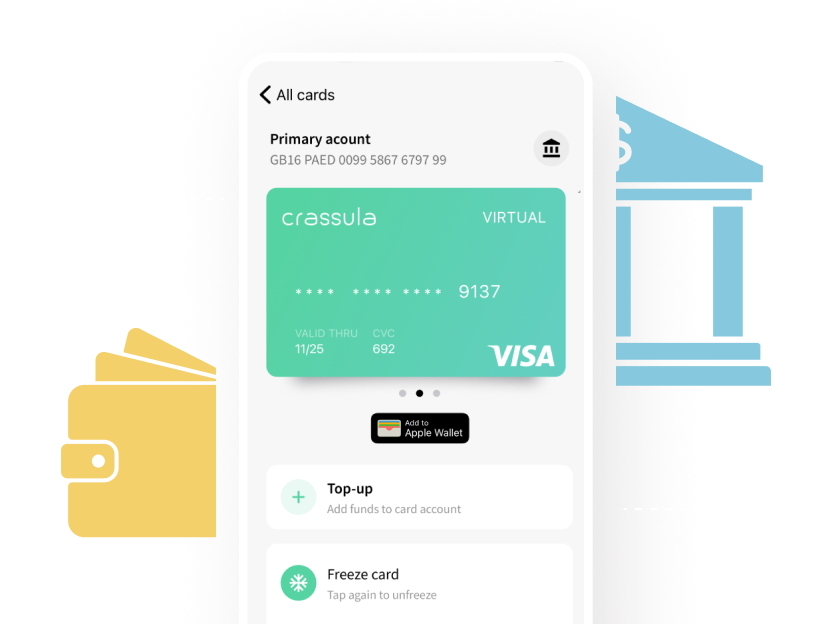

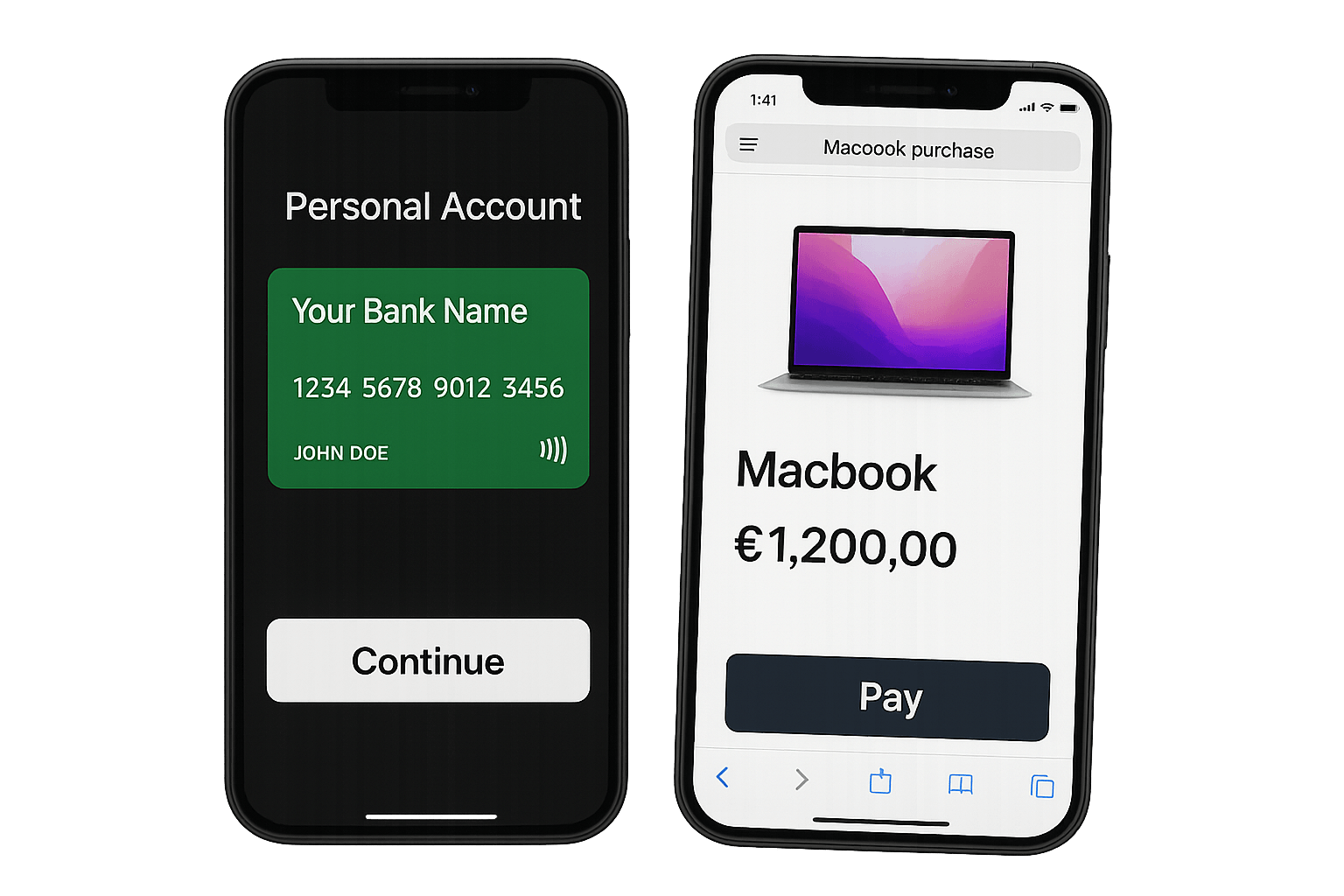

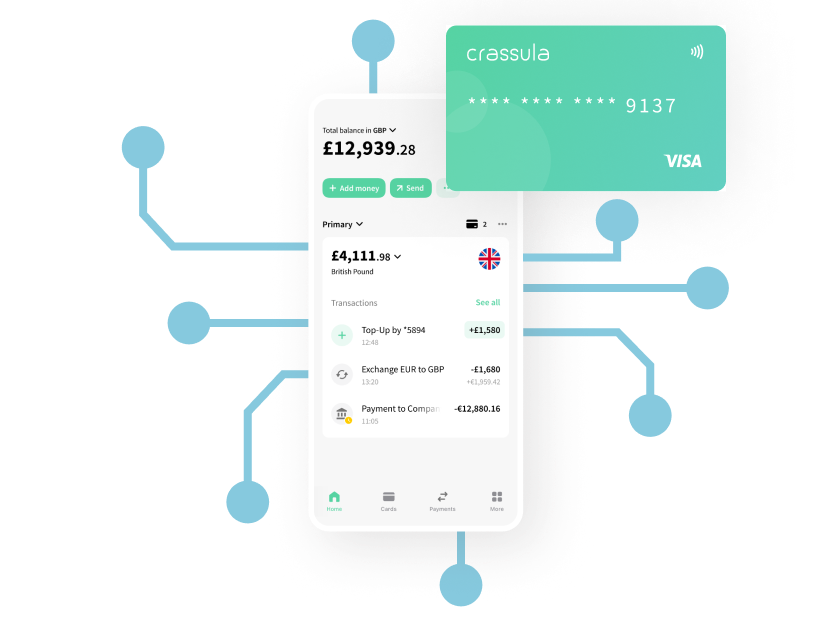

You can guess the branchless banking meaning by its name – this kind of banking provides financial services outside of classic bank branches. Basically, it is digital banking that operates through various digital communication channels. Banking services are requested by clients and provided by the bank through a website or mobile application.

Such a branchless banking platform can either complement the traditional bank system with branches or be used separately as a full-fledged financial institution — without bank offices at all.

The Evolution Of Branchless Banking

In recent decades, the population demand for banking services has grown significantly faster than the number of bank branches. The slowdown or even postponement of the opening of bank offices is influenced by various factors, including geographic or demographic ones. However, even in those regions of the world where the number of banks was sufficient to satisfy all incoming requests, clients began to understand that it takes too much time and effort to obtain banking services.Thus, the digitalization of financial services has become not just an improvement in the banking industry but the only possible next stage in its development. Transfer of financial services to online mode ensures maximum banking accessibility.

The branchless banking solutions not only allowed a large number of people from hard-to-reach places to join global banking, but they also revolutionized standard banking procedures by simplifying and speeding up services that are carried out online.

Benefits Of Branchless Banking

Branchless banking would not have become so widely discussed if it had not attracted a large number of people with its offer of enhanced financial service. The list of reasons why you should choose a digital bank or at least pay attention to it is long. Moreover, the advantages of the virtual bank apply to both clients and service providers. Below, we will look at the benefits of digital banking from the perspectives of these two sides.Customer Perspective

Let's start with branchless banking service features that improve customer experience. According to several points described below, virtual banking is significantly superior to traditional.Convenience

Just imagine that any banking transaction, be it transferring money to a card or paying bills, can be done in a few clicks without leaving your home at any time of the day. With a branchless bank, you don’t need to imagine it anymore because this is the reality that it offers. You get a full range of banking services right in your gadget. Digitalization also ensures cost-effective banking since there is no need to spend money on commuting to the office and preparing paper documentation.User-Friendly

Branchless banking platform developers take into account that the client audience is very diverse, and this means that different levels of experience with online services need to be taken into account. So, banking sites and apps are always simple and intuitive. All processes are automated, and, in fact, the platform itself guides you from stage to stage.Accessibility

Banks without branches are not tied to a specific place, which means their functioning is not limited by territorial boundaries. You can get access to your money and banking service anywhere. This is a solution for those who travel a lot because virtual banks make any international transfers simple and fast.Enhanced Security

Authoritative banks without physical branches provide advanced security measures to protect clients’ sensitive data. Popular, reliable safety methods are biometric authentication, encryption, two-factor authentication, etc.Business Perspective

Businesses, regardless of whether they specialize in finance or not, can also get a lot of benefits from branchless banking solutions. The introduction of digital banking into the business system will definitely increase the level of any company in several respects at once and expand opportunities for development.Cost Savings

Branchless banking solutions allow you to transfer all monetary transactions into a digital field, thereby automating most of them. This approach not only saves money but also the time.Expanded Market Reach

Digital services have no boundaries, so they inevitably lead to an expansion of the audience. By offering virtual banking to your clients to pay for your services or products, you make their lives easier since virtual banking will be available to them wherever they are. By choosing digital banking for your business transactions (for example, accepting money from buyers of your goods), you free yourself from the need for the physical presence of your employees in all regions where your customers live. This is a significant saving of money and effort. So, if you have long been planning to enter the international arena but do not have enough money or are not ready for all the difficulties associated with such a process, digital banking is your solution.Competitive Edge

As mentioned above, branchless banking simplifies and speeds up monetary transactions through their maximum automation. This cannot but attract clients who value their time. Thus, the audience’s trust in your business will grow and lure away the clients of your competitors. Today, the reputation of a business that supports various innovations is sure to improve.Scalability

Thanks to the atomization of financial services, money saving, and the open way to the international market, you can easily scale your business. The opening of new branches, the development of new directions, collaborations, etc., will be supported by the reliable backing of a well-structured financial system.Environmental Sustainability

The fact that the branchless bank is not tied to a physical building and all processes are carried out purely online makes it eco-friendly. Opening such a bank, investing in it, or choosing other types of cooperation with it increases the reputation of the business in the eyes of the public.Disadvantages Of Branchless Banking Solutions

Digital banking is a fairly new phenomenon, and you should understand that banks without physical branches are still developing. Naturally, at this stage, they encounter problems and difficulties. Below, we talk about the main challenges of branchless banking solutions.Cybersecurity Risks

Of course, any actions carried out online, including digital financial services, are at risk of a cyber-attack. Unfortunately, hacker attacks in all areas are the scourge of our time. Despite the fact that banks without branches try to protect themselves and their clients in all available ways, many experts argue that digital banking has not developed a single universal security system. This problem could be solved by developing standard branchless banking regulations that all banks must adhere to. This would increase not only the level of security but also customer confidence.Limited Security For Large Transactions

The root of this problem also lies in the lack of regulatory framework development. Transfers of particularly large amounts have always been a complex process, even in traditional banks. This procedure always requires more checking and attention. When a large amount passes online, it cannot help but attract fraudsters. So, if the bank does not install reliable security methods, the client risks losing money.Technical Problems And Outages

Another problem with branchless banking is its dependence on the serviceability of appliances, introduced programs, and the server to which the site or application is linked. If the system suddenly fails, the digital bank freezes, and the client cannot perform a single operation. Of course, today, the technical support of most virtual banks is strong and experienced, and specialists cope with downtime issues quite quickly. However, this still brings a lot of inconvenience to clients whose plans are disrupted due to such failures.Why Many Customers Refuse To Use Banks Without Physical Branches

There are three main reasons why many customers still prefer traditional banking with branches:- Offline banking is customary. Everything new and unfamiliar is frightening and alarming, so many are in no hurry to switch to branchless banking. Of course, well-known offline bank branches instill more confidence in people simply because they know exactly what it is and how it works.

- Personal communication. Many people like it when they see the face and hear the voice of the person who processes their account and advises them. Besides, when a person wants to clarify some question and approaches the counter staff, they immediately see a response to their request (even if the problem is not solved quickly, managers talk to the person, and the client observes the work process live).

- Self-advertisement. An offline office has at least a sign that already serves as a reminder of the bank to all random passers-by. People tend to remember bright pictures and logos.

Why Do Banks Stick To Branches?

There are four main reasons why banks, even those that have branchless services, need branches:- Reduced identity theft risk. Personal meetings with bank staff and live communication with clients minimize the possibility of cyber-attacks and personal data theft. It’s still much easier to verify your identity in person.

- Revenue increase through self-service. Self-service terminals automate most day-to-day branch transactions. This allows additional income to reduce the payback period for new branches by seven months.

- Advanced staff utilization. When a bank has a network of branches, it is very easy to organize work and distribute tasks between employees from different offices.

- Customer trust. There are still a lot of clients who prefer to resolve banking issues face- to-face with staff and do not trust all the financial data to gadgets. So banks leave branches so as not to lose customers.

What The Future Holds For Branchless Banking Services

Despite the fact that offline bank branches around the world are still in demand and financial companies continue to open new offices, this does not prevent digital banking from developing in parallel. Branchless banking service is gaining the trust of an increasing number of people, so a decrease in those wishing to try mobile banking is definitely not expected in the near future.

The most important problem in the short term will, of course, remain the issue of security. The threat of cyber attacks will be the deterrent that will stop clients who are interested in digital banking but are not confident in its reliability. However, considering how quickly data protection technologies are developing, a solution to this problem will not take long to come.