A Complete Guide to Cloud Banking

Unleash the Power of the Cloud: A Complete Guide to Implementing Cloud Banking.

The financial industry enthusiastically accepts all innovative technologies as they simplify and speed up key digital processes. And cloud systems are no exception!

Cloud banking allows banks and other monetary platforms to complement their current systems and services, monetize corporate information assets, enhance business efficiency, and increase revenue. Moreover, cloud solutions for bank services open up new opportunities for financial businesses and clients, significantly improving customer experience. In our article, you will learn about the main features of cloud-based banking. You will also find out more about core banking models and types of hosting environments, as well as the main benefits and challenges of digital banking solutions.

What Is Cloud Banking?

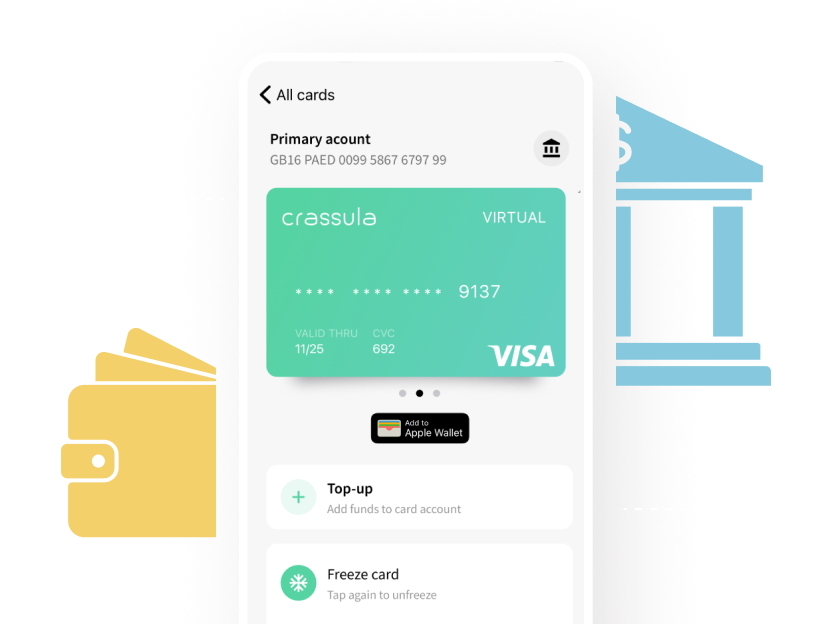

Cloud-based banking is an online service that hosts computing bank services (data, servers, communication, applications, and data analysis) for financial institutions (banks, fintech companies, credit unions, etc.). Basically, it is a standard bank infrastructure that operates in the cloud.

The lack of attachment to physical servers allows financial companies to manage banking platforms and applications via the Internet, expanding their business capabilities. Since the IT department ensures continuous delivery of services, content, and applications, this saves resources and time for other important bank operations.

Let's discuss your project and see how we can launch your digital banking product together

Request demoHow Does a Cloud-Based Platform Work?

Any cloud-banking provider’s functioning is based on a complex cloud infrastructure produced by the main cloud service providers, such as Google, Microsoft, or Azure. Therefore, banks and other financial institutions can access such cloud systems’ full functionality for a certain fee.

The operating principle of cloud platforms is easy. Cloud storage is provided to the user in the required amount, is paid upon use, and eliminates the need to purchase and manage your IT infrastructure for data storage. This offers flexibility, rapid scalability, and reliability. Unlike traditional servers and PCs, cloud data storage allows you to host and store a large amount of data.

Standard Cloud Solution Models

The choice of the cloud banking software model should be based on your business’s size, budget, and activity characteristics. There are four standard cloud service models:

BPaaS(Business Process-as-a-Service). This model ensures day-to-day operations, such as human resources or billing.IaaS(Infrastructure-as-a-Service). This type offers a complete core banking platform infrastructure that manages business operations and software integration.SaaS(Software-as-a-Service). This one provides a cloud-based banking infrastructure for customer relationship management, accounting, invoicing, etc.PaaS(Platforms-as-a-Service). And finally, this model delivers cloud-based core banking services for developing databases and digital bank apps.

Core Types of Cloud Hosting Environments

In this section, we’ll consider three main types of cloud hosting environments. Keep in mind that the choice between them should be guided by your bank’s current capabilities and future goals.

Private Model

A private cloud is an environment of cloud computing owned by a single organization (bank or other financial institution). Any cloud service that a financial company provides on the private cloud is delivered on a private network. Moreover, there is an additional layer of security since the private cloud infrastructure is usually located in the owner’s data center. Thus, it is clear that the main advantages of a private cloud are data security and easy control. However, it lacks scalability and flexibility, and being separated from other cloud clients makes it rather costly.

Public Model

A public cloud is a hosting environment in a public domain accessible via the Internet. Famous examples of public clouds are hosted by prominent brands such as Amazon Web Services (AWS), Microsoft Azure, and IBM. Choosing a public cloud for banking services opens up new opportunities to scale, as it enables financial institutions to develop and deploy services directly in the cloud. However, maintaining data confidentiality is more complex here since the environment is divided between multiple users.

Hybrid Model

A hybrid cloud combines the benefits of cloud computing from both private and public hosting environments. Today, this technology is growing much faster than other cloud storage formats. Hybrid systems include a range of possible combinations of private and public clouds. For example, a private cloud can be combined with a public cloud, a public cloud with a local infrastructure, or a local infrastructure with a private cloud. Thus, there are quite numerous options for using such technologies. Companies can independently build and modify the systems they need, dynamically distributing tools between different components depending on current needs, tasks, and workload.

Cloud Banking Solutions Vs. On-Premise Banking Software

| Feature | Cloud-Based Banking Solution | On-Premise Software |

|---|---|---|

| Cost efficiency | Requires a fee for the service. Still, you avoid the costs of maintenance and upgrades. | There is no service fee. However, you need to purchase the expensive infrastructure and maintain it. |

| Management and control | A third party provides and maintains the server infrastructure. This frees the financial company from technical concerns, but also reduces its role in regulating the cloud platform. | Financial companies receive full control over their IT infrastructure but must independently ensure the functioning of the hardware and software. |

| Scalability | Cloud hosting is very flexible and allows a financial company to scale quickly, responding to changes in market demand without additional investments. | Local hosting is limited by the bank's resources, making it difficult to scale quickly. |

Benefits of Cloud-Based Banking Softwar

Cloud digital banking solutions are becoming increasingly popular among different financial businesses. Let’s take a look at the main advantages of the cloud infrastructure for your bank:

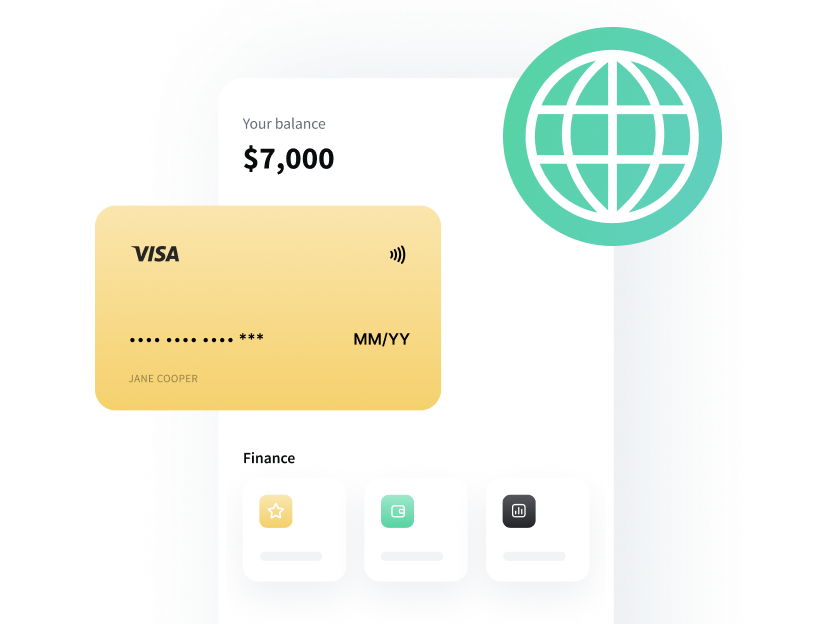

- Cost efficiency. Transferring data to the cloud reduces the cost of data storage and analysis. Moreover, the cloud infrastructure offers more flexible payment options, adjusting them only according to the functions used. Therefore, banks can adjust their budget and business plan depending on their immediate needs.

- Enhanced data security. Cloud-computing systems guarantee customer data safety due to the use of extra security layers, including data encryption and anti-fraud bank services. Furthermore, many cloud environments offer built-in

DR(disaster recovery) capabilities to help banks and financial platforms recover quickly during a mass outage or after a serious security breach. - Fast service delivery. The cloud banking solution is a progressive approach to already familiar bank services. Thanks to banking systems via the cloud, all functions are optimized on a large scale, simplifying your team’s operations. You can automate and thereby speed up most computing services, improving your bank’s competitiveness and enhancing customer experience.

- Flexibility and scalability. The cloud environment is designed to be easy to change, integrate with other platforms, and introduce new digital tools. This allows you to build your bank in any direction without worrying about the technical part of business scalability.

- Convenience. Cloud platforms offer well-designed and thoughtful systems with an intuitive interface. In addition, CSPs provide constant technical support for your customers.

Challenges of Core Banking Processes

Despite the apparent benefits of cloud-computing banking, you must be prepared to face some difficulties when integrating it into your bank:

- Regulatory compliance. Occasionally, the compliance rules offered by cloud providers conflict with your region’s established financial regulations. In this case, you have to negotiate each standard with the solution provider or change the cloud.

- Data migration. Transferring the entire database and all bank services to the cloud usually takes several months. Therefore, instant migration is impossible.

- Unforeseen circumstances. Incidents like a failure due to human error or a hacker attack can slow your bank’s productivity. Moreover, since you don’t control the cloud vendor’s infrastructure, you will have to pause your banking platform’s processes until the cloud-native core provider solves the issue.

Digital Banks That Successfully Implemented the Solution

Let’s look at successful projects that integrated cloud-computing banking into their financial enterprises. These three banking platforms are the best examples to consider:

JPMorgan Chase.This leading financial company used the cloud infrastructure to boost the digital transformation of its bank services. Due to the strategic partnerships with big cloud environment providers likeGoogle Cloud,AWS (Amazon Web Services), andMicrosoft Azure, the bank increased application development and deployment speed. Almost 40% of all its processes have been moved to the cloud, with nearly $2 billion spent on the new core data centers.Capital One.Switching to cloud banking services allowed the bank to increase its operational efficiency, leverage scalable resources, optimize processes, accelerate digital transformation, and improve the quality of customer service.HSBC.The main goal of moving HSBC’s data and applications to the cloud was increased flexibility, scalability, and cost optimization. The HSBC bank has fully automated more than 95% of all transactions.

How to Migrate from On-Premise to Cloud-Banking System

Now that you have learned about cloud banking and how it works, you need to understand how to implement it in the financial business. The instructions below will guide you through each transition stage from on-premise to cloud infrastructure.

- Understand Your Business Needs and Requirements: Initially, you need to clearly define your bank’s main features and outline its main goals. In addition, you must assess your current infrastructure and determine the core data you need to migrate to the cloud. This will help you choose the best option among cloud service providers and ensure efficient bank performance.

- Develop a Cloud Migration Strategy and Select a Provider: When choosing a cloud service provider, focus on your bank’s requirements and service expectations. Also, consider the cloud solution’s reputation, price, speed, and flexibility.

- Plan and Execute Financial Data Migration to the Cloud: Cloud migration, which involves transferring data to a cloud infrastructure, must be carefully planned to avoid inaccuracies and confusion. Elaborate on a detailed plan that includes resource allocation, deadlines, and budget. Also, make sure to consider the possibility of unforeseen circumstances and how to migrate in this case.

- Configure Cloud Infrastructure and Security Controls: When transferring data to the cloud, it is necessary to ensure data security and regulatory compliance. In addition to securing the migration process, ensure your cloud-computing provider offers the appropriate security certificates. After uploading your data to the cloud server, you can customize the environment to make it convenient and effective for running your bank.

- Test and Integrate Migrated Banking Components in the Cloud: We recommend testing the data migration plan to ensure the cloud banking service works properly. Only then, can you integrate all migrated components into the cloud infrastructure, making the environment efficient for your bank activities.

- Cutover to Cloud Systems and Optimize for Performance and Cost: After testing, launch your cloud-based banking service and start monitoring. Reporting tools will help you track the cloud performance. Ensure that key indicators meet your expectations. If necessary, don’t hesitate to make organizational changes, such as staff reassignment, freeing up the server for reuse, etc. Analyzing the cloud computing service’s performance and optimizing its key functions is crucial!

Final Thoughts

Cloud banking has much-untapped potential, and its popularity will increase rapidly in the coming years. Progressive companies already understand that this innovative banking solution will help them bring their financial business to a new level.

Cloud infrastructure offers many advantages that can significantly improve the quality of financial services you provide. Thus, cloud computing banking provides maximum service automation, transaction acceleration, interface simplification, new computing capabilities, and first-class security measures. Of course, the cloud environment can be challenging for some banks, but if you choose a reliable provider, your transition to the cloud will be smooth and stress-free!