What Is Banking As A Service And How Does It Work?

Banking as a service BaaS is an end-to-end process that enables licensed banks to execute financial operations and offer digital banking services to other third parties.

Nowadays, the banking industry expands its scope to offer clients the finest solutions. Thanks to groundbreaking financial technologies, each-sized company may provide banking as a service by using BaaS API, drawing on the infrastructure of traditional banks. This allows business owners to create branded financial products and services, earning more money and boosting recognition among potential clients.

So, what is banking as a service? BaaS (Banking as a Service) stands for a unique business model, enabling non-banking institutions to build and provide financial services and products. Continue reading, as we uncover essential BaaS features, benefits, and minuses.

What Is Banking-as-a-service?

BaaS is a comprehensive technological process that allows businesses to conduct financial operations and provide essential banking services to their clients. The unique aspect is that they can supply these services without needing to be licensed banking providers. Thus, this concept revolutionized the industry.

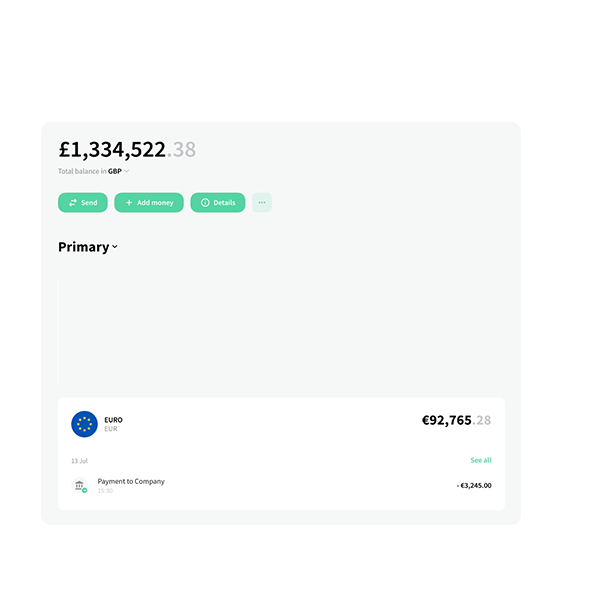

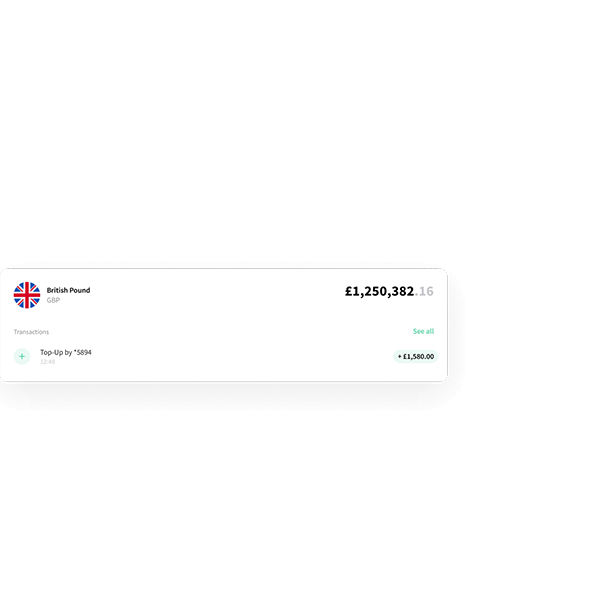

With that said, banking as a service allows non-bank institutions to supply banking services to their clients via APIs. This way, banks may suggest white-label solutions to independent companies willing to provide their clients with the newest financial services or products.

For instance, any business outside the financial market may utilize BaaS to provide clients with bank products like debit cards, savings accounts, or loans. These operations occur while partnering with a licensed bank to handle these services' operational and regulatory aspects.

Let's discuss your project and see how we can launch your digital banking product together

Request demoHow Does Banking-as-a-service Work?

To understand how banking as a service works, let's first look at the user story when the business owner cooperates directly with traditional banks to get various services.

Work With Banks Directly

Imagine you own a massage studio and need to open a business account, pay salaries to your employers, withdraw revenue, collect payments from clients, etc. In this case, you should go to brick-and-mortar banks and submit applications to open a bank account and request the services you need. Nonetheless, it involves numerous actions and time.

For example, you may need additional capital to invest in marketing or building renovation. In these cases, you may visit your bank for a loan but may be unsatisfied with the loan percentage. Then, you have to go to another bank but may be refused credit since you have not previously cooperated with this financial institution. After that, you apply for a loan at two other banks and are approved for one a few months later. This way, you get accounts in at least two different banks for different purposes.

So, as you can see, working with banks directly always requires a lot of time and effort to solve the necessary hassles.

Access Financial Services Via A Platform

In contrast, imagine you are still a massage studio owner and use special management software to collect clients payments and schedule appointments. But if this software has BaaS integrated, you can use it for banking services as well! You can access banking products like employer debit cards, merchant accounts, loans, etc. This type of cooperation means that your software provider offers banking-as-a-service via a platform. In simple words, a non-financial company collaborates with a bank to provide any financial services and works as an intermediary, adding banking products to its platform.

For example, you may easily get a loan the next day as the company you already work with has all your payment history and shares it with the bank. On top of that, you can access up-to-date financial reports and transaction history without visiting a bank branch.

Banking As A Service VS Open Banking Vs Platform Banking

Since the concepts of banking as a service, platform banking, and open banking are partially similar, we suggest discussing them in detail.

BaaS is a model that allows licensed banks to integrate their financial services into the products of non-banking companies. For example, a taxi service can issue debit cards to its drivers and offer mobile bank accounts, loans, and other payment services, without the needing a financial license.

Platform banking means that banks provide their infrastructure and services to third-party developers through APIs, enabling them to create new financial products and services. This approach transforms banks from being mere providers of financial products to becoming enablers of a broader financial ecosystem. The difference between these two concepts is that in BaaS, a company may be non-financial and integrate services from a bank to offer them to its customers. In the case of the platform banking model, the bank provides its assets for fintech companies so that they can create their own products.

Open banking is a concept that allows non-banking organizations to access customers' bank accounts for payments and is a secure and reliable system. The connection is made through the API for receiving data, ensuring the safety of your financial information

How To Get Started With BaaS

So, if you have decided to integrate banking as a service into your product, you need to go through several stages. Let's check our guide below to uncover all the necessary actions.

Define Your Requirements

Initially, we recommend deciding on the banking services you want to provide to meet your customers' needs. It can be account opening, cash flow monitoring, access to various loan products, and more. Do not overlook security measures, compliance, flexibility, and the opportunity to scale according to changes.Research And Evaluate BaaS Providers

Now, you should closely research the BaaS fintech market to find the finest banking providers. We advise you to prefer reliable companies with excellent feedback and reputation. Besides, look at such aspects as well:- availability of solid infrastructure;

- operation according to regulatory standards;

- excellent API documentation;

- pricing and fees;

- customer support and speed of operations issues;

- possibility to scale financial services according to your needs.

Request Demos And Proofs Of Concept

Before launching BaaS banking as a service, you probably would like to ensure an exceptional user experience and smooth functionality. Thus, you may request a demo and ensure smooth integration into your systems. After close testing, you may decide whether to cooperate with the selected bank.Negotiate Terms And Contracts

Negotiating contracts and terms are also essential to starting the BaaS platform. Initially, you need to read and understand the terms and conditions indicated by the provider. We recommend paying attention to the principles of price formation, data usage policies, service-level agreements (SLAs), and compliance requirements. Of course, you should also indicate the date when the cooperation agreement can be terminated.Integrate APIs And Develop The Solution

Now, you need to complete API integration into your app codebase. This process involves sending HTTP requests for authorization, push notifications, and more. You should also improve your business logic when using APIs. It may include maintaining notifications and online payment processing.Test And Validate The Integration

Closely test your software operation to ensure the success of the integration process. At this stage, you (or your technical specialists) need to run integration and end-to-end tests to examine how your application will work in various cases, including edge ones.Obtain Necessary Licenses And Approvals

As a provider of banking as a service, you should work according to regulatory frameworks in your country. It is crucial for legal operation without issues. However, receiving a license becomes more challenging for non-banks. Therefore, you may work according to the license of your financial partner. Moreover, you should be informed of new updates and regulation changes to provide your services legally.Implement Security And Compliance MeasuresM

Implementing security and compliance measures while providing BaaS is essential. It helps to prevent fraud, money laundering, and potential threats and protect sensitive data. We recommend using robust data encryption methods (like TLS and SSL). Using authentication protocols such as OAuth, and OpenID Connect is also a good idea. On top of that, implementing disaster recovery and data backup measures will be useful as well.Train Staff And Provide Support

Do not avoid training staff and providing support when you integrate banking as a service. Your employers and clients should understand how to use the BaaS platform to benefit from financial services. We would recommend you prepare hands-on tutorials to help them realize how to integrate banking services. Of course, you should provide round-the-clock customer support via different channels (like live chat or email) to help users solve any technical difficulties.Monitor And Optimize

Over time, your BaaS platform will probably grow. As a result, you need to stay updated with its operation and scalability. Do not forget to optimize your backend code or update to a higher-tier plan that will provide more resources to process traffic. For sure, you should ensure your platform works correctly without bugs round the clock.The Benefits And Drawbacks Of Using The Solution

Undoubtedly, banking as a service has numerous pros. We highlight the primary benefits of this solution in the list below:- Lower cost. BaaS platforms are less expensive than creating and maintaining a complete banking infrastructure. Providers offer banking services via APIs, decreasing the need for substantial initial investments.

- Unleashing the potential. Banking as a service fintech company enables businesses of all sizes to enter the financial market swiftly. This presents an exciting opportunity for startups to start their operations, significantly reducing the time it takes to introduce new services to the financial market.

- Support and regulatory compliance. Companies that create BaaS platforms do not need to apply for licenses, as the bank partner has all the necessary permissions. It allows non-financial companies to focus on their primary activities. Besides, BaaS technology operates according to regulatory requirements, such as Anti-Money Laundering checks and KYC (Know Your Customer).

- Scalability. Banking as a service is a solution designed to meet the client's needs. As banks have an extensive infrastructure, companies that integrate BaaS do not need to worry about possible additional investments when their customer base grows. The bank will cope with the load.

- Integration pitfalls. Integrating BaaS platforms into available workflows and systems may be difficult. The business needs to plan and accomplish integrations closely to guarantee the flawless work of systems.

- Limited customization. Although banks offer a wide range of services using APIs, some customization functions may be limited compared to creating them from scratch. This may provoke some restrictions to specific business needs and requirements.

Banking-as-a-service Market Trends And What To Expect

As trends show, the banking-as-a-service market continues to develop actively in a plethora of countries worldwide. This area is expected to grow by another 16.2% by 2030. Therefore, the financial services market is moving to a new stage where consumers and suppliers will interact faster and more efficiently.

Non-financial institutions of any size and experience with BaaS platforms will be significantly ahead of the competition, offering their customers new opportunities.

Besides, they may boost their income by attracting more clients who use their services or banking products via third-party providers. This approach opens up a new revenue stream by monetizing existing platforms.

Final Thoughts

So, what is BaaS in banking? It is a unique opportunity for any business to integrate financial services for clients only with a few lines of code, cooperating with the chosen bank.

The main benefit is that you don’t need to obtain a license for banking services. This model benefits each player in the field, allowing you to increase customer experience and move your business to the next stage with banking modernization.