MSB License in Canada

Canada remains one of the most stable economies around the globe, with a wide array of fintech operating under a business-friendly jurisdiction. High standards of financial regulation, continuous innovation, and numerous sales channels — that’s what Canadian businesses are all about.

The company incorporation process requires business account opening, license application, advisory services, compliance evaluation, and preparation of internal policies. So, whether you are a foreign investor or international business owner wishing to expand, Canada is by far the best location that makes these initial phases more manageable if you aim for a permanent establishment. But where should you start? This article will present an MSB license and its benefits to assist you in that regard.

What is MSB?

MSB is a Money services business that offers financial services and mainly engages in the activities such as money transfers, foreign exchange transactions, reimbursements, bank charges, fund transfers, collection, digital assets dealing, rental of premises, and more.

If you plan to run Money Service Business and deliver any of the above-mentioned services to the public, you must fulfill an obligatory measure related to the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA). Canada’s financial intelligence unit (FIU) is in charge of detecting, preventing, and deterring these malicious activities.

For that, you are required to obtain the Canada MSB License that deals with financial crimes within Canada.

Let's discuss your project and see how we can launch your digital banking product together

Request demoWhen is a Canadian MSB license required?

Providing any of the following banking services

- offering foreign exchange dealing (exchange of one type of currency for another)

- conducting foreign exchange transactions (cross-border transfer funds for individuals and business owners)

- remitting or transmitting funds (card payments and transfers via a terminal or an online payment gateway solution)

- issuing or redeeming money orders (cash on demand received from a bank, post office, Walmart, grocery store, etc.)

- working with virtual currency (offer digital assets exchange and virtual currency transfer services)

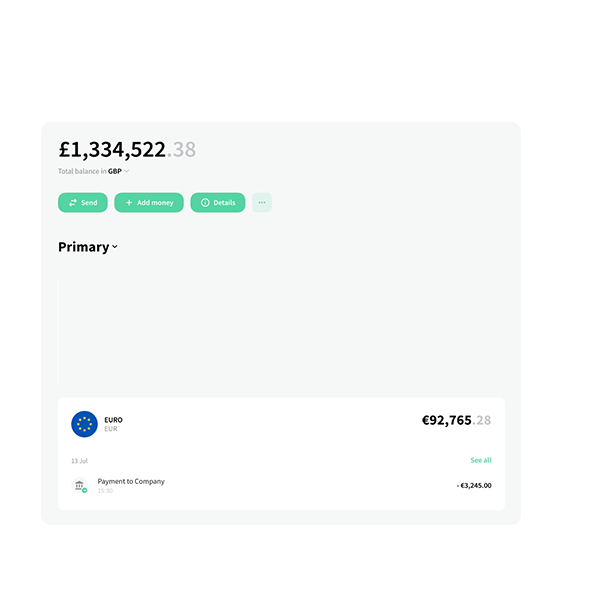

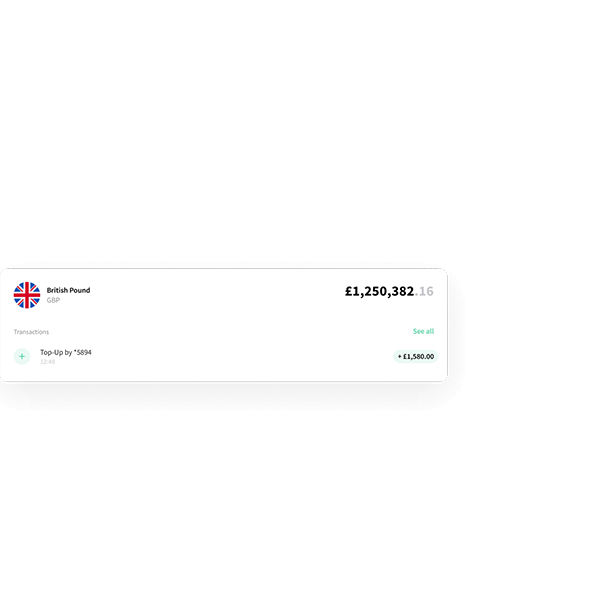

- issuing personal accounts (issuance of personalized e-wallets, allowing your customers to store the funds or deposit and pay securely)

Having a physical place of business in Canada

- be either incorporated in Canada and have a physical location in Canada

- or have employees, agents, or branches in Canada

Servicing a person or entity located in Canada

This applies to the individuals and entities who have registered or licensed with a province or territory to conduct their business and provide MSB services to Canadians.

How do you register your Money Services Business?

First of all, you must fill out the pre-registration form online. Here you are required to submit information related to your business’s structure, business number, address, legal name, contact information, and the list of services your business will provide (mentioned previously in the article).

A FINTRAC representative will contact you within five business days once your pre-registration is complete. When it is confirmed, you can proceed to submit the MSB registration form on the MSB Registration System. At this stage, you must include your bank account details, information about your compliance reporting, the number of employees, incorporation information, information about owners, branches, and agents, as well as an estimated total number of transactions in dollars per year for each MSB service.

After that, you just need to wait until the FINTRAC Commission revises your request. You may receive a notice of approval and your registration number or a denial. The latter occurs for the valid reasons of either involvement in certain financial offenses or simply ineligibility for registration. For clarification, the respective authorities are to be consulted.

Conclusion

The government of Canada is very loyal and welcoming of those individuals or entities that intend to start their businesses. Not only can these newly established startups provide financial services to the local citizens, but they also attract foreigners to the development of the financial sector. The conditions of trade, economic growth, quick process of obtaining, and minimal capital are the main reasons why you should get the MSB license and do business in Canada.