Core Banking: Everything You Need to Know

Core banking is a centralized system that streamlines financial operations, enabling real-time transactions, account management, and digital banking services for modern financial institutions.

Seeking cost-effective ways to operate your financial institution more efficiently or start your business from scratch with a customizable progressive system? With us, your desirable fully-branded core banking solution will be launched in less than a week.

Nowadays, technologies are constantly changing the traditional way we process funds. For example, core banking has started the digital revolution, providing automation software for financial institutions. According to the statistics, this solution will grow by 9.3% annually through 2030. The United States, the Asian Pacific, and China will be front-runners in core banking development.

So, what is core banking? It is like a powerhouse that unites all your financial operations in one place. Continue reading our guide to realizing the crucial core banking system's features, functionality, technologies, and other details.

What Is a Core Banking System?

We need to start with the term CORE to uncover the "core banking" definition. CORE stands for Centralized Online Real-Time Environment. It means that the customer can experience the financial institution as a single entity. Besides, the client's location does not influence the transactions that occur.

Therefore, core banking is the unique back-end system that unites branches of the same financial institutions to perform essential core tasks like transaction processing, loan management, depositing, and risk prevention in real time. As you can see, the core bank system is crucial for providing a flawless customer experience (CX).

Let's discuss your project and see how we can launch your digital banking product together

Request demoHow Does Core Banking Work?

Let's explore how the core banking system technology works. Core banks operate via centralized systems that help perform crucial banking services like transaction processing, depositing, account management, loan opening, and currency exchange. They also have particular databases and applications for network integration between different channels (a mobile platform, physical branches, online services, and ATM networks).

In our list, we have highlighted several common tasks that core banking systems perform:

- Transaction initiation. The client initiates the financial transaction. It can be done through a physical branch or via an online platform. A transaction may include a withdrawal, opening a deposit, or applying for a loan.

- Centralized data processing. The core banking system captures the transaction and instantly processes it.

- Account management. The core bank spawns, updating the client's balance and closely studying the transaction history.

- Reports and analytics. The core banking system generates customer behavior reports, providing monitoring and analytics for decision-making.

Core banking platforms are compatible with unique technologies of all types, including traditional and digital banks, fintech startups, experienced fintech companies, holding structures, and resellers.

Types of Core Banking Systems

As the owner of a financial company, you will need to deal with various core banking system types. Commonly, we categorize core systems into three types.

Traditional Solution

Traditional types of core banking systems are based on classic bank structures. They include legacy infrastructure with centralized and integrated architecture and extensive codebases, and are associated with limited flexibility. Unfortunately, in most cases, traditional core banking systems cannot scale due to the need for significant investments.

Digital-First Banking

In contrast, a digital-first core banking platform relies on modern financial technology. Such systems utilize a plethora of innovations like blockchain, AI, automation, and more. As a result, clients may count on superior functionality and enhanced technologies.

Cloud-Based Banking Platform

As the name implies, cloud-based core banking technologies are hosted on third-party cloud providers. It guarantees cost-effectiveness, encryption modules from cyberattacks, scalability, and quick deployment for financial institutions. Occasionally, a cloud vendor may provide a Cloud app as a Service (CaaS). So, financial companies can move their local servers to the unique core cloud to enjoy more flexibility.

Essential Core Banking System Features

Numerous features of core banking software benefit merchants and clients. Here, we can highlight functions like mobile and online platforms, two-factor authentication, KYC and other secure measures, fast transaction processing, and more. Let's discuss all of these facets in more detail below.

Customer Information Management

Of course, the essential component of core banking technology is customer information management. It enables financial institutions to manage client data for different goals flawlessly. Here, we can highlight functions such as customer relationship management and support, account opening, compliance monitoring, etc.

Onboarding (With KYC Features)

Undoubtedly, KYC onboarding is a substantial part of the core banking system. Particularly, the "Know Your Customer" function allows companies to thoroughly verify the identity of new customers, preventing fraud and money laundering. While traditional financial institutions require users to show physical identification (such as a passport, ID card, or driver's license), core solutions can verify customers online utilizing special programming. It significantly saves time and increases the security level and efficiency of banking operations.

Two-Factor Authentication

Each core banking service offers customers two-factor authentication to ensure an increased level of information security and protection of personal data. The core verification level requires the client to complete session authentication using a one-time password. For example, customers who transfer funds will receive a 4-digit code (the system will send it to the contact number) to protect their transactions. Thus, the customer will be insured from unauthorized access and hacking attacks.

Deposit and Loan Management

Core banking services involve deposit and loan management, simplifying the handling of clients' accounts. This core feature frequently includes deposit account opening and maintenance, interest calculation, transaction processing, and overdraft protection. In the same vein, we can highlight other important core banking system features like loan origination, repayment schedule, loan servicing, refinancing, and restructuring according to the client's needs.

Transaction Processing

The core banking system's most attractive feature is online transaction processing. Core software allows you to instantly process transfers, deposits, and other financial actions. This feature improves records management and makes customers more satisfied with the services. Besides, core solutions allow you to perform SEPA credit transfers. These are euro transactions in which the receiver and sender are signed up with financial institutions in the SEPA area.

General Ledger and Accounting

We cannot dismiss the general ledger and accounting as a core banking technology, as it is crucial for accurate financial reports. General ledger management usually involves creating account charts, processing transactions, and automatically balancing the ledger. The services cover aspects like accrual accounting performance, financial statement preparation, and multi-currency accounting.

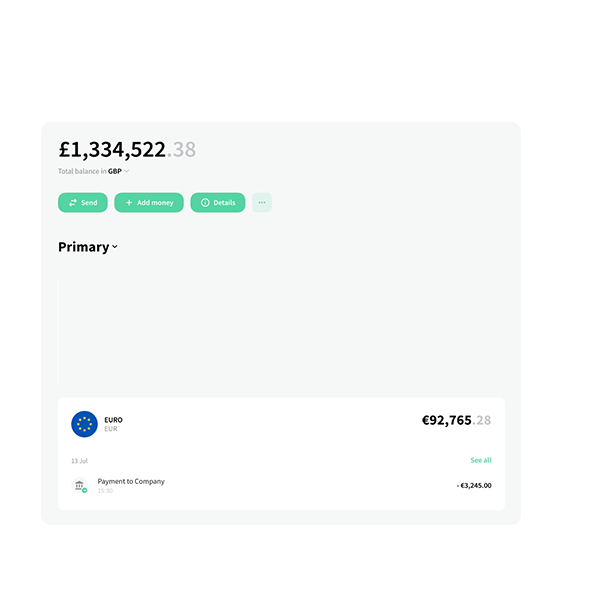

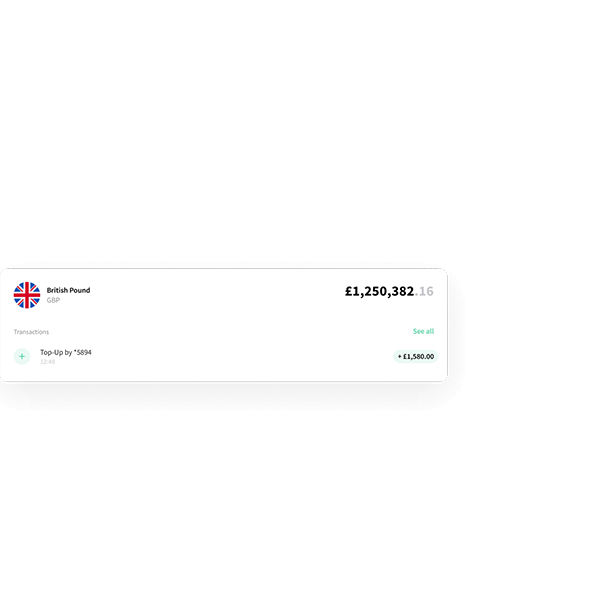

Online and Mobile Banking

Online and mobile solutions are core technologies enabling customers to access financial services digitally. In particular, your clients may count on handy account management, checking the balance, performing payments and transfers, and managing cards (active or blocked cards). Moreover, customers can access loan services and investment accounts on their smartphones.

Regulatory Compliance

It is not a secret that regulatory compliance in core systems is crucial for operating according to laws and official regulations. It frequently involves compliance with data protection laws, anti-money laundering (AML) regulations, and other norms. Core solutions use regulatory compliance methods, such as AML and KYC checks, transaction monitoring, data encryption, regulatory reporting, and audit trails.

Risk Management

Core banking systems prevent technical or fraud risks in various ways, such as AML and KYC checks, transaction monitoring, data encryption, and audit trails. Moreover, systems help with legal risk management, guaranteeing that financial institutions work according to set regulatory norms.

Integration and Interfaces

Of course, core solutions do not ignore integration and advanced interface implementation. We should highlight that these aspects are crucial for the flawless operation of all core banking systems. For instance, the technology guarantees integrating various payment methods (SWIFT, card networks, ACH, and payment gateways) and third-party services. Moreover, the core banking solution allows impeccable integration with CRM systems, APIs, and more. The technology also enables virtual IBAN integration for payments in multiple jurisdictions.

Benefits of Implementing Core Banking Services

So, we have dealt with the main features of this technology, and now, let's uncover the advantages of core banking systems. Do not overlook an opportunity to find out all the pros of this technology in the list below:

- Access to the core banking platform around the clock. In the modern world, 24/7 access to bank services is crucial. Clients may accomplish financial transactions globally and anytime, as the core banking platforms work without interruptions. Besides, users may communicate with managers for customer support available round-the-clock.

- Advanced productivity. Such platforms boost operational efficiency by decreasing the time it takes to connect several branches. Consequently, financial institutions can process all transactions more efficiently and faster, regardless of the customer's location.

- Reduced operational expenses. Since core systems require fewer human influences, financial institutions may decrease operational expenses. Moreover, AI-powered technologies boost the speed of processing operations. Additionally, they minimize the chances of manual errors in user documentation.

- Access to banking software via multiple channels. You can manage all the interaction tools with your customers using multi-channel integration. The process will take seconds; you will not have to wait for hours.

- Enhanced security. Core platforms utilize advanced encryption methods for software security and hacker attack prevention. Regarding the customers' benefits, they may count on two-factor authentication to receive supplemental security layers. Thanks to these features, financial institutions operate according to KYC standards and legal regulations.

- Multiple currencies. Clients can utilize various currencies without using a currency exchange. A core banking platform allows automated currency exchange using an API. Besides, you may count on excellent rates and currency liquidity. This fact is essential for customers who plan to start e-commerce activities.

- Analysis and analytics. The latest technologies enable financial platforms to collect and analyze countless customers' data and follow transactions in real time. Thus, banks can receive valuable information about clients' behavior and preferences. This function simplifies making informed decisions and implementing marketing strategies.

- Flexibility and scalability. Whether it's a global financial institution or a small one, the modular nature of the core banking system allows for rapid service scaling without hindering efficiency. It is a beneficial solution as financial institutions have different needs and abilities to scale operations. Such solutions guarantee quick and flexible adaptation to the company's and customers' needs.

- Automation of all financial processes. Notoriously, automating decisions is the key to minimizing errors that can be made manually. A core banking solution allows you to automate transactions and other repetitive processes, increasing work efficiency.

Moreover, numerous core banking platforms have decided to issue credit or debit cards, which can be virtual or physical, since they are essential to a customer's financial experience.

Challenges and Pitfalls of Core Bank Services

Besides the benefits of core banking solutions, we need to consider their potential risks and pitfalls. Keep in mind that this technology may include some hurdles, such as technical challenges and human factors. Initially, you must remember that numerous traditional financial platforms operate on dated technologies that may not integrate flawlessly with the newest core banking solutions.

Additionally, you may face cybersecurity and data migration issues. Migrating data from legacy systems to newer platforms involves several potential risks, and this process should occur securely to protect sensitive financial information.

As a business owner, you should remember another critical point that can prevent a quick transition to the latest systems. Your employers should learn innovative technologies and master all the processes required by the core banking platforms in advance.

We also advise you to analyze the costs and ROI (return on investment) when implementing core banking. Therefore, you should explore the approximate required budget and benefits that you will receive. The investment must pay off eventually.

Current State of Core Systems and What the Future Holds

Looking ahead, we can say that the core banking system is developing more actively, optimizing operations, and improving client interaction. Financial platforms have integrated mobile software, online account opening, and AI-powered analytics.

Of course, today's financial platforms primarily focus on the customer experience, aiming to improve user interaction and facilitate self-service functions. This customer-centric approach is not a passing fad but a strategic direction that will continue to evolve.

Banking automation is on the horizon, and blockchain and distributed ledger technologies, with their promise of enhanced security, transparency, and efficiency, are expected to become even more prevalent in the financial space.

Final Thoughts

So, what is a core banking system? It is a central location for the banking software, where crucial operations are managed. Core system services provide several significant benefits to financial institutions and their customers. Advanced data analytics allows you to increase your ROI while keeping your customers satisfied.

Another significant plus of this solution is automation, which allows for maintaining the operation of the entire infrastructure. Additionally, you don't have to worry about your customers' data security. Modern financial platforms use reliable protection methods like two-factor authentication, KYC, and anti-hacker programs.

So, the core banking market will grow in the future, making all financial services more accessible and lucrative.