How Do Neobanks Make Money

The Neobank Profit Playbook: Decoding the Revenue Models Behind Digital Banking

The ascent of the neobank has been nothing short of meteoric. In little over a decade, names like Revolut, Chime, Monzo, and Starling have transitioned from disruptive upstarts to household names, attracting tens of millions of customers. This has created a digital banking paradox: in an industry where traditional players rely on a complex web of fees and interest margins, how do these digital-first institutions, seemingly built on giving services away for free, actually make money?

The answer is not a single silver bullet but a sophisticated and diversified playbook. Neobanks generate revenue through an agile mix of low-margin, high-volume streams, all enabled by a fundamentally different, technology-driven business model that sheds the crippling overheads of their legacy counterparts. To truly understand their path to profit, one must look beyond the app interface and dissect the lean operational core, the regulatory gateways, and the multifaceted strategies that define this new era of finance.

The Foundation: A Radically Different Cost Structure

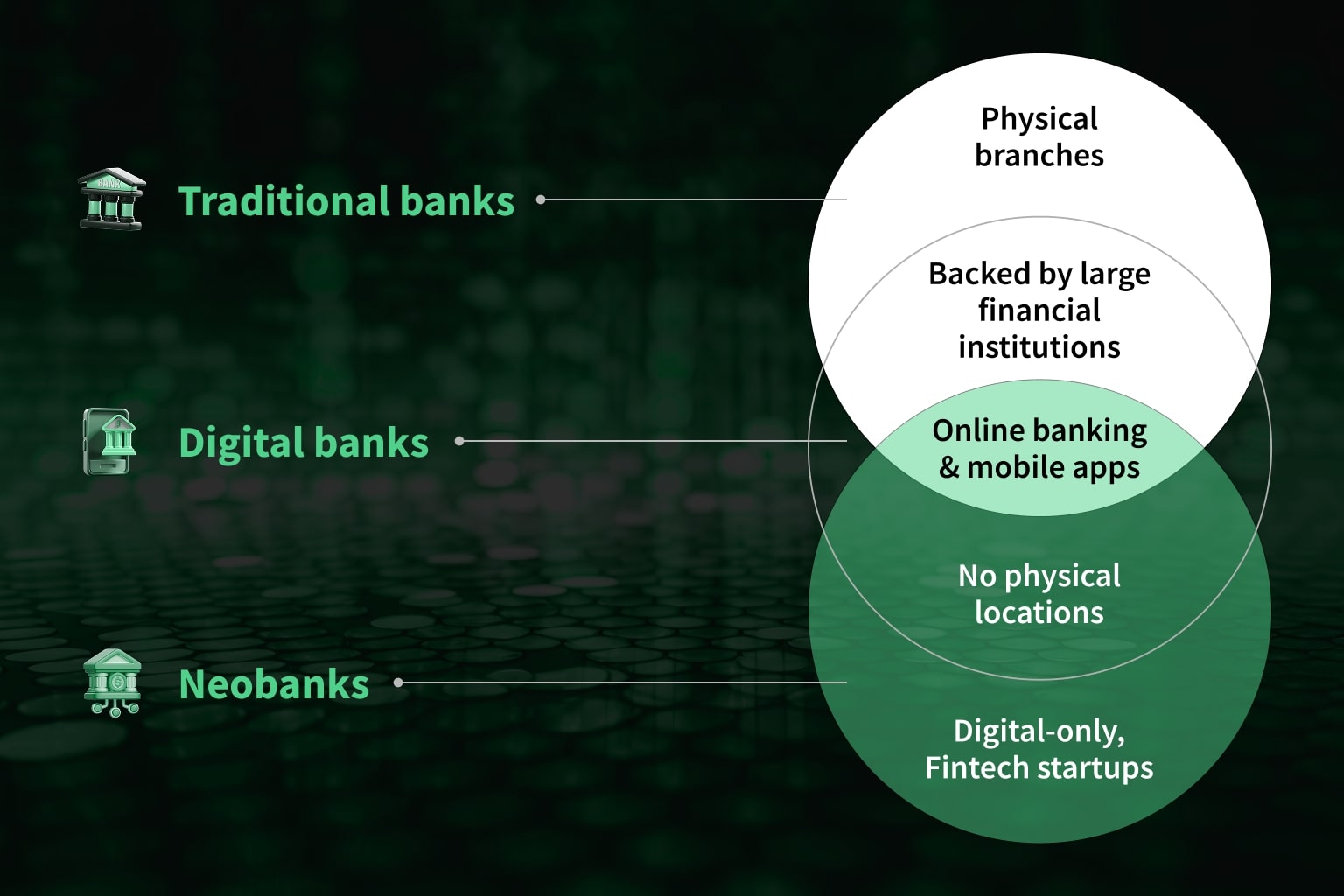

Before we can analyse revenue, we must first understand the profound cost advantage that underpins the entire neobank proposition. Traditional high-street banks operate on a model burdened by immense fixed costs, including vast branch networks and archaic IT systems.

Neobanks dismantle this model entirely. Their key characteristics are:

- No Physical Branches: By operating entirely online, they eliminate the enormous costs associated with real estate, utilities, and in-person staff.

- Lean, Agile Teams: Overall headcount is a fraction of a traditional bank’s, with automation and AI handling tasks once performed by entire departments.

- Cloud-Native Technology: Built on modern, cloud-based infrastructure, which is cheaper to run and allows for rapid product development and powerful data analytics.

This lean operating model is a strategic enabler. The low cost of customer acquisition allows them to build a large user base quickly. This low operational breakeven point gives them the flexibility to offer basic accounts for free and experiment with a variety of revenue models. Many also leverage a partnership model, integrating with licensed banking partners and payment processors like Mastercard or Visa to launch quickly.

The Regulatory Gateway: The Licence to Earn

A critical factor in a neobank’s revenue strategy is its regulatory status. The type of licence a neobank holds directly dictates which revenue streams it can access.

E-Money Institution (EMI) Licence

A common starting point. Allows issuing e-money and facilitating digital payments. However, an EMI cannot use customer deposits for lending. Revenue is constrained to non-lending activities like interchange, subscriptions, and FX fees.

Full Banking Licence

The holy grail for profitability and scale. Granted by regulators like the UK's Prudential Regulation Authority (PRA), it permits deposit protection (e.g., Financial Services Compensation Scheme or FDIC insurance) and, crucially, lending money. This unlocks the significant profit centre of net interest margin.

While a banking licence unlocks powerful revenue streams, it also comes with higher capital requirements and a heavier burden of regulatory compliance, including stringent Know Your Customer (KYC) and Anti-Money Laundering (AML) obligations.

The Core Revenue Streams: A Detailed Breakdown

With their low-cost foundation and regulatory permissions in place, neobanks deploy a diverse toolkit of revenue streams.

Weaving It Together: Strategic Business Models in Action

Individual revenue streams are just the components; the real art lies in how neobanks combine them into coherent, strategic business models.

The Interchange-Led Model

Focuses on mass user acquisition to maximise card spending and interchange revenue. Capital-light but requires enormous scale. Archetype: Chime (US).

The Credit-Led Model

Places lending at the heart of the business, with net interest margin as the primary profit centre. Capital-intensive but offers a clearer path to high profitability. Archetype: Starling Bank (UK).

The Ecosystem-Led Model ('Super App')

Aims to be the central hub for a user's entire financial life, aggressively cross-selling a vast array of services to maximise revenue per user. Archetype: Revolut (Global).

The Niche-Focused Model

Targets a specific, underserved segment (e.g., SMEs) and then layers on revenue-generating services. Archetype: Tide (UK).

Case Studies: Learning from the Leaders

The diversity of these strategies is best seen in the real world:

A poster child for the credit-led model. After securing a banking licence early, Starling focused on building a robust loan book, making it one of the first major European neobanks to achieve sustained profitability.

The quintessential 'super app'. Revenue is highly diversified across subscription tiers, significant foreign exchange fees, and commissions from its rapidly expanding wealth and crypto trading features.

Illustrates strategic evolution. Started as an interchange-led player, but has deliberately diversified by launching popular premium subscription tiers and cautiously building out its lending book.

The world’s largest neobank by market cap. Began with a fee-free credit card in Brazil before expanding into a full suite of products, demonstrating a powerful credit-led strategy in an emerging market.

Conclusion: The Path to Sustainable Profitability

The question of how neobanks make money reveals a fundamental shift in the architecture of banking. Their profitability is not derived from a single source but from a carefully constructed portfolio of revenue streams built upon a low-cost, technology-first foundation. The journey often begins with a reliance on high-volume interchange fees, but the path to sustainable, long-term profitability almost invariably involves diversification.

The most successful neobanks are proving that a resilient business model emerges from the strategic interplay between free core services that attract users and a sophisticated layer of premium subscriptions, data-driven lending, and marketplace offerings that generate value.

While the road is fraught with regulatory hurdles and intense competition, their ability to combine a lean cost structure with a deep, data-driven understanding of their customers creates a powerful new paradigm—one that is not just challenging the old guard, but rewriting the profit playbook for banking in the 21st century.