BaaS Providers

Banking-as-a-service platforms’ capabilities encompass a full suite of products and services provided by the partner network, including sublicensing, IBANs, SEPA, SWIFT, and other types of payment methods.

Studies conducted by Finder show that British adults that opened an account with a digital-only bank equated to 14 million people as of January 2022. It is crucial to indicate that this figure has not changed much since 2021. With such an increase in digital banking activities, you might want to be among those who take digital transformation initiatives as fast as possible and discover hidden benefits of banking.

There is currently growing awareness that owning a Banking as a service platform will play a pivotal role in the future of banking. Thus, if you strive to take advantage of financial technology, this article will help you understand this emerging trend better. You will find out what BaaS is, what opportunities it unlocks for the non-bank players, how to choose BaaS platform providers, and whether it has long-term potential for the financial industry as such.

What is Banking as a service?

Banking as a Service (or BaaS for short) constitutes a business model that enables existing licensed banks, insurers, and wealth managers to directly integrate financial services and products into other non-financial digital platforms, most typically, non-bank businesses.

Thanks to BaaS, any company that doesn’t have a license or expertise in digital banking can actually become a financial institution. The cost of opening a bank or creating digital banking services such as mobile bank accounts, debit cards, loans, and payment services is sky-high.

In this manner, companies often resort to white-label banking providers that can facilitate banking products adoption.

Let's discuss your project and see how we can launch your digital banking product together

Request demoWhat can BaaS providers do?

Banking-as-a-service platforms’ capabilities encompass a full suite of products and services provided by the partner network, including sublicensing, IBANs, SEPA, SWIFT, and other types of payment methods. Here’s more about each service:

Sublicensing

Obtaining a license takes month and involves a lot of red tape. Not every business has time and funds to do that. However, there is an alternative – a competent supervisory EMD agent that can grant an e-money license. Many banking software platforms, including Crassula work together with firms and individual agents like that, releasing the burden of paperwork.

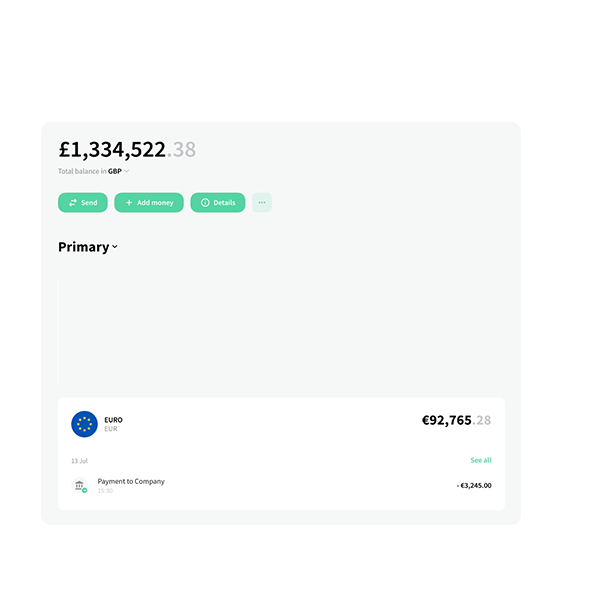

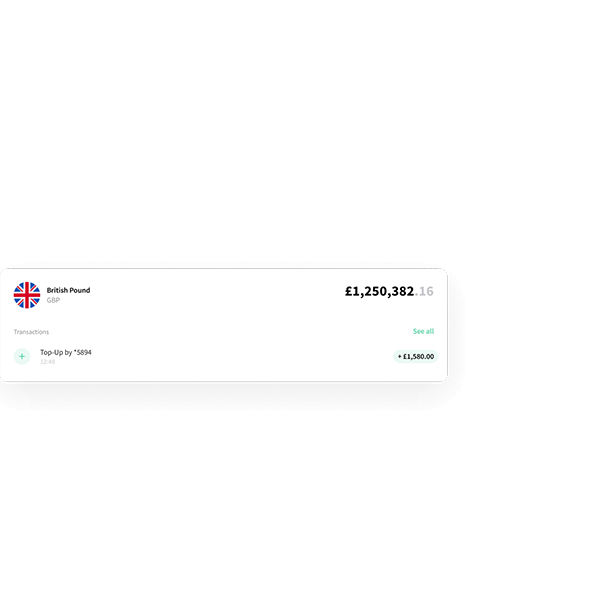

Virtual/Real IBAN generation

BaaS platforms enable cross-border transactions with their IBAN issuing capabilities. They provide the infrastructure needed to create both virtual and real IBAN accounts with SWIFT integration. In addition to that, BaaS providers offer multi-currency management tools to make operating in foreign markets happen.

SEPA/Instant SEPA

BaaS providers simplify the international payments process by supporting SEPA. Beyond that, your customers can make instant euro transactions that are executed in a matter of seconds, thanks to Instant SEPA.

FasterPayments

Setting up FasterPayments is the next BaaS provider’s capability. It is a very common way of making fast and reliable transfers within the UK.

Swift Payments

Also, BaaS providers leverage partnerships with the leading banking industry players, such as innovative payment processors, to implement SWIFT payment solutions that offer the interconnected financial experience your customers demand.

KYC

As a future company providing banking services or products, you must comply with KYC regulations to minimize fraud, corruption, and money laundering. BaaS platform providers offer an out-of-the-box KYC solution, which is essentially a process of identity verification (ID card verification, face verification, document verification such as utility bills as proof of address, and biometric verification.)

Card programs

Merchants can issue personalized payment cards by partnering with the FinTech platforms. Such card programs can be tailored in accordance with specific uses and needs: financial management, exchange, deposits, payment services, creating loyalty, and so on. Anyone can create a payment virtual or physical card virtual and link it to an e-wallet account.

FX

Most BaaS platforms are FX providers that have extensive foreign exchange offers for large-scale clients. Now, you can make fast and secure global transactions in the currencies you need. Depending on the platform, you can access over 50+ currency pairs.

Top Banking-as-a-service platforms

Here are a few of the top BaaS scalable platforms that Crassula partners with. They can become your shortcuts to get to the market quickly:

- Railsr: For Railsr, customer behavior is above all. It’s a frictionless and fun experience they need. This platform’s finance capabilities, such as digital wallets, payments, rewards, loyalty points, or cards, are a way to facilitate an enjoyable embedded finance experience seamlessly integrated into your brand products.

- Clear.Bank: Anyone from financial institutions to merchants uses their API to obtain a fully-regulated banking infrastructure. Clear.Bank makes opening and managing accounts easier and lets you clear payments in real-time.

- Clearjunction: Clearjunction can integrate seamless, automated cross-border payments into your next service offering, navigate the risk and compliance, and offer a vast number of other features. This global payment solution provider helps to overcome the barriers and challenges relating to banking and payments.

- Centrolink: It is a payment system of the Central Bank of Lithuania, which provides a technical possibility to connect to the Single Euro Payments Area (SEPA) through the infrastructure of the CB for all payment service providers licensed in the European Economic Area – banks, specialized banks, credit unions, e-mails. monetary institutions, payment institutions.

- Currencycloud: This last BaaS provider helps you stay relevant in a fast-paced market. It has everything you need: from virtual wallets and named accounts to the ability to send, receive and manage your multi-currency payments.

Who needs a BaaS platform provider?

BaaS providers are real game-changers for many businesses that want to provide fintech products or services but don’t have the resources for it. Developing a new financial product and bringing it to market means finding a bank partner, signing a long-term contract, following compliance regulations, and then finally building that financial app or service you were looking to offer to end users.

If you aim to cut through the complex path of creating a financial product on your own and differentiate financial offers in your product at an affordable cost, we suggest looking for a provider. Don’t attempt to go off the beaten track. Instead, find a platform of experts that can guide you through the complex stages of product development.

How to choose the best BaaS provider?

The rapid development of the BaaS industry and increasing demand for the banking platform contributed to the entrance of many new players in the market. Making an informed decision about which BaaS provider is right for your specific business idea is probably the most daunting. There are many providers out there, and every single BaaS provider offers different banking features. Here are the key points to look out for:

Diverse client base

Nothing can tell you more than the client base of the BaaS platform. The more diverse it is, the more likely the platform is versatile. Thus, search for a provider that specializes in working with many different types of businesses.

A range of products

You don’t want to hop from one service BaaS provider to another, do you? We suggest finding one that offers a wide range of specialized, high quality products and related services. Opt for a provider that has various offers designed to provide limitless combinations. This way you will build a comprehensive solution with all the required bells and whistles.

Regulatory compliant

Regulatory compliance helps you protect your business’s resources. It lays the foundation on which you build your company’s reputation. Respectively, choosing a BaaS provider that complies with all essential regulations is essential.

How to choose the best BaaS provider?

Entering the finance and banking industry is always time-consuming and stressful in terms. However, you can unlock the world of core banking operations and innovations through our marketplace of fully customizable banking-as-a-service platform providers.

Our BaaS providers give you flexibility, a quick time through the market, and reduced risk.

Choose ready-to-use API-accessible banking services, connect to the most preferred ones, and enrich the banking experience of your existing and potential customers.