Electronic Money Institution (EMI) License Explained

The Electronic Money Institution (EMI) market in the euro area has witnessed a remarkable transformation in recent years. Notably, the EMI sector grew rapidly in 2020, marking the growing prominence of EMIs in fintech, with a milestone of 19,164 million euros.

However, operating as an EMI is not without its challenges, complex regulatory landscape, and stringent Financial Conduct Authority (FCA) guidelines.

In this guide, we will walk you through all the pitfalls and intricacies of the EMI licensing process, from understanding the requirements and essential documentation to successfully navigating the application process and becoming an authorized EMI provider.

What is EMI?

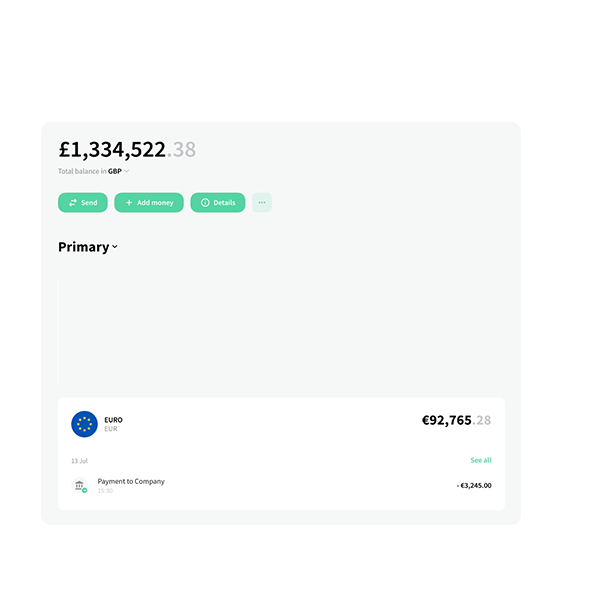

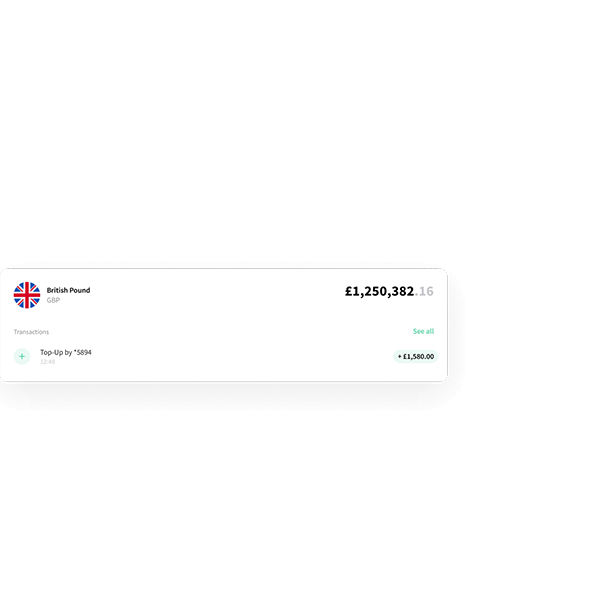

An EMI is a licensed money institution that is authorized to provide electronic money services. These institutions issue electronic money and offer digital wallets, prepaid cards, and other electronic payment solutions.

EMIs emerged in Europe starting from 2009 when the E-Money Directive came into force. Within a few decades, their influence has extended beyond the continent. Now, many EMIs operate globally and are usually regulated under the Electronic Money Directive (EMD) and the revised Payment Services Directive (PSD2).

Let's discuss your project and see how we can launch your digital banking product together

Request demoWhat is e-money?

Electronic money is a digital substitute for cash. It allows individuals to make cashless transactions using funds stored on an electronic medium, whether it's a card, mobile device, or online platform.

EMIs provide online e-payment systems via debit, credit cards, direct bank deposits, and e-checks. Other alternatives also include e-payment methods like e-wallets, bitcoin, cryptocurrencies, and bank transfers. Electronic Money Institutions issue e-money on behalf of their users, ensuring that the monetary value they provide is equal to the amount issued. Also, e-money is accepted by a wide range of merchants, online retailers, service providers, or legal persons other than the issuer.

Requirements for EMIs

To become a fully certified EMI, a central bank or another relevant regulatory body must review a financial institution's operations, compliance with regulatory requirements, and ability to safeguard the customer funds. Certain steps are needed to acquire an e-money license and become an EMI.

First, an EMI must apply for authorization to issue and manage e-money. For this, the company has to submit information about its business plan, management, ownership, financial stability, institutional frameworks, internal controls, security measures, etc. The Application Form for Authorisation as an Electronic Money Institution and the documentation requested therein can be found here.

Then, the central bank reviews the regulatory and legal requirements of the company, conducts thorough due diligence, and assesses the anti-money laundering (AML) and counter-terrorist financing (CTF) measures.

The central bank assesses the EMI's operational readiness and protection mechanisms.

Therefore, it's critical for the company to:

- Own a license from the relevant FCA.

- Meet regulatory and security standards.

- Provide regular financial reports.

- Maintain sufficient capital and financial reserves.

- Keep customer funds and financial data secure.

Finally, applicants who meet all the stringent EMI requirements are granted the desired license.

How Crassula Can Assist You in Becoming an EMI

Getting an EMI license resembles a labyrinth of complexities. Yet, the right tools and expert guidance can transform challenges into opportunities. Crassula integrates with top-tier anti-money laundering solutions, ensuring vigilant monitoring, timely detection, and prompt action. With our versatile solution, you'll get:

- Robust core software for building a merchant payment processing company.

- Licensing and certification support.

- User-friendly interfaces for payment systems.

- Expert guidance and support throughout your EMI journey.

- Streamlined compliance with regulatory requirements.

- A robust foundation for your financial services venture.