10 Best Neobanks That Are Leading The Industry

The financial sector has become one of the fastest-growing industries today. It is impossible not to notice dramatic improvements in the financial services area. One of these significant changes, of course, was the digitalization of many financial services. However, the phenomenon of neo-banking has gone further as it offers a complete transfer of all banking services to online mode.

In our article, we suggest taking a closer look at the top neobanks in the world and familiarizing yourself with the essential factors when choosing a neobank for you.

Let's discuss your project and see how we can launch your digital banking product together

Request demoWhy Neobanks Became Popular

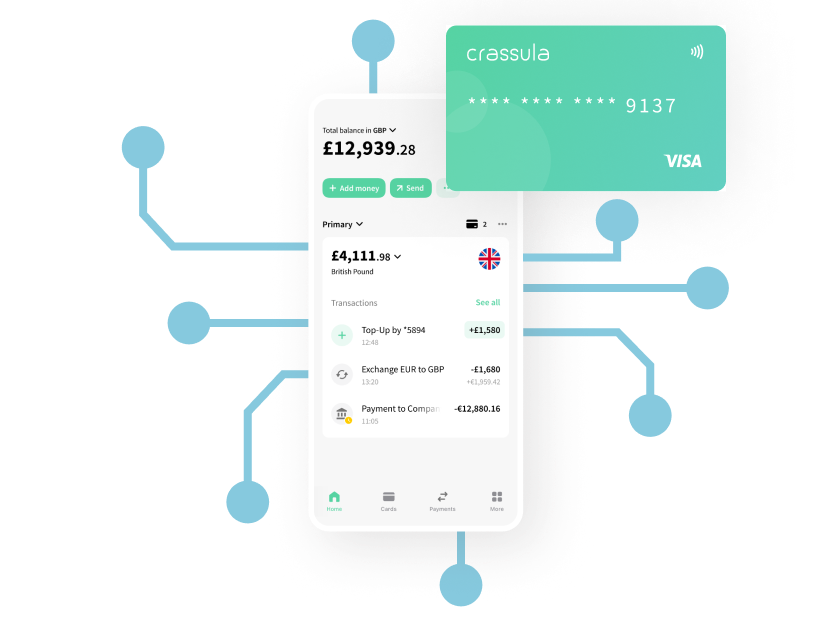

Neobanks are representatives of the new generation of online banking. This is a type of direct bank that operates exclusively in the digital field without the use of traditional physical branch networks. The best neobanks challenge traditional big-name banking structures that have dominated the financial market for decades.

Neobanks have revolutionized the world of finance over the past few years. They have already managed to lure a huge number of clients from classical banks. Experts predict an even more significant increase in those who wish to use neobanking services due to the convenience, speed, accessibility, advanced security, and expanded range of services offered.

Top Neobanks To Consider For Your Business

Below, you can find a list of neobanks considered the best options on the market. We have prepared detailed reviews of each of the largest banks that will help you understand their operating principles and make it easier to choose a neobank for your business.

Chime

Key information:- Headquarter – San Francisco (US)

- Currency – USD

- No monthly fees, ATM withdrawal fees, and transfer fees

- Direct deposits, early paychecks, cash withdrawals

- APY - 2.00%

- Mobile app

- Automatic saving options

- Fee-free ATM network

- No minimum balance requirements

- No wire transfers

- Third-party fees for cash deposits

GoBank

Key information:- Headquarter – Monrovia (US)

- Currency – USD

- Monthly fee — $8.95 (no fee when deposits totaling at least $500)

- Early direct deposits

- APY – 4.5%

- Large ATM network

- Mobile app

- Crypto-friendliness

- Fees for cash deposits

- No joint accounts

Revolut

Key information:- Headquarter – London (UK)

- Currencies – 30+

- No monthly fees; 2% fee for withdrawals over $200

- Real-time notifications and instant expenses updates

- APY – 4.25%

- Mobile app

- Many extra features

- Transparent pricing

- Great exchange rates

- No cash transfers

- Expensive weekend currency conversion

Varo

Key information:- Headquarter - San Francisco (US)

- Currencies – 50+

- No monthly fees, ATM transaction fees, and overdraft fees

- Variety of lending products (credit builder loans, personal loans, etc.)

- APY – 5%

- Mobile app

- Early payday options

- Automated round-ups available

- No multicurrency accounts

- Charges on bank and card payments

SoFi

Key information:- Headquarter – San Francisco (US)

- Currencies – 40+

- No monthly fees

- Lending products, stockbroking, wealth management

- APY – 4.60%

- Crypto-friendliness

- 15% cashback for debit card payments

- FDIC insurance (up to $2 million)

- No checking and saving options

- The highest APY rate is only for direct deposits

Current

Key information:- Headquarter – New York (US)

- Currencies – 30+

- No monthly fees, overdraft fees, or minimum balance requirements

- Directs deposits, instant notifications, budgeting tools

- APY – 4%

- Mobile app

- Teen accounts

- Free ATM withdrawals

- Crypto-friendliness

- No international transfers

- No joint accounts

Nubank

Key information:- Headquarter – Sao Paulo (Brazil)

- Currency – Brazilian Real

- No monthly fees

- Automatic debit and invoice payment, personal loans

- APY – 3%

- Mobile app

- Crypto-friendliness

- International transactions

- Cashback reward program

- Each debit withdrawal costs $6.50

- No joint accounts

N26

Key information:- Headquarter – Berlin (Germany)

- Currencies – 35+

- No monthly fees, no card payment charges

- Budgeting tools, mobile payments

- APY – 2.6%

- Great exchange rates

- Mobile app

- Open to innovations

- Global availability

- Only 3 free ATM withdrawals a month

- Slow customer support

Monzo

Key information:- Headquarter – London (UK)

- Currency – GBP

- No monthly fees, transfer fees, or local ATM withdrawal fees

- Budgeting tools, online and contactless payments

- APY – 4.10%

- Bill splitting feature

- Joint accounts

- Mobile app

- Instant notifications

- Debit and credit card replenishment isn’t supported

- Available only in the UK and the US

Starling Bank

Key information:- Headquarter – London (UK)

- Currencies – 30+

- No monthly fees, transfer fees, or local ATM withdrawal fees

- Innovative app, real-time notifications

- APY – 3.25%

- Mobile app

- Categorized spending insights

- Interest paid on account balances

- Interest of -0.5% on EUR balances (€50,000+)

- Overdrafts are charged at 15% EAR

How To Choose The Best Neobanks

How can you ensure you’ve chosen the best neobank if there are so many offers on the market, and they all look very attractive? To make an informed decision, you must carefully approach the selection process. We have described the main factors that anyone who wants to find a bank ideal for their requirements needs to consider.Interest Rates

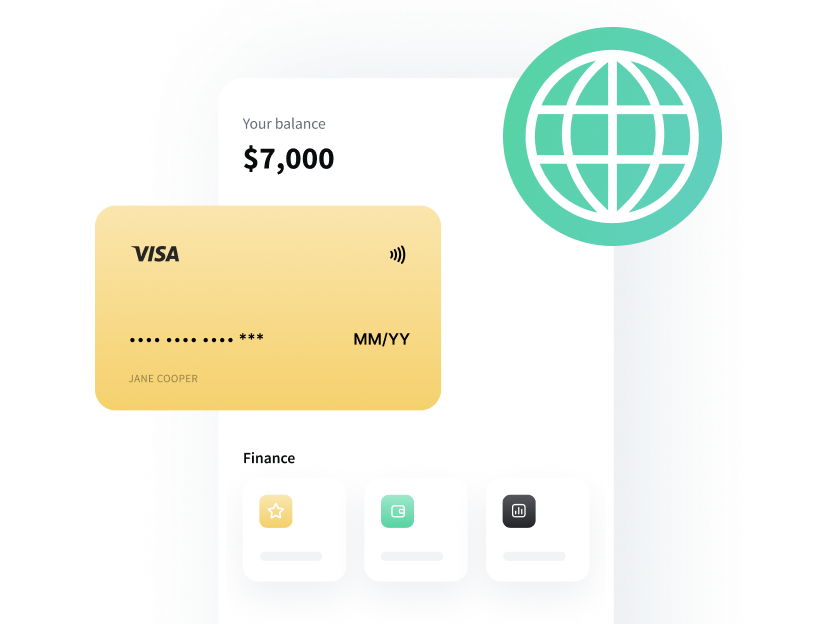

Regardless of whether you are going to save money or take a loan, the interest rate offered by the bank is significant. For example, the lower the loan interest rate, the faster you can pay it off. When it comes to boosting your savings, the best one is to use one of the top neobanks in the US with high-interest rates that are presented in the form of a competitive APY rate.Accessibility And Convenience

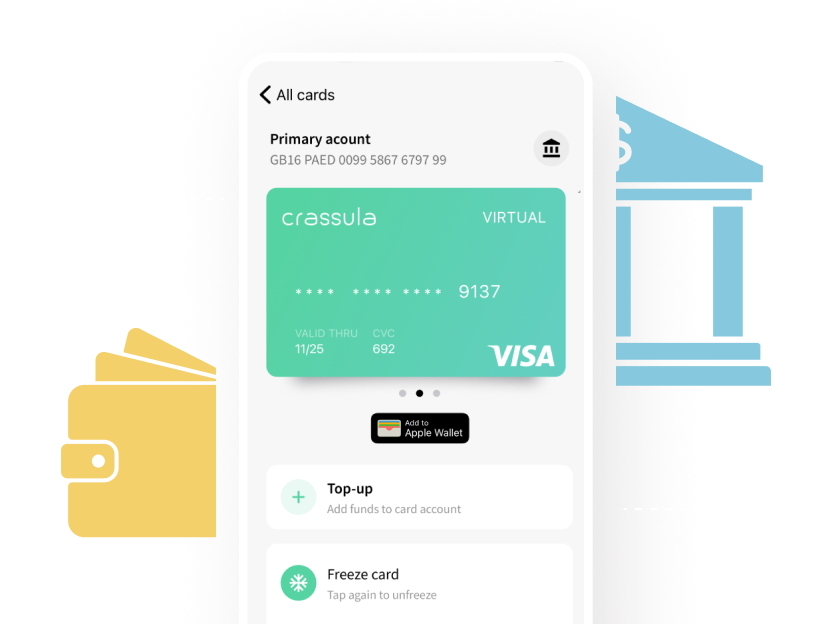

Even though neobanks operate online, most of them still limit their activities to the territory of one or several regions. Thus, when choosing a bank, you should focus on where you will use it from. For example, if you travel a lot, you should pick a neobank option available everywhere, and you will not be unable to use your money. Another critical point is convenience. The neobank's platform should be straightforward to use. Moreover, the speed and automation of services play a decisive role in shaping your experience of using neobanking.Mobile App And Digital Experience

Pay attention to mobile-centric platforms. Mobile compatibility allows you to use bank services anywhere and anytime without making any effort apart from a few clicks on your phone. Top neobanks are fully adapted to any type of gadget and screen size.Fee Structure

Each neobank determines its fee system individually. Neobanks may offer regular fees (monthly or yearly) or fees for specific operations. Before registering an account, you should familiarize yourself with the fee structure and calculate which system will be beneficial for your business based on the amount you operate and how often you conduct transactions.Security And Protection

First, you should ensure the security of your money and personal data. Cooperating only with licensed neobanks with a good reputation and high-quality security measures, such as encryption and biometric authentication, is essential. All options from the neobank list presented in the article above are safe and reliable.Rewards And Cashback

In general, the cashback feature and other rewards are not the main priority when searching for a bank. However, they can be a nice bonus and, if everything else in the bank suits you, you should pay attention to additional services. The best neo-bank services usually include a reward system as an encouragement method to increase customer loyalty.Customer Service And Support

The best neobanks know how to deal with any technical problems or customer complaints quickly and efficiently. It is important to cooperate with financial structures that provide a professional support service that is available 24/7.Additional Features

Any additional services will increase the level of financial services provided to you. Consider the availability of such beneficial extra features as contactless payments, early access to paychecks, peer-to-peer lending, financial education tools, etc.Top Neobank Market Trends

Despite the fact that top neobanks have already set a very high bar for everyone who wants to provide any financial services, neobanking continues to develop. Here are some of the development areas that will receive a lot of attention in the near future:|- Focus on personalization. Top neo banks will pay more attention to customer-centric approach to provide a personalized experience to their clients.

- New technologies. To improve the level of their services and maximize the automation of all processes, neobanks are beginning to introduce innovative technologies, such as blockchain and artificial intelligence, into their work.

- Eco-friendliness. The largest banks are developing green banking products, such as debit cards from recycled materials and carbon offset programs.

- Partnerships. Many joint projects between neobanks and classical banking structures and financial institutions are expected to expand the client base and improve the services provided.

- Entering the international market. Many banks targeting one region plan to expand their borders and attract audiences from other countries.