Your Ultimate Guide to Open Banking And How It Works

A comprehensive guide to open banking.

Open banking has revolutionized the financial system. We no longer need slow and rusty banking services, as we have a faster and more efficient alternative. This innovation's adaptability and flexibility are exactly why modern businesses and their customers highly appreciate it.

We have created this comprehensive guide to ensure you are aware of what open banking is and how it works. Our experts will explain its elements and how to use them to the greatest benefit. Moreover, this article explores open banking definition and all its main advantages and drawbacks.

What Is Open Banking?

The open banking framework is an innovation in the fintech world that allows third-party companies to access the data in traditional banking. This access is possible thanks to application programming interfaces (APIs). In other words, banks have the possibility of data sharing with third-party companies. This data includes transactions, payment history, and much more.

As a result, the possibilities provided to financial and non-financial businesses, thanks to open banking, revolutionized how financial data is accessed and shared. First of all, customers receive more control over their financial information. This, in turn, makes financial apps and services more convenient and user-friendly.

Let's discuss your project and see how we can launch your digital banking product together

Request demoHow Does Open Banking Work?

The open banking system works through APIs (application programming interfaces) that facilitate the exchange of data between banks and third-party companies and ensure interoperability of financial services. This technology works with standardized data formats and secure communication protocols that ensure high data protection. This open banking infrastructure allows third parties to collect data from different banks simultaneously. You might consider that your credentials are also shared with third parties. However, it is not true, as no one can share such kind of data without your consent.

What Is An API In Open Banking?

API is a set of routing protocols that grants access to a bank’s services to other third-party companies. This tool revolutionized the way companies use data to meet their customers' needs and ensure their satisfaction with the provided services. Banking APIs have a robust ecosystem that enhances data exposure, exchange, and performance.

APIs are used in different spheres but are essential for banking as they accelerate data sharing. Moreover, they create endless integration possibilities and boost connectivity. As a result, any business that benefits from open banking technology can offer unique and more diversified services. Those include mobile applications, additional features for the interface in your products, and embedded banking services.

Data APIs

What does open banking mean if the data APIs are used? It means that third parties have access only to the read-only data. E.g., those who access information in the database of traditional banking services will be able to see the information in the accounts, balances, and transaction history. This information might be used to predict customer experience and behaviors and adjust your services accordingly.Transaction APIs

This type of API is more practical, as it allows some transaction processes. It is most often used for funds transfers, but it might also be useful for setting up direct debits and initiating payments. As a result, it is essential for payment services.Product APIs

They are not related to open banking services exclusively but are widely used in the fintech sphere. Product APIs make the existence and operation of comparison websites and marketplaces possible. How? Their owners list financial products, rates, and terms based on the accessed data. If you ever wondered how websites that list prices of the same product in different retailers work, that is how: they use product APIs.Use Cases For Open Banking APIs

Here are some practical open banking examples that might make the life of fintech businesses much easier. Use Case 1: Mortgage Taken by Laura: Laura plans to buy a house but has already spent months looking for a place she really likes. Finally, she has found one she would like to purchase. Now, she needs an instant confirmation of her mortgage.How does open banking work in this situation?

A fintech company, X, offers a low-percentage mortgage, but it needs to check the history of Laura’s transactions to approve the mortgage. Thus, it sends a request to Laura’s bank. Then, the bank asks Laura to approve the data sharing. Within a few minutes, the fintech has all the necessary information so it can review it and approve the mortgage. Use Case 2: Accounting Software in Kate’s Work: Kate owns a small local business and does all the accounting for it with accounting software. As a lot of her work is done manually, Kate spends hours transferring transaction data from the bank to her accounting software.

How does open banking work in this situation?

Since Kate’s accounting software supports open banking, she can synchronize it with the account number. The accounting software will then request access to the data in that bank account. As an additional level of data security, Kate should log in to her banking and confirm that she really wants to share data. After that, the data flow starts, and the accounting software has access to the complete history of transactions.

Open Banking Vs Traditional Banking

Open and traditional banking are both a part of the financial ecosystem but are two entirely different concepts. Their unique features make them exclusive and useful in their own ways.

Traditional banking is a closed system containing all the information about accounts, balances, transactions, etc. It is well-protected and has several layers of security to ensure funds are protected, and no fraudulent activities are made.

At the same time, open banking is more flexible and adaptable. It is a tool that has certain access to the data created by traditional banking. Based on the information accessed with the help of this technology, businesses can integrate payment services and enhance their products

Examples Of Open Banking

There are plenty of open banking examples, as this technology is common in different fintech spheres. So, the list provided below is not complete, as this framework constantly evolves and expands the list of businesses for which it can be applicable:- Payment Initiation Services: An open banking platform allows businesses to initiate payments bypassing the payment gateway. This leads to faster transactions and lower transaction fees.

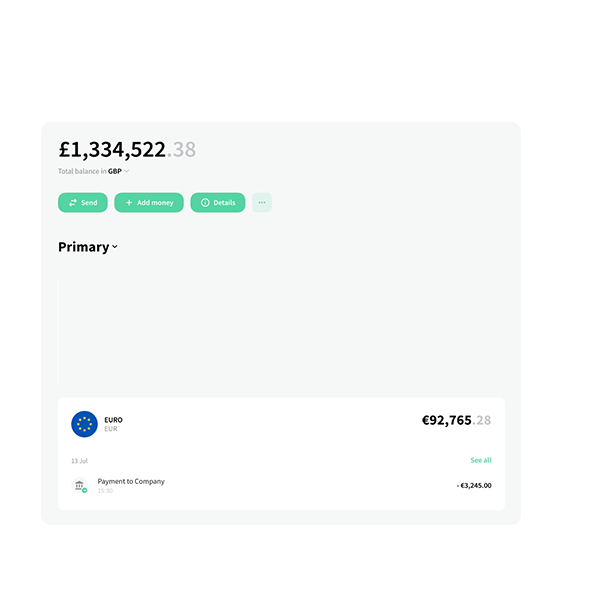

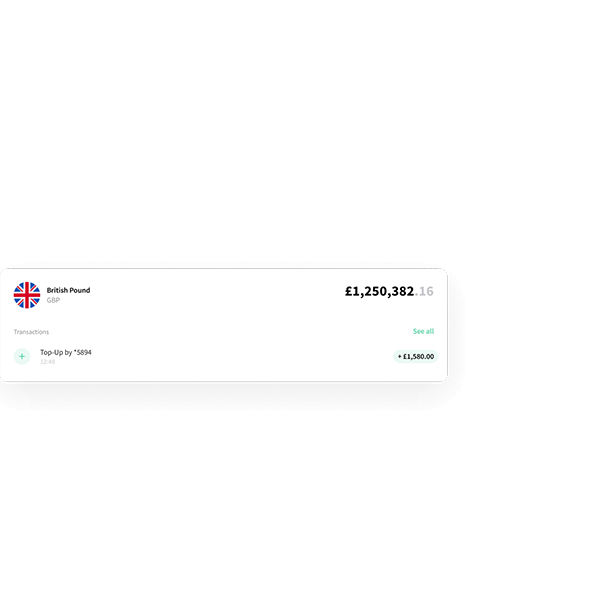

- Account Aggregation: the usage of this technology allows the extraction of data from multiple accounts and has a more comprehensive view of the financial status of customers.

- Automated Budgeting: the open bank system allows businesses to offer their customers an automated service that categorizes and tracks their spending for more efficient financial management.

- Instant Loans: banks and other financial institutions can access information about credit scoring to make data-driven decisions about loans and credits in real-time.

- Automated Invoices: this technology allows institutions to reduce administrative work thanks to the automation of invoices.

- Fraud Detection: Access to transaction data allows businesses to analyze transactions in real time and detect fraudulent activity.

- Personalized Marketing: a perfect example of how to increase sales with the help of open banking. Based on the analysis of provided financial data, you can understand the behaviors of customers and design personalized offers for them.

Open Banking Solutions And Trends

The open banking market is not fixed and evolves constantly. As a result, plenty of solutions already exist, and new ones continue to appear. These solutions often follow current trends and ensure modern businesses' needs are met. Two of the most popular solutions are explained below.PSD2/PSD3

PSD2 is a European regulation that allows businesses to access e-payment services and user accounts (with customer consent given) through technology based on APIs. It is an excellent solution for new players in banking, as it allows plenty of fintech innovation and developmental creativity.Embedded Banking

Another popular solution of open banking in the fintech industry is embedded finance. This tool is a perfect choice for those businesses that would like to integrate banking and payments into the services they provide. A bright example of embedded banking is payment solutions used by online merchants. Personalization and plenty of opportunities for branded payment solutions are among the features that make it highly popular in the fintech industry.Risks And Benefits Of Open Banking

As with any other modern solution, open banking has its strengths and weaknesses. Below are explained all the main benefits and challenges of open banking. Let’s explore the advantages first. Their list includes:- Data-driven Solutions: you can innovate your business with the help of open banking through accessed data. Data transformation plays an essential part in this, so make sure you interpret it most efficiently.

- Operational Agility: You can perform your everyday tasks related to finance more efficiently (e.g., the use case with accounting software). Thanks to the open banking system, many administrative actions that have been performed manually can be automated.

- Interoperability: different companies and banks in the fintech world can work together to innovate the industry. Such cooperation helps the technology to evolve and overcome all the possible challenges.

- Optimized Payments: open banks allow companies to bypass payment gateways and speed up transactions. This is one of the main benefits for the merchants and their customers who appreciate efficiency. Moreover, bypassing payment gateways reduces the cost of transactions.

- Data Standardization: open banking often uses standardized protocols, simplifying its usage.

- Market Expansion: the open banking framework allows businesses to enter new markets more easily, as they can sign partnerships with local fintech companies.

- Integration of Innovations: many businesses can innovate their services and make them more efficient with open banking. As a result, customer satisfaction increases, and business owners receive new opportunities for growth and expansion.

- Inconsistent Quality: not all third-party services are of the same quality and might not meet high standards. Those inconsistencies might cause costly adjustments and operational difficulties.

- Integration Issues: API integration and third-party services do not always go smoothly, so you might face different integration challenges.

- Regulatory Framework Issues: regulations on different markets constantly evolve, and not all open banking systems catch up with all the changes.

- Hidden Costs: sometimes, not all the fees for the usage of this technology are obvious. Thus, some hidden fees might appear as unpleasant surprises.

- Security Vulnerability: keeping the service safe might be challenging, as high security requires multiple measures to be implemented.

Open Banking’s Impact On The Fintech Market And What The Future Holds

Open banking has an essential impact on financial technology already. Its influence will continue to grow in the future, as it is implemented into new businesses, and the number of use cases will expand. On top of that, we can expect the following:- Global Expansion: this framework is currently prevalent in Europe, but we will see its integration in North America and Asia shortly.

- Integration of New Technologies: experts predict that APIs will be used with AI and other innovative technologies to diversify the list of possible services.

- Enhanced Security: we might also see much more secure and protected open banking in the future, as new and revolutionary measures might be taken to ensure the safety of collected data.