White Label Financial Software

An in-depth guide to understanding the benefits and intricacies of white-label financial software solutions.

What Is White Labeling?

White labeling is a common practice across different industries where one company purchases a product or service from another company and then rebrands it to make it seem as if they had built it. In other words, the company offering its customers the end product or service has no hand in manufacturing and supply chain. White labeling is ubiquitous in the electronics industry, web hosting, payment processing, beauty and personal care, retail, and financial services.

In banking, financial institutions expand their service offerings by partnering with third-party providers who specialize in launching and maintaining banking solutions. Crassula and similar software companies offer white-label solutions that allow businesses to personalize and rebrand their products.

These white-label products can be customized with a logo or brand name, UI/UX, language, analytics dashboards, and other customized features. Essentially, the primary goal of white labeling is to develop and launch new products without digging into the intricacies of manufacturing.

Let's discuss your project and see how we can launch your digital banking product together

Request demoOverview of Financial Software Landscape

The fundamental changes in commerce, merchant and consumer behavior, and technology have massively expanded the adoption of accounting and finance software solutions. According to Gartner’s annual forecast, the global financial management software market is expected to be valued at $24.4 billion by 2026.

Companies invest in financial software for a number of reasons. For instance, most respondents in Gartner’s survey (53%) invest in accounting and finance software to improve productivity. The other prevailing reasons are managing competitive pressure (41%) and outgrowing current technology (41%). It’s also important to highlight that 21% of respondents embrace financial software solutions due to business disruptions caused by events such as COVID-19.

Indeed, white-label financial software solutions are gaining traction. It is always a safe bet for businesses looking to adapt and thrive in a dynamic financial landscape. Its versatility, scalability, economic efficiency, and low barriers to market entry make it a secure and strategic investment that can drive growth and innovation.

Why Are Businesses Turning to White Label Solutions?

Now that we have a better grasp of the financial software solutions landscape, it's time to explore the compelling incentives behind the shift toward white-label solutions.

Speed to Market

With the white-label model in place, businesses can expect to bring their white-labeled products or services to the table in a matter of weeks to a few months, as opposed to the potentially much longer timeframe required for custom development.

Cost Savings vs. Custom Development

Custom development entails hiring an experienced in-house IT team responsible for building, testing, and maintaining everything from the ground up, which can be a significant financial investment. To optimize your budget, go no further than a comprehensive white-label solution.

Access to Established Technologies and Best Practices

White labeling unlocks the opportunity to access the newest technologies and innovative tools. By harnessing the power of white labeling, you can tap into the provider’s specialized expertise and resources and still maintain your brand identity.

Branding Opportunities

Consistency in branding is paramount for a cohesive client journey and, therefore, your company's long-term success. With white-label services, you can be certain that the end product will reflect your brand’s identity according to clear-cut branding guidelines and standards.

Core Components of White Label Financial Software

To understand white-label financial software better, you need to grasp its core structure. Below, you will find the five components that are the backbone of white-label financial software:

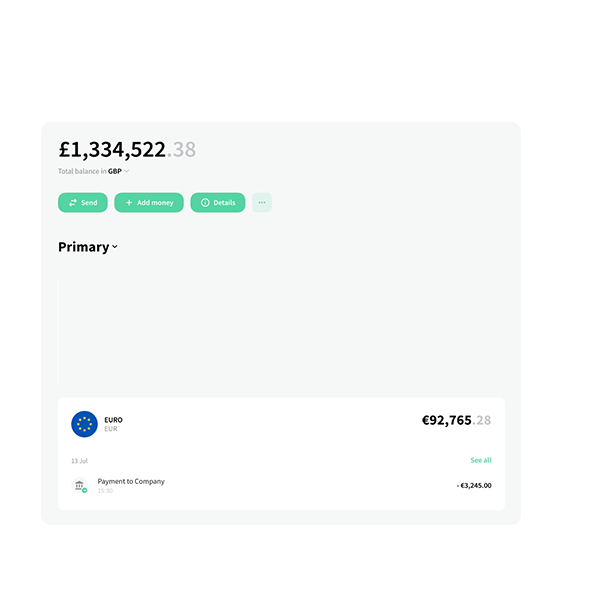

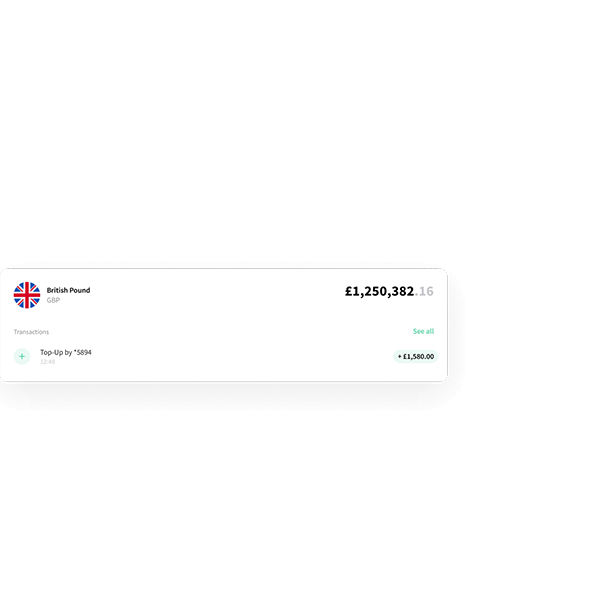

- Front-end User Interfaces: The Front-end user interface is essentially what the end user sees and interacts with. The front end typically consists of layout and design, interactive elements such as buttons, dropdowns, checkboxes, input fields, dashboards, web and mobile applications, and client portals. Thus, for a smooth and seamless user journey, the front-end user interface should be intuitive, easy to use, and tailored to the financial institution's branding.

- Transactional Systems: Transactional systems are the backbone of financial software, responsible for processing financial transactions such as payments, fund transfers, trading, and lending activities. These systems need to be secure, reliable, and efficient. White-label solutions often come equipped with robust transactional systems that can be customized to meet specific business needs, including transaction types, currency support, and security measures.

- Reporting Modules: With the aid of a report generation module, any member of your institution can directly run metrics and statistics on the entire database and either view it directly online or export it in open formats. Reporting modules allow to receive, manage, and analyze all kinds of data, such as financial performance metrics, compliance reporting, and customer and account analysis, to make informed decisions and manage risks.

- Compliance and Regulatory Features: To ensure that your fintech business is compliant with industry-specific regulations, laws, and standards, it’s essential to choose a white-label software provider whose solution has the most relevant compliance functionalities and regulatory capabilities. GDPR, HIPAA, MFA, RBAC, KYC, and AML are the most common regulations.

- Integrations and APIs: APIs are sets of rules and protocols that define how different software components can communicate and exchange information. Using it is a common practice for launching applications that integrate with other software services and platforms.

Key Benefits of Adopting White Label Financial Software

Scalability and Flexibility

White-label financial software seamlessly accommodates a growing user base. Furthermore, it adjusts to changing market demands, giving you a competitive edge in the financial sector.

Security and Compliance

White-label solutions come with robust built-in security features and regular updates in line with regulatory changes, minimizing compliance-related risks.

Cost-Effective Development and Maintenance

White-label software requires less upfront capital and long-term maintenance expenses. You can implement it and keep your software up-to-date.

Real-world Applications and Use Cases

There are many white-label financial software solutions out there that offer templates for a variety of use cases. Businesses can build a custom app without having prior knowledge and resources. Let’s check out our top 5 popular use cases:

- Digital Banking Platforms

- Payment Gateways

- Investment and Portfolio Management

- Crowdfunding and Peer-to-Peer Lending Platforms

- Financial Analysis and Advisory Platforms

Choosing the Right White Label Financial Software Provider

Businesses choose a software vendor to drive continuous improvement and maximize the benefits of White-Label software. Given the shifting regulatory landscape and the complexity of development, it’s more cost- and time-efficient to partner with a software provider that can take this burden off your shoulders.

Yet, an unobvious caveat is that there are numerous white-label financial software out there. If you want to find the right one that will serve you in the longer term, there are specific nuances to keep in mind:

Evaluating Technical Capabilities

First of all, you need a white-label software provider with a proven track record of successfully launched products or services in your industry. Evaluate the provider’s programming and development expertise, knowledge of cloud platforms and infrastructure.

Understanding Pricing Models

White-label providers offer different pricing structures. For example, fixed, subscription-based, customized, and others. Understanding this is essential for resellers to make informed decisions about white-label partnerships.

Reputation and Customer Reviews

A good place to start is to read reviews or monitor key performance indicators, such as client satisfaction and project success rates. Also, it’s worth looking at the vendor’s partners and investors.

Post-deployment Support and Training

Technical issues are inevitable, so you want to be sure that you’ll receive immediate support. Thus, look for a provider that offers regular check-ins, progress reviews, and trainings.

Potential Challenges and How to Overcome Them

With the adoption of white-label financial software, certain challenges often surface. The main concerns revolve around integration and compatibility with existing systems that can potentially disrupt deployment.

Customization limitations pose another challenge. There’s a need for a delicate balance between customization and usability. Collaboration with providers for custom features can mitigate this potential challenge.

Last but not least, businesses need to understand that financial regulations don’t become any less stringent but evolve and become increasingly complex over time. Regular system updates, continuous diligence, and engagement with regulatory experts are essential strategies to proactively address the dynamic nature of financial regulations.

The Future of White Label Financial Software

The future of white-label financial software promises to be marked by transformative advancements. In not very distant future, we can anticipate a significant surge in AI and machine learning features.

Big data will also play a pivotal role in crafting highly personalized financial solutions, tailoring services to individual needs like never before.

Additionally, the growing necessity for cross-border financial tools is expected to shape the landscape, addressing the increasingly interconnected global markets and providing seamless solutions for international financial operations.

These trends are set to redefine the way we interact with financial technology, ushering in an era of greater efficiency, personalization, and global connectivity.

Final thoughts

Policies, regulations, and a lack of infrastructure impede fintechs from realizing their full potential. These unfavorable circumstances push leaders in all industries to adopt new and agile technologies.

White-labeling opens a huge door for fintechs. It helps businesses to build ready-made and low-cost solutions or expand their current offerings, while software vendors, such as Crassula, pave the way for a successful integration and utilization of white-label financial software.

Partnering with a white-label financial software provider is a strategic approach that allows your business to maintain a competitive edge, adapt to market demands, and seize new growth opportunities.