Payment Institution (PI) License

Learn how to secure a Payment Institution license with our expert guide. Ideal for banks, fintech startups, and entrepreneurs in the payment sector, we simplify the process and requirements for a successful financial venture.

If you wish to venture into the realm of regulated payment services, including money transfer, payment processing, merchant acquisition, or initiating and managing accounts, obtaining a Payment Institution (PI) license is not just a legal necessity but a strategic move toward industry legitimacy.

In this comprehensive guide, we'll navigate you through the intricacies of acquiring a Payment Institution License. Whether you're a bank, a fintech startup, an e-money institution, an established financial service provider, or an entrepreneur looking to enter the payments sector, the journey towards obtaining a PI license demands a clear understanding of the application process, key regulations, crucial requirements, and documents. This guide contains everything you need to provide payment services.

What is PI?

Payment Institution (PI) License is a regulatory authorization granted by the Financial Conduct Authority (FCA) to individuals or entities that wish to provide payment services and issue electronic money.

This license serves as a basic requirement for PSP companies, e-money Institutions, digital wallet providers, currency exchange and money transfer services, and other platforms, and it allows these holders to legally carry out payment transactions, money remittances, and direct debit/credit transfers, etc., subject to compliance with all relevant laws, regulations, and oversight.

Let's discuss your project and see how we can launch your digital banking product together

Request demoPayment Institution Licence Services

Under the PSD3, payment institution licenses open the gateway to an extensive range of financial services, extending far beyond mere banking. With a PI license, an organization can offer:

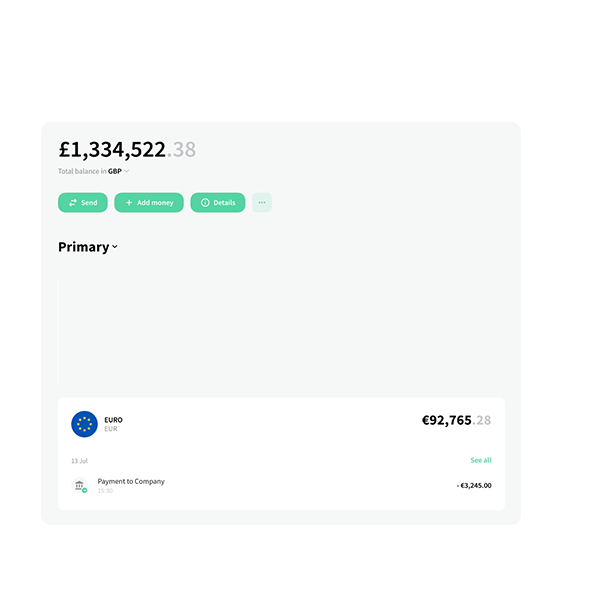

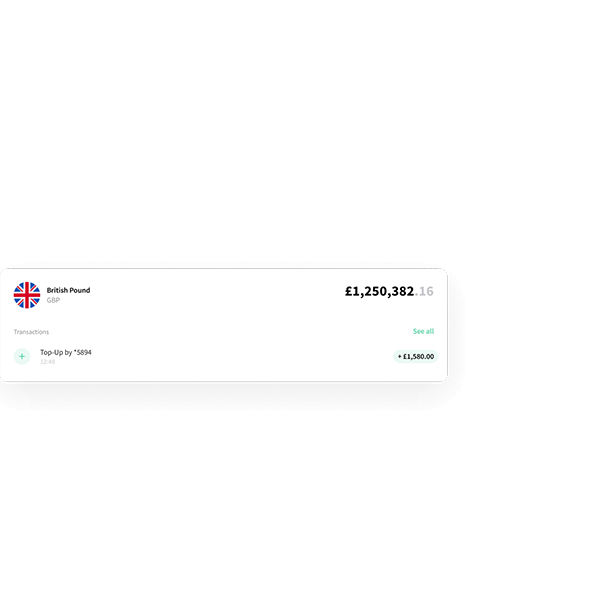

- Handling Payment Accounts: PIs enable the efficient operation of payment accounts.

- Deposits and Withdrawals: PIs facilitate deposits through bank transfers, cash deposits, electronic transfers, or payrolls, as well as withdrawals of funds at ATMs, checks, or other methods.

- Execution of Payment Transactions: PIs play a critical role in handling various payment transactions, including transfers, direct debits, and credit transfers.

- Money Remittance: Money remittance services enabled by PIs are crucial for individuals and e-commerce businesses to send and receive funds across geographical borders no matter when or no matter where.

- Payment Initiation Services: These services allow users to initiate transactions, such as online purchases or bill payments, directly from their bank accounts.

- Account Information Services: With this service, users can get an overall view of their financial situation and use financial data to their advantage.

Key requirements to obtain the Payment Institution Licence

According to the EU Directive 2015/2366, a Payment Service Provider (PSP) needs to obtain authorization to function as a Payment Institution (PI) before offering services within the EU. This directive outlines regulations governing PI authorization, registration, licensing, and supervision by the relevant national authorities. Thus, PIs are expected to meet specific conditions that attest to their ability to ensure the security of payment transactions.

To be considered as a PI, your business must meet the following requirements:

- a three-year business plan demonstrating your company’s business model, market study, resources, and strategy;

- minimum level of initial capital of €20,000 is required, and other finances that demonstrate your solvency;

- a viable method of safeguarding the funds received from your users;

- a transparent organizational structure;

- a solid internal control system for detecting and managing risks;

- an appropriate system for anti-money laundering and counter-terrorist financing.

You are also required to pay a non-refundable fee to submit your application. The amount you'll pay will depend on the type of firm you own. On average, the process for obtaining a PI license takes about three months. For more information about authorization and registration fees, visit FCA’s official website.

How To Apply For a PI License?

To make an application for the Payment Institution license, you must apply to the Financial Conduct Authority (FCA). Include all required documentation, including your business plan, financial statements, AML procedures, and other relevant information.

The regulatory authority will review your application in 6 months if you're a FSMA firm and in 3 months if you're a payments or e-money firm. Keep in mind that if your application isn't complete, the approval can take up to 12 months.

Also, be prepared to respond to requests for additional information as well as on-site audits to assess your compliance with regulations and the suitability of your business operations.